Tech rally brings new assets, and more ETFs

There's nothing like an established market trend to spur demand for MOAR. And when fund companies see that demand from investors, they will do whatever they can to supply it.

The breathtaking run in technology stocks has spurred Invesco, creator of the wildly popular QQQ exchange-traded fund, to create offshoots. As the Wall Street Journal notes (emphasis added):

"Invesco Ltd. is adding more Qs to its fund lineup, a wager by the world’s fourth-biggest issuer of exchange-traded products that investors’ love affair with technology stocks will continue."

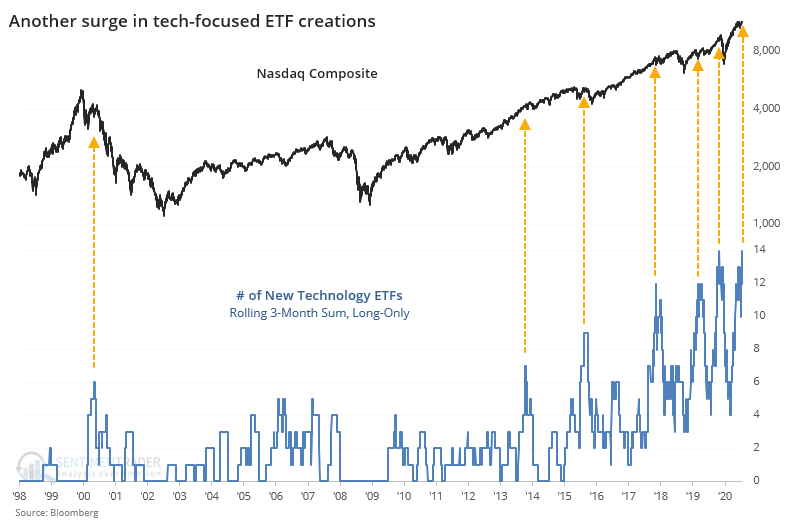

We see this all the time. When a sector, or the market as a whole, does well, fund companies will create more ETFs, as we saw in the summer of 2015. Or the opposite - when a sector does poorly, then fund companies will quietly liquidate the funds or split the shares, like what happened with volatility ETFs in 2016.

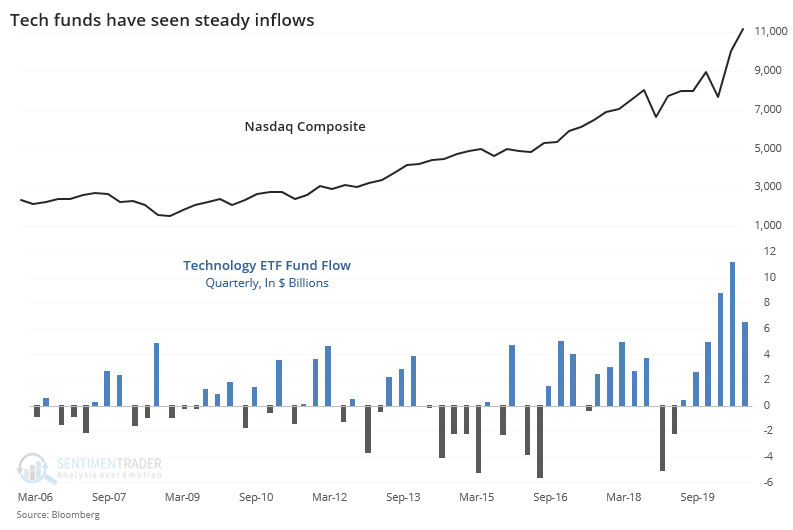

There has certainly been demand for anything tech-related. Flows into and out of QQQ have swung violently in 2020, but that isn't the only tech fund. As a sector, quarterly fund flows have soared this year.

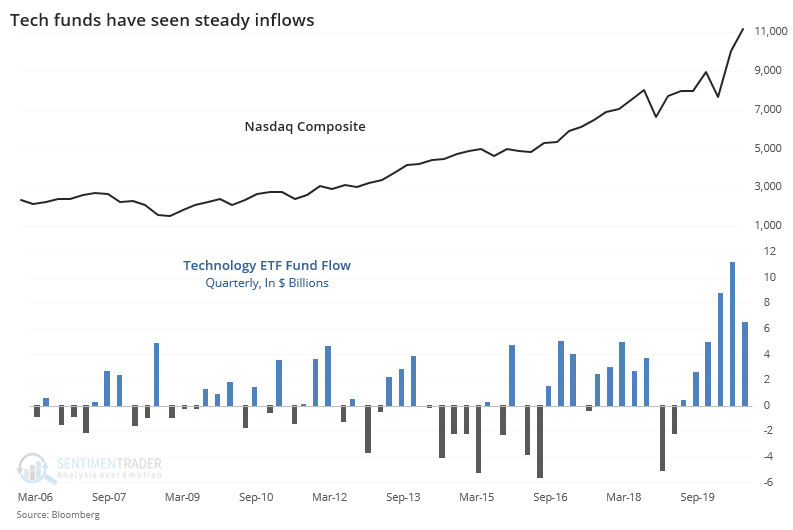

On a yearly basis, we've already surpassed 2000.

