Key points:

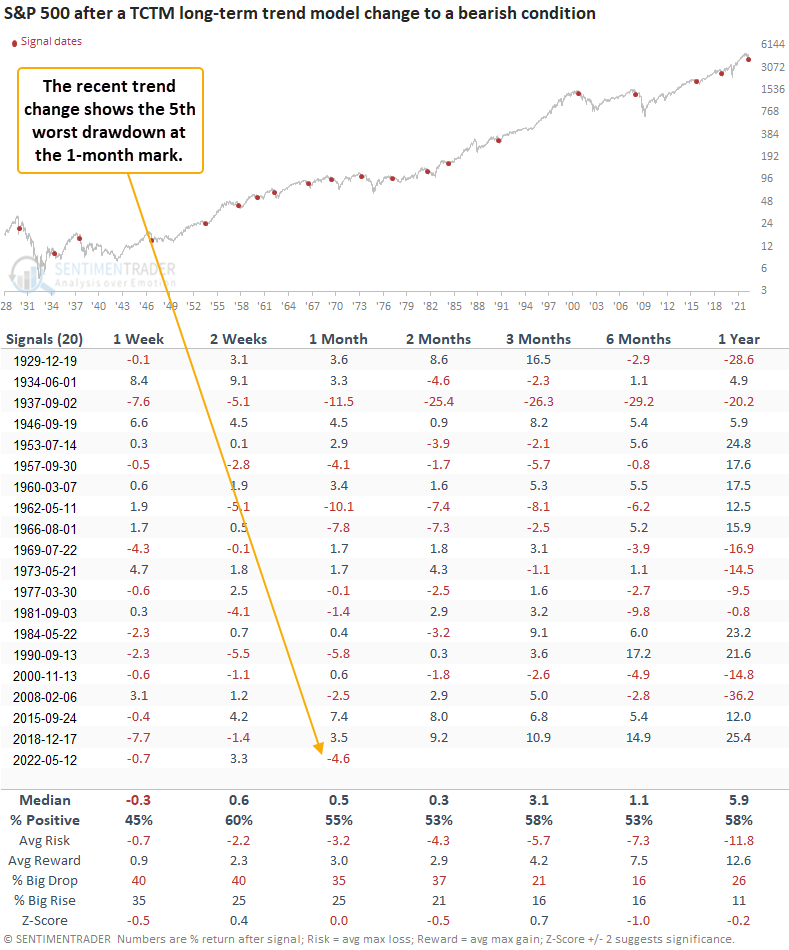

- The TCTM long-term trend model turned negative on 5/12/22

- With the trend change, the TCTM status moved from cautious bull to negative

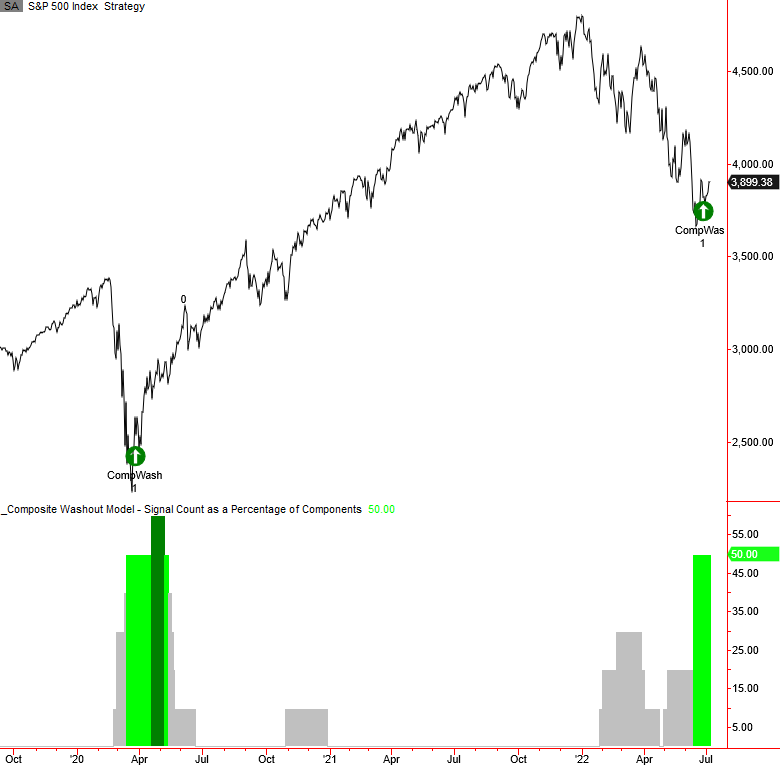

- A washout model signal triggered on 6/28/22

- The recession composite model signal count increased to 25% with a new signal on 6/30/22

Data as of 7/8/22.

