Tech stocks show returning internal momentum

Thanks to at least a temporary pre- and post-election sigh of relief among technology investors, underlying momentum in many of those names has turned positive.

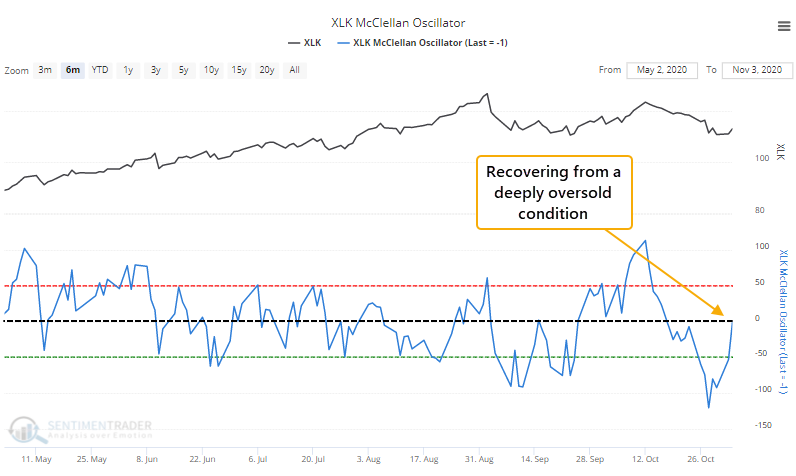

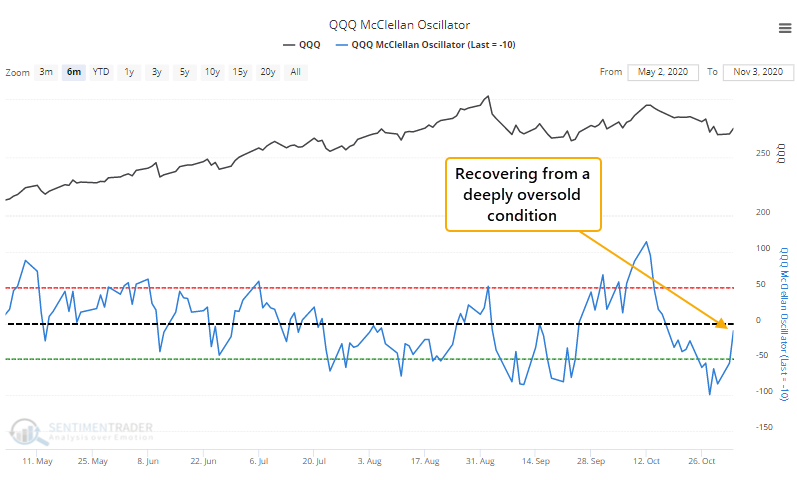

The McClellan Oscillator for the broader tech sector will move into positive territory on Wednesday after a couple of weeks below zero (barring a historic intraday reversal after this is published), and with a severely oversold reading during that span.

The Oscillator is telling us that the average stock in that sector is not only rising, but doing so at an increasing pace. And that's within the context of the S&P 500 Information Technology sector still being more than 5% above its 200-day moving average. It's showing recovering momentum during an already-momentum-driven market.

