Swallowing a chunk of unnatural supply

Much of August was dominated by big indexes, which in turn have become dominated by big stocks, soaring to new highs. Under the surface, a lot of oddities have been bubbling, but to no effect. To a near-record degree in August, indexes were hitting highs with more stocks declining than advancing, leading to a nearly unprecedented split between sectors, and even between indexes and their underlying stocks.

Due in part to those oddities, indexes like the S&P 500 had been able to score new high after new high despite high optimism and risk. Almost never before has "dumb money" been so right.

Perhaps now we know why.

The biggest story in markets over the past few days has been the unveiling of Softbank as a large buyer of call options on a few big tech stocks. In a premium note over the weekend, we saw why it's not really the true story at all. It's easy to package and sensationalize a simple narrative that a single huge entity has been buying a bunch of calls. The more accurate story is that it's mom-and-pop driving these stocks higher, not Softbank.

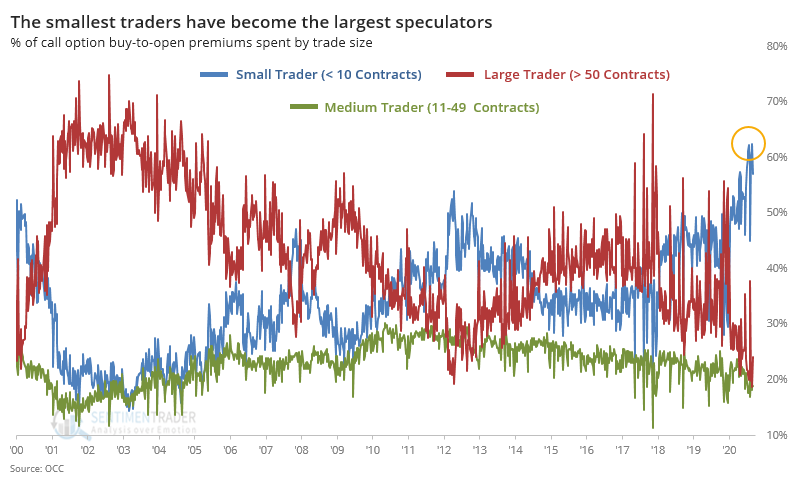

In the weekend piece, we only looked at trades for 10 contracts or fewer. Unless Softbank's traders divided up their orders into tiny lots, these are orders by the average stay-at-home gambler. And last week's volatility didn't discourage them, it did the exact opposite. They added to their bullish bets.

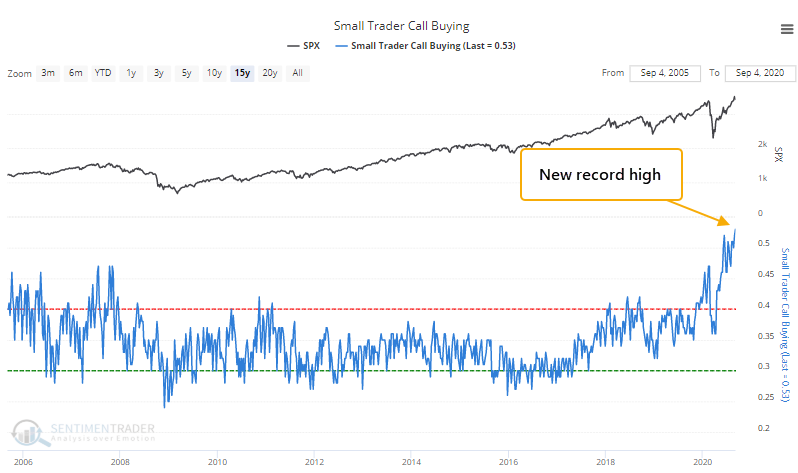

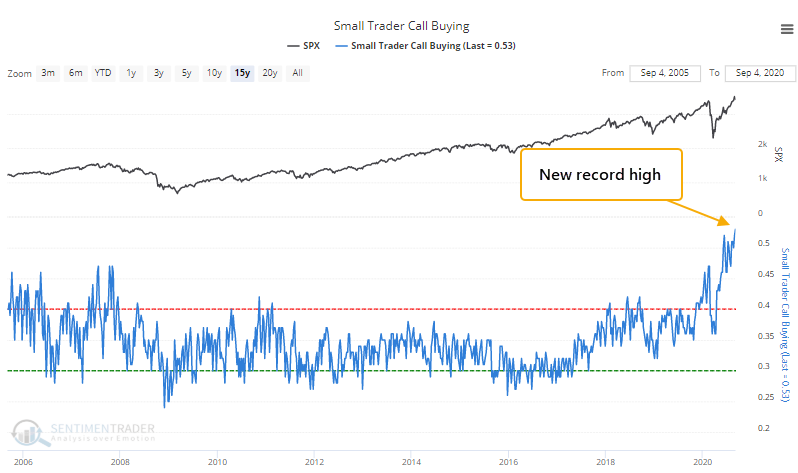

For trades of fewer than 10 contracts, 53% of total volume went into buying call options to open. That's a record high.