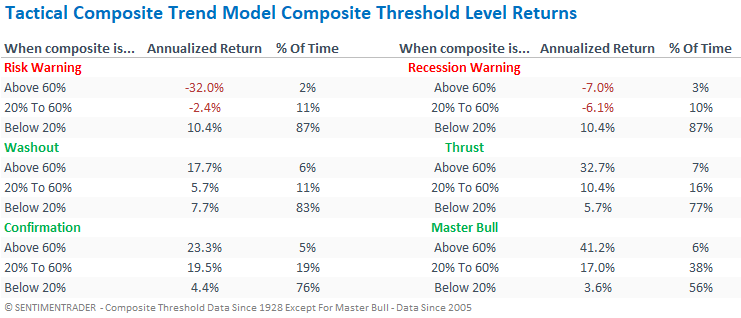

| MODEL | Signal Count % | STATUS |

| Tactical Composite Trend Model (TCTM) | Negative | |

| Long-Term Trend Model | Negative as of 5/12/22 | |

| Composite Risk Warning Model | 0 | Neutral |

| Composite Recession Model | 25 | Neutral |

| Composite Washout Model | 50 | Neutral |

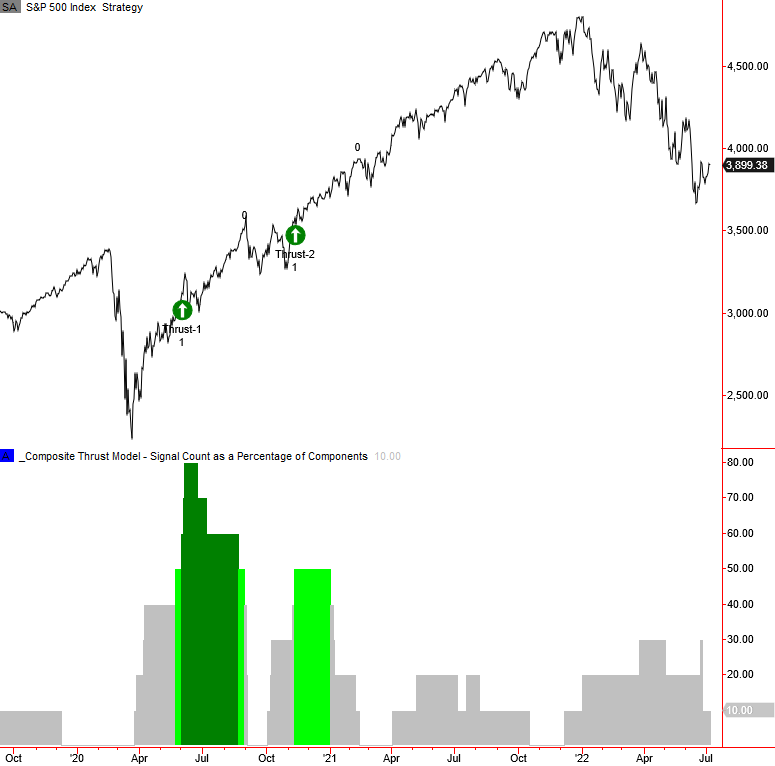

| Composite Thrust Model | 10 | Neutral |

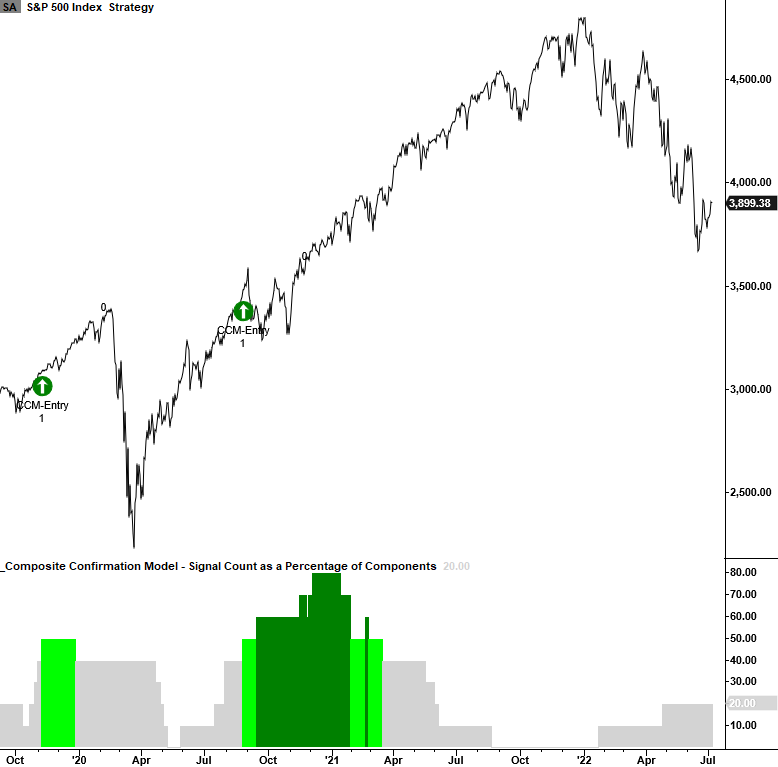