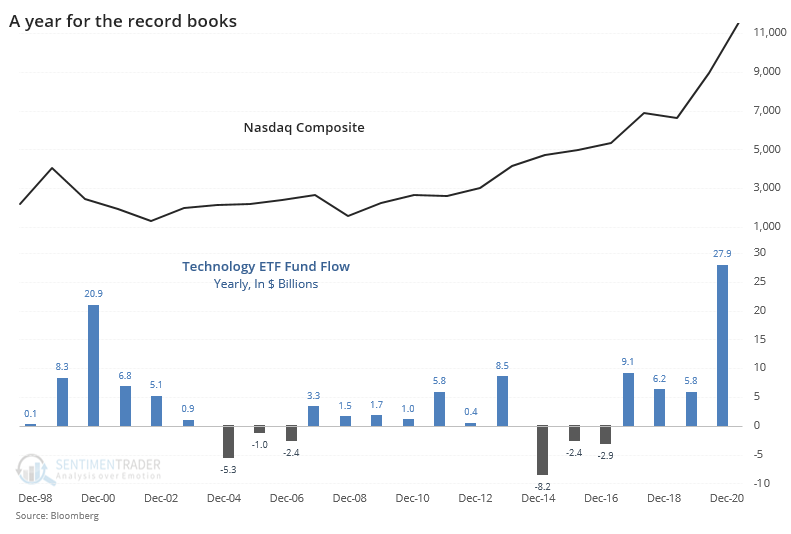

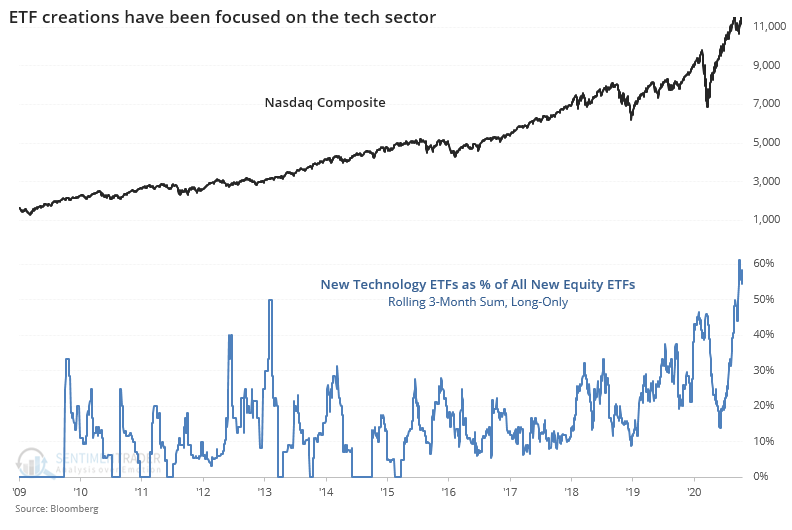

Because there is demand for tech stocks at the moment, fund companies are creating more ways to satiate that demand. Below, we can see a rolling 3-month sum of all new ETFs that explicitly have at least 25% exposure to the tech sector at inception.

As a percentage of all new equity ETFs, these funds have never been more popular.

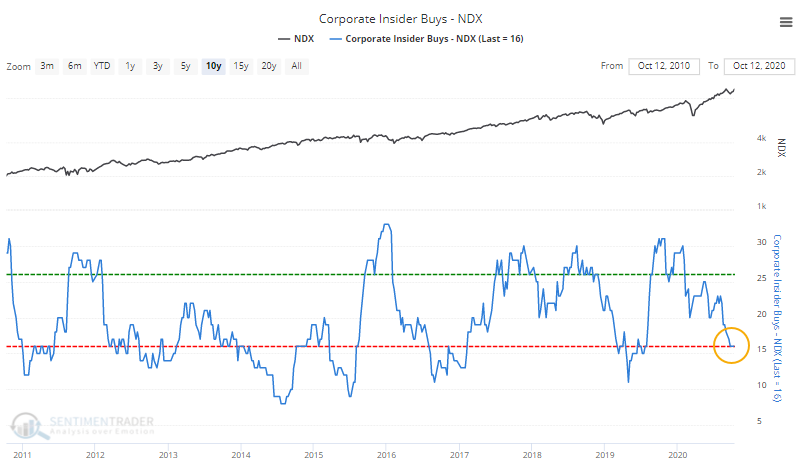

While demand from retail investors has been great enough to spur fund companies to undergo the expense and risk of creating new funds, corporate insiders in many of these companies continue to sell, with few buyers.

In Nasdaq 100 companies, open market purchases have tapered off significantly.

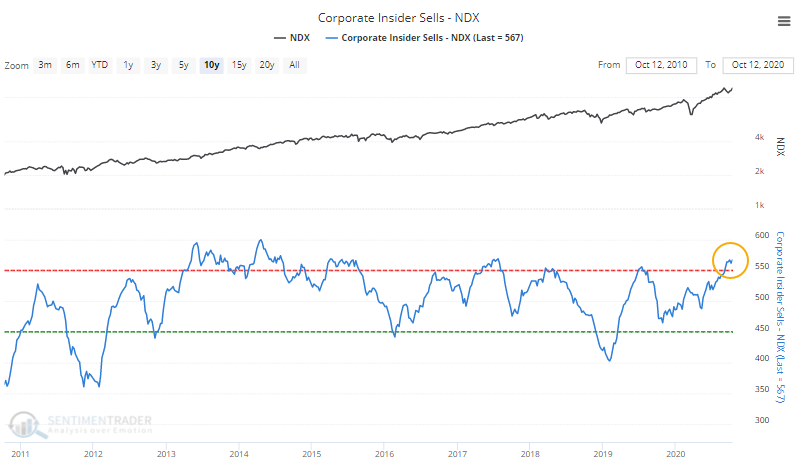

A drop in transactions isn't all that surprising as earnings season approaches, but at the same time, the number of open market sales remains high.

The recent surge in tech stocks has become about more than just a few massive stocks sitting at the top. This kind of broadening participation has been a consistently good sign over the medium-term. On a long-term basis, there has to be at least modest concern about the attention these stocks are getting. When any single sector becomes such a focus, there is usually something, at some point, that comes along to knock it down a peg.