These small traders have become the biggest part of the options market. Since mid-July, trades for 10 contracts or fewer have consistently accounted for more than 60% of all opening call purchase premiums, massively dwarfing larger trade sizes.

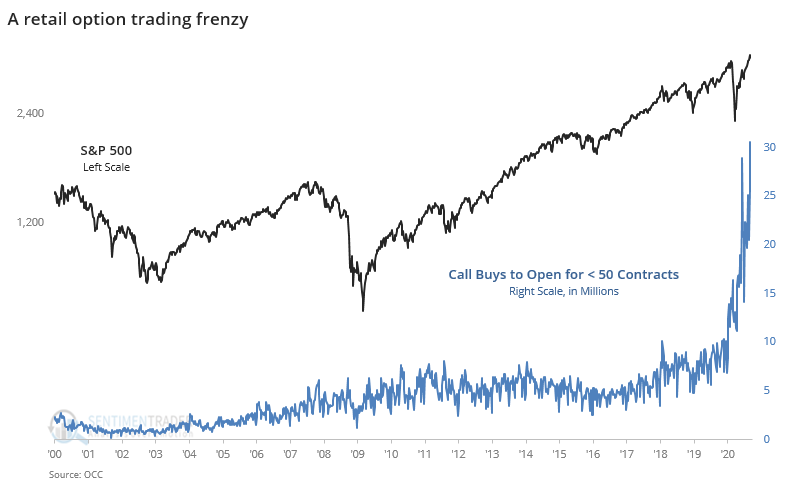

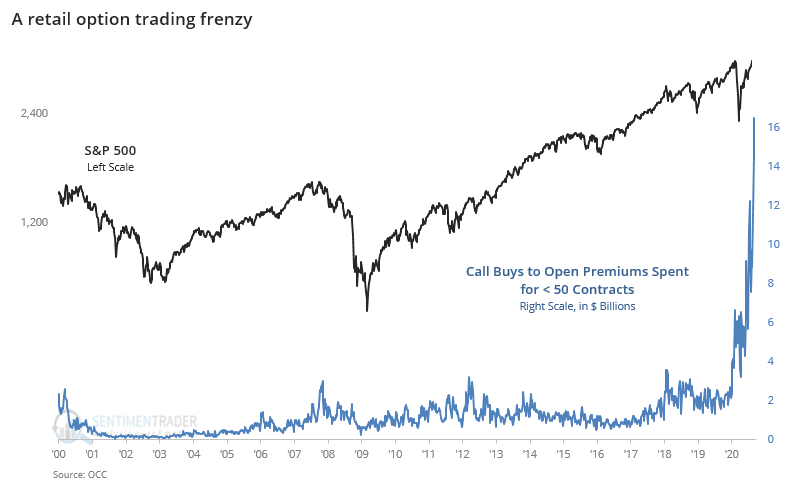

If we expand the universe from what we looked at on Saturday and examine at all trades for under 50 contracts, then we can see how spectacular their activity has become.

Because options prices have become more expensive in recent weeks - an extremely unusual condition in a rising stock market - these call buyers have spent an ever-increasing amount for their bets, so that the premiums paid for their speculative calls has truly gone parabolic. Last week alone, retail traders spent more than $16.5 billion on these lottery tickets.