| Composite Confirmation Model | 20 | Neutral |

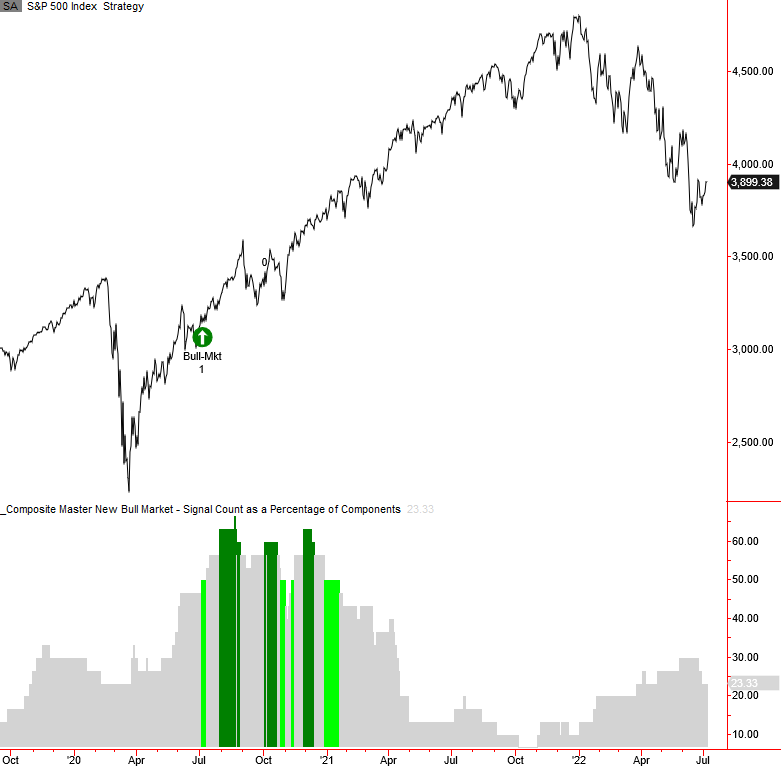

| Composite Master New Bull Market Model | 23 | Neutral |

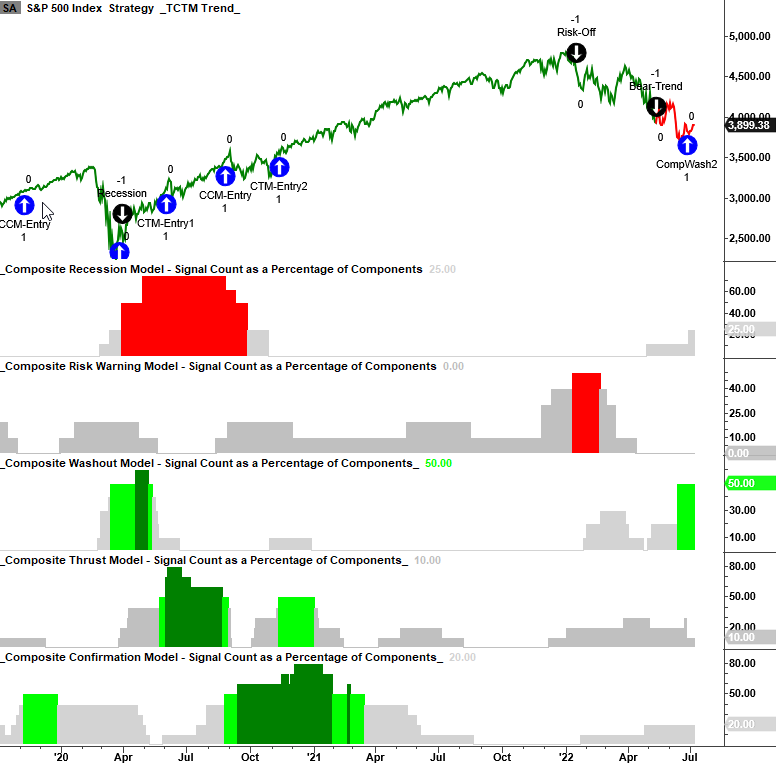

Tactical Composite Trend Model - Bearish

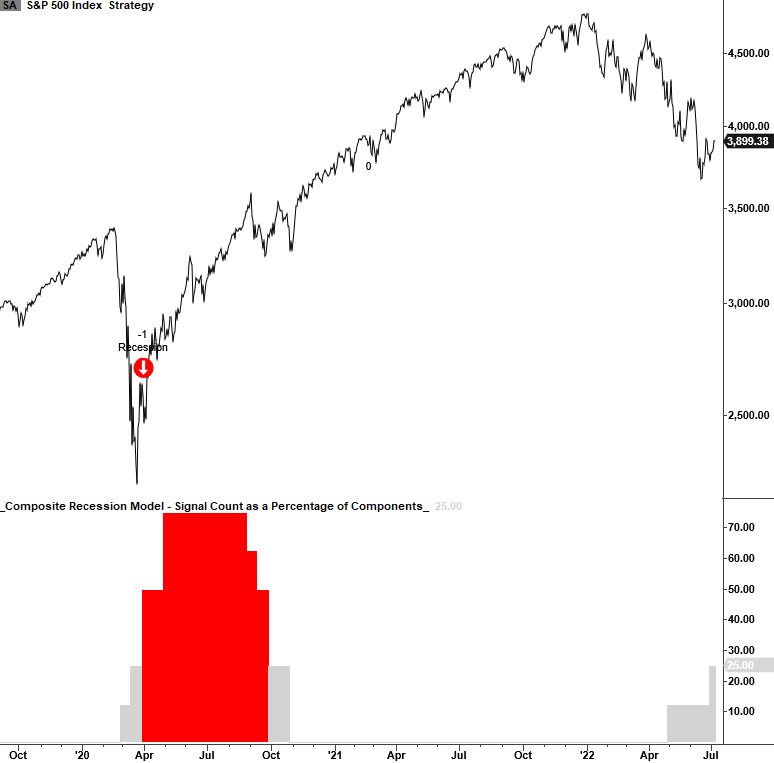

The TCTM long-term trend model flipped from bullish to bearish on 5/12/22. The trend change moves the overall TCTM status from cautious bull to negative. On 6/28/22, the composite washout model triggered a new alert. While the CWM has a solid record of identifying a turning point around significant lows, it cannot change the TCTM status in a bear market. I use it as a counter-trend rally tool. The only thing that can change the TCTM status from here on out is a long-term trend model change or a composite thrust signal. The recession model count is inching up. It's now 25%. I would be mindful of a potential recession, which typically means the market experiences a more significant drawdown.

