T-bonds entering the seasonal danger zone

Key points:

- 30-year Treasury bonds are about to enter one of their weakest seasonal periods of the year

- The period will begin with the price already in an established downtrend

- This combination suggests caution for bond buyers

30-year bond seasonality is about to turn sour

Bonds have had a tough year, like almost everything else. And the calendar isn't going to help.

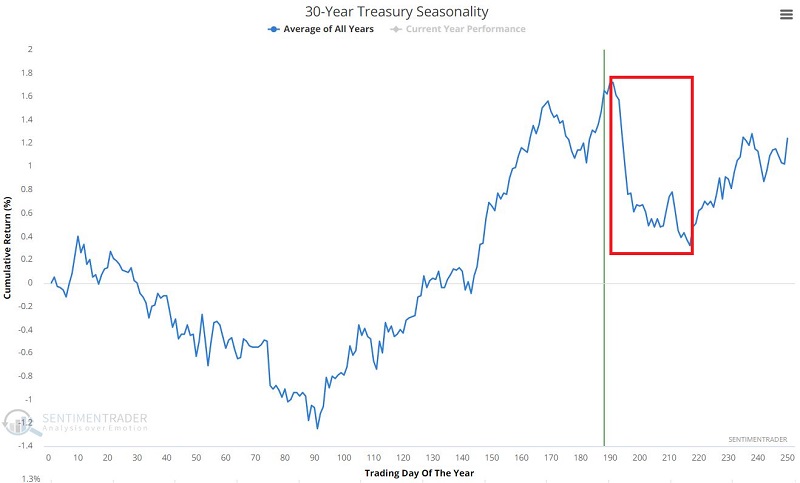

The chart below displays the annual seasonal trend for T-bond futures. It is about to enter a period of general price weakness.

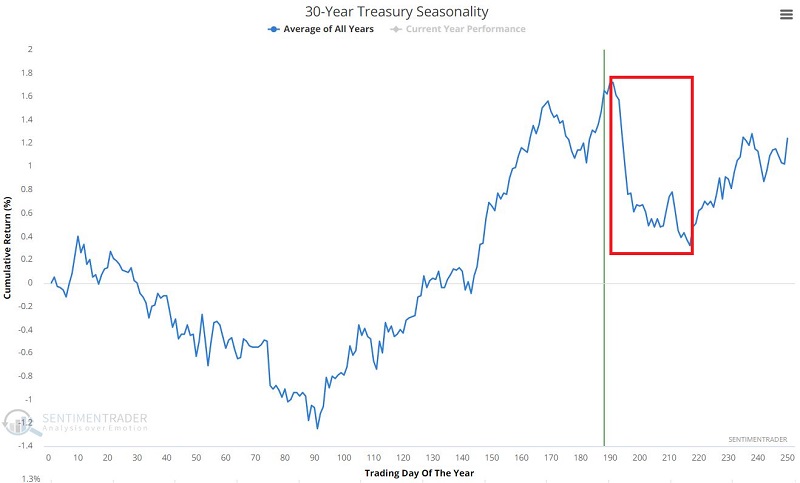

The chart below shows the cumulative return for T-bond futures held only during Trading Day of Year #191 through TDY #217 since 1977. For 2022 this period extends from the close on October 3 through November 8. Each one-point move in a T-bond futures contract is worth $1,000 in contract value.

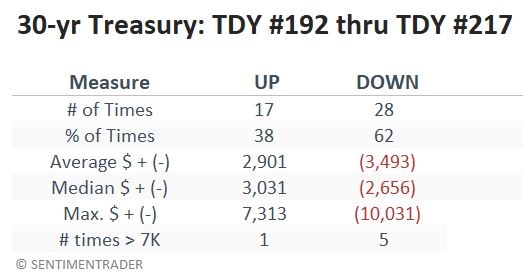

The table below shows that 28 out of 45 years witnessed a decline in T-bond prices. The average gains and losses were about even, but during the bad years, losses tended to be significantly larger than gains during the good years.

What the research tells us…

The caveat with seasonality never changes: there is no guarantee that even the most persistent seasonal trend will hold the next time. Still, the purpose of considering seasonal trends is not to engage in pinpoint market timing. The real goal is to find situations where price action and seasonality align and a trading opportunity with an acceptable tradeoff between reward and risk.