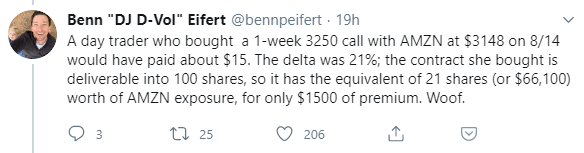

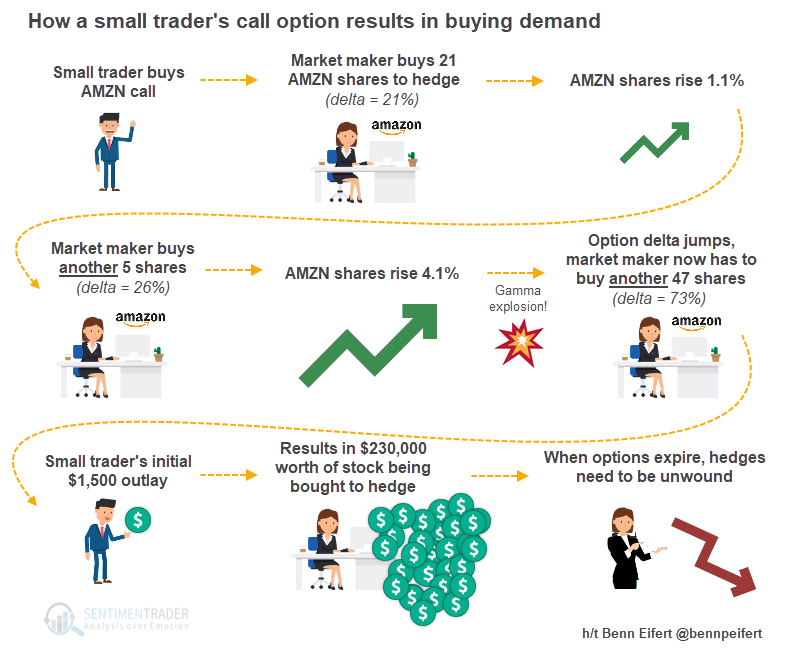

This has a multiplicative effect in the underlying stocks under certain conditions, explained in detail by Benn Eifert. He posted a Twitter thread explaining how a buyer of Amazon call options can trigger an avalanche of buy orders on the underlying stock, causing an effect many times greater than the implied leveraged of the options.

When someone buys a call option to open, somebody else has to agree to the other side of that contract and sell it to them. When they sell a call option to open, they're at risk of losing money if the stock price rises. To hedge against that upside risk, they buy the underlying stock, driving the price even higher.

The keys are:

- Delta - how sensitive the option is to changes in the price of the underlying shares

- Gamma - how much that delta changes

To visualize this, imagine Benn's scenario of a single small option trade resulting in a market maker having to buy an increasing amount of stock to stay hedged and limit her risk.

Traders taking the other side of opening options contracts constantly juggle their exposure, and most of the time it has little to no impact on the underlying stocks; it just one more of a thousand different influences. Once every couple of years, though, there seem to be short periods when traders suddenly expand their options presence, gamma changes rapidly, and the underlying dynamics are enough to influence the entire market.

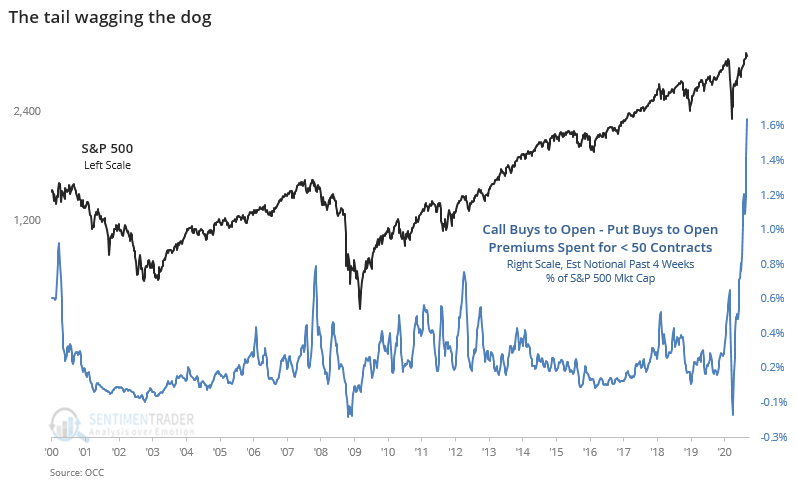

Let's look at this in the most comprehensive way we can without having access to the actual underlying trades. We'll look at the premiums paid for all retail call options bought to open, subtract premiums paid for puts, add a conservative multiplier to estimate how much stock the offsetting traders might have had to buy for a hedge, and compare that to the value of the S&P 500.

This is really stunning, beyond anything we've ever seen before.

Looked at this way, over the past four weeks, retail traders have (very roughly) generated a net $472 billion notional amount of exposure, accounting for nearly 1.7% of the S&P 500's entire market cap. In reality, their leverage, given dramatic jumps in delta over the past two weeks, was likely much, much higher.

And it was focused in only a handful of stocks. And it was concentrated in soon-to-expire contracts.

This means that in the coming weeks, most of these contracts are going to expire, exposing traders who bought the underlying stocks as a hedge. Unless they sell - and that's a lot of stock to sell. Clearly, there is some underlying "natural" demand for stocks, especially with interest rates essentially pegged at 0%. The big question is whether on a shorter-term time frame it will be enough to absorb what is likely going to be a big chunk of "unnatural" supply.