The TCTM is not a pure black-box model that says we should be all in or out. And it should act as a complementary tool to your research process.

To see any published research about this model, click here.

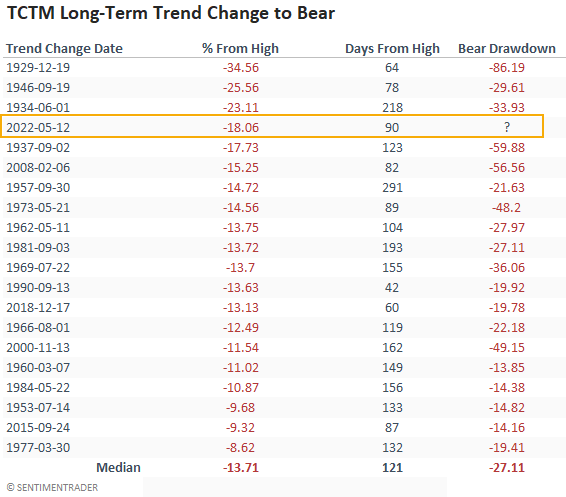

1. Long-Term Trend Model - Bearish

The long-term trend model turned bearish on 5/12/22. Annualized returns are unfavorable when the model is negative.

The long-term trend model change occurred when the S&P 500 was down 18.06% from the index peak. Comparing the current trend change to other signals shows one of the most significant drawdowns in history. After similar trend change drawdowns, the overall bear market decline looks troubling.

After other trend changes, the 1 to 12-month time frame shows a negative return at some point in 14 out of 19 instances.

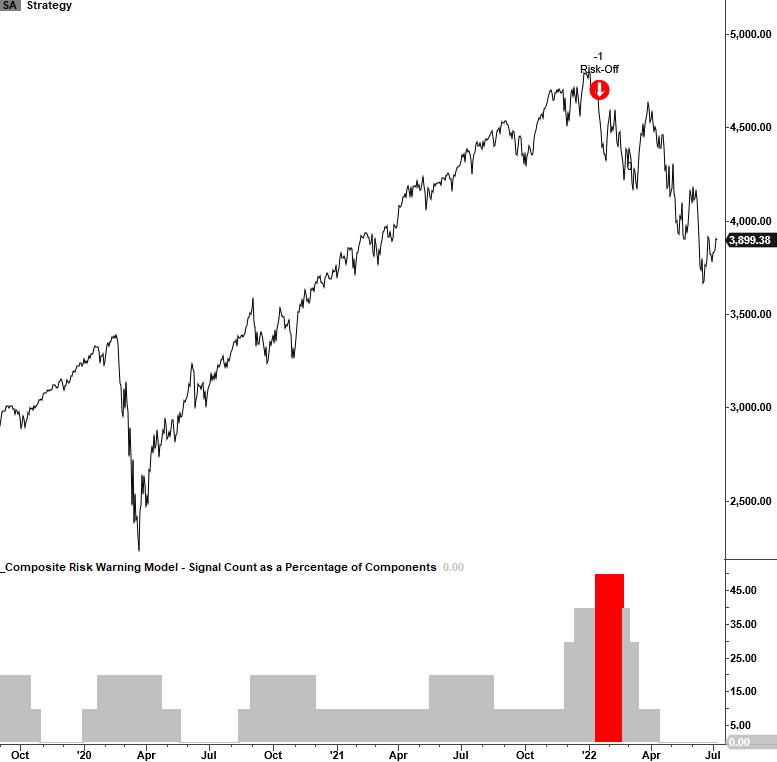

2. Composite Risk Warning Model - Neutral

To see published research about the risk warning model, click here.