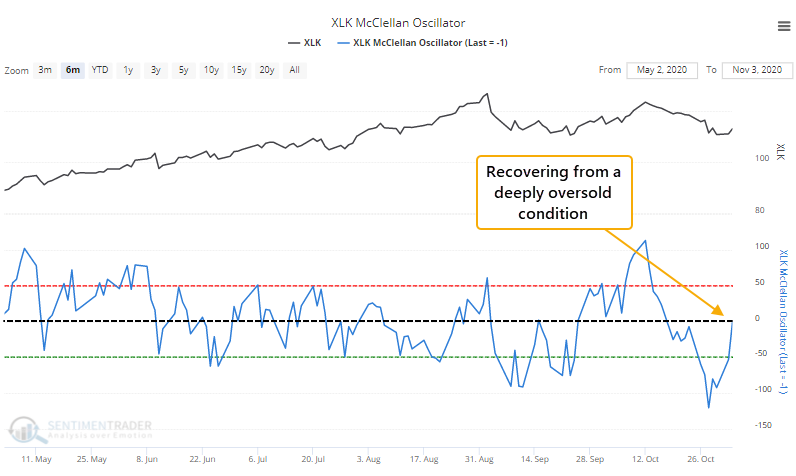

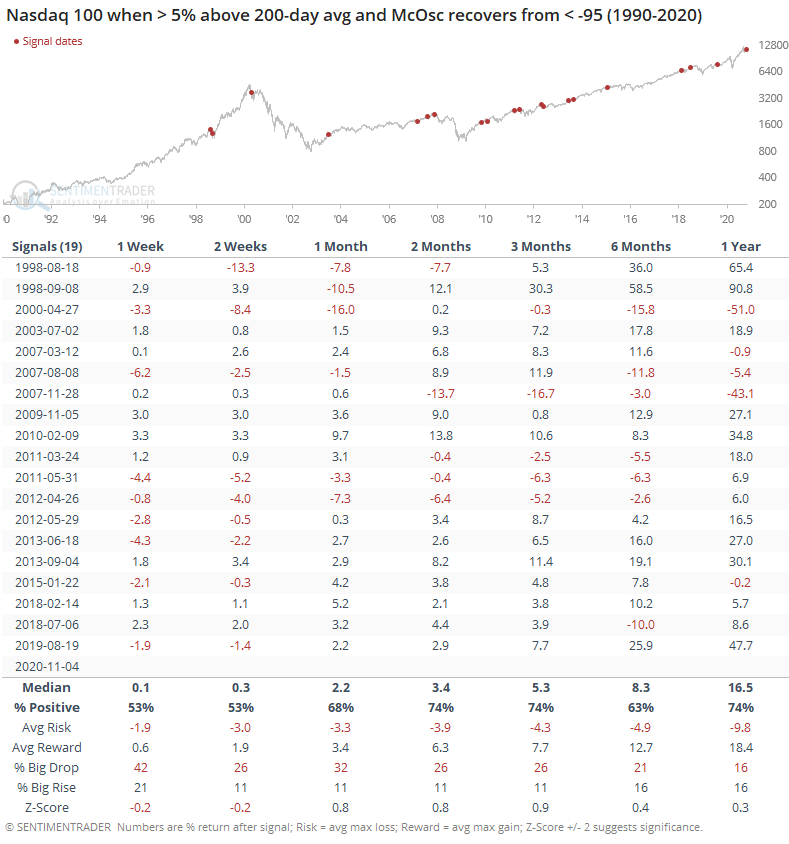

This was a mostly good sign for the sector, especially over the next 1-2 months, which had the best combination of average returns, percentage of time positive, and risk/reward ratio, especially in recent years. The probability of a big rise was about equal to that of a big drop, but both were small.

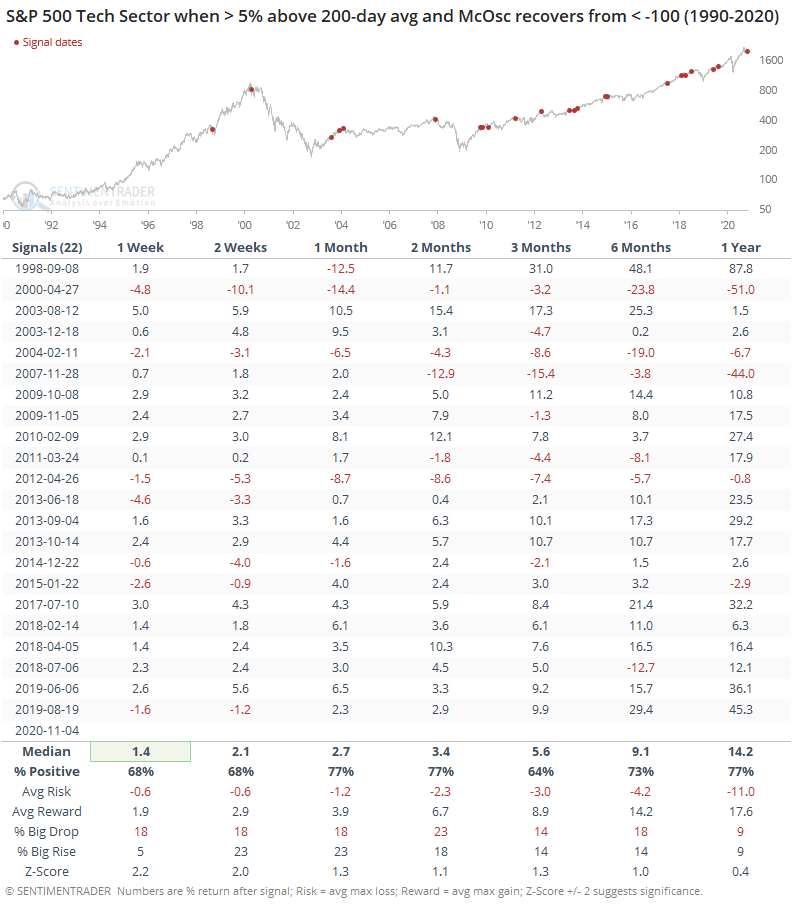

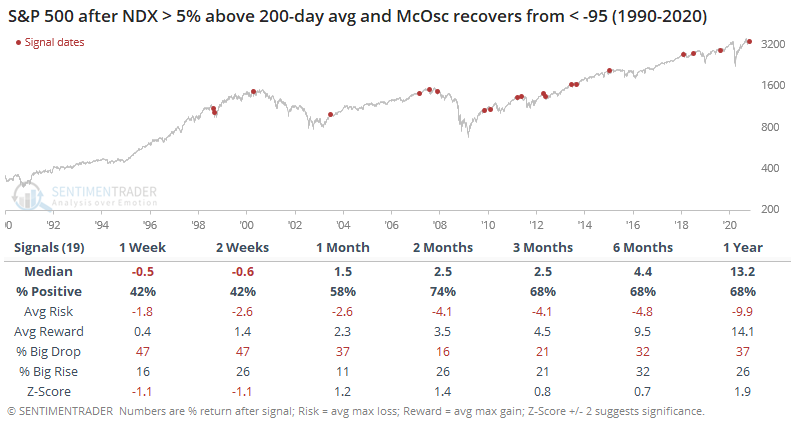

For the broader S&P, it was an even better sign, with only 4 losses out of 22 signals after 2 months.

We're seeing the same thing happening among the biggest tech stocks, as the McClellan Oscillator for the Nasdaq 100 is also recovering from a deeply oversold condition.

This was less of a positive for the biggest stocks, especially shorter-term. Still, over the next 2-3 months, they typically rose. It wasn't a very strong signal, mostly due to some losses from 2008 - 2012.

It was less of a positive for the S&P 500 in the short-term.

Markets have a nasty habit of showing a fake-out first move following major and widely anticipated events. That makes it hard to trust the knee-jerk reaction to Tuesday's elections. While momentum in many tech stocks has turned positive, it hasn't been a very reliable signal in the shorter-term, and the fact that it's triggering around a major news event probably makes it even less so. It should still be at least a minor medium-term positive.