3. Composite Recession Model - Neutral

The composite recession model signal count increased to 25% with a new alert on 6/30/22.

Signal Notes:

4. Composite Washout Model - Neutral

The composite washout model issued a new alert on 6/28/22 when price momentum for the S&P 500 turned favorable. Please click here to see the CWM signal note.

Signals:

- Absolute volatility model - Signal date = 5/6/22

- Percentage of issues at a 21-day low divergence - Signal date = 6/13/22

- Breadth Washout - Signal date = 6/14/22

- Volume Washout - Signal date = 6/14/22

- Percentage of issues oversold (14-day stochastic < 20) - Signal date = 6/14/22

While the CWM triggered a new alert, we did not see a divergence signal from the 63 & 252-day low components. Historically, markets bottom when new lows are contracting, not expanding, which is the case now. Please click here to see a note about divergence signals.

5. Composite Thrust Model - Neutral

I will be monitoring the thrust model for a buy signal. The signal count decreased to 10%, with the expiration of all signals except for the 10-day average reversal alert. A composite thrust model signal will change the TCTM status from negative to positive.

6. Composite Confirmation Model - Neutral

The composite confirmation model signal count remains low. Once the current bear market ends, I would watch this model as the signal count should increase as the recovery develops. The CCM typically lags during a rally as the components are big-picture algorithms that take more time to trigger.

7. Composite Master New Bull Market Model - Neutral

The master-bull-market composite score decreased to 23.33 with the expiration of several signals. Once the current bear market ends, I would watch this model as the signal count should increase as the recovery develops.

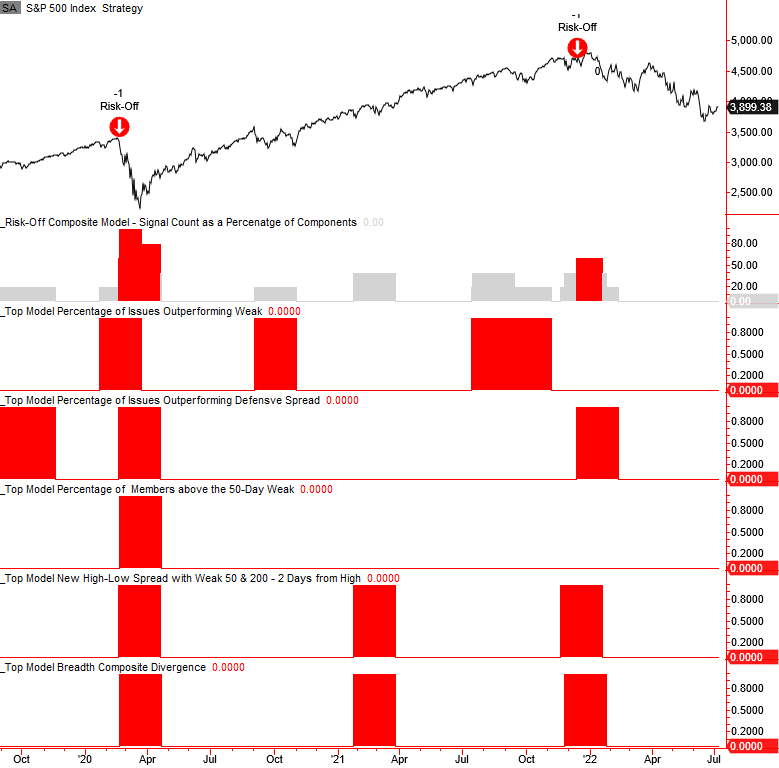

Risk-Off Composite Model - Neutral

The risk-off composite model is an excellent secondary tool for managing market exposure with the TCTM Risk Warning Model. Please click on the following link for a note on the model. Click here.

After triggering a risk-off signal in December, the composite count has fallen to zero with the expiration of all alerts.