Surveys show persistent pessimism

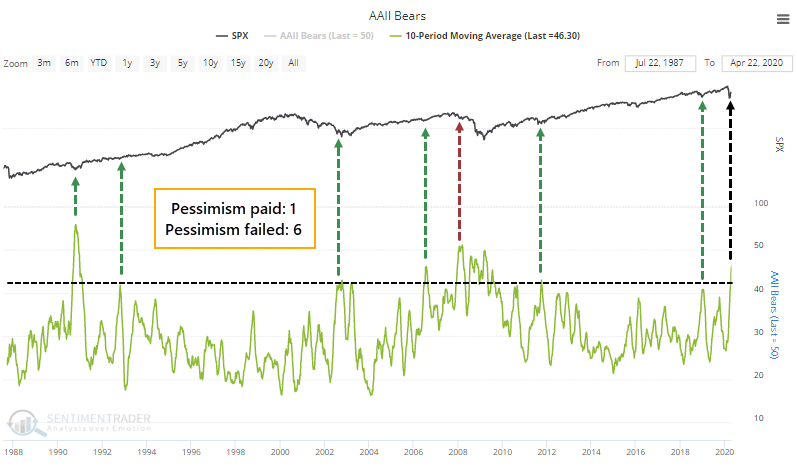

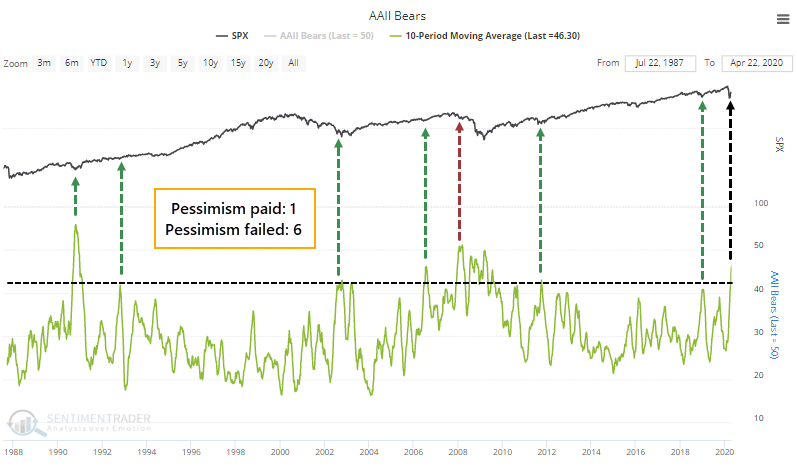

Last week, we saw that despite a big rally in stocks, individual investors in the AAII survey were not showing much optimism that it could continue. That continued this week, with half of the respondents expecting stocks to drop in the months ahead.

Over the past 10 weeks, bears have averaged more than 46% of total respondents, among the most persistent bouts of pessimism in the survey's history. All but once (and that "once" was a major exception), the pessimism was unwarranted.

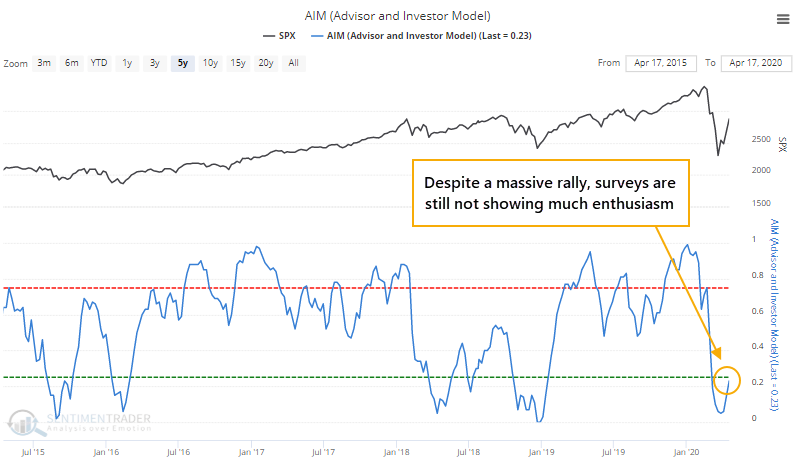

When we aggregate surveys covering a broad swath of investor types, it's apparent that the mom-and-pop types who frequent the AAII survey are not alone. The AIM Model this week is on track to decline from last week's still-low 23%. In the face of a huge rally off the lows, folks still aren't buying into it. Or at least, that's what they're saying.

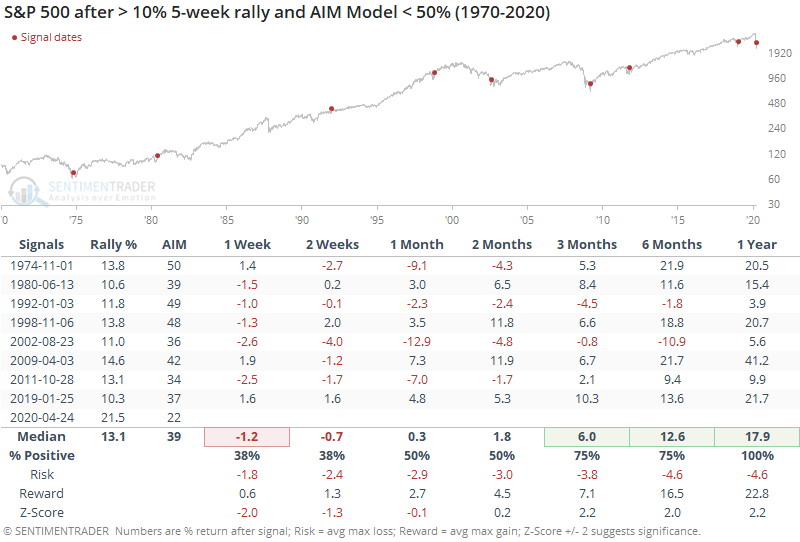

We saw this kind of behavior last January, too, though on a smaller scale. The S&P had jumped more than 10% over five weeks, yet the AIM Model remained below 50%. This time, the S&P has rallied twice as much, and the model is about half of where it was then.

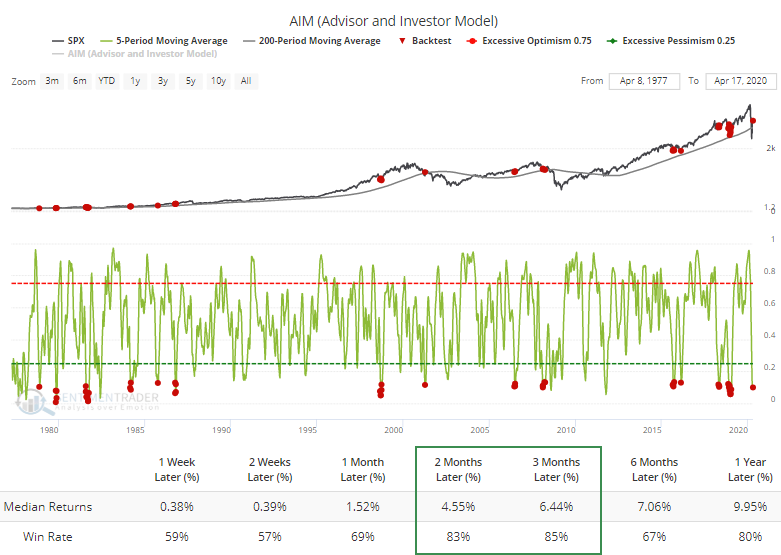

Shorter-term returns were poor because stocks have a tendency to back off a bit after big multi-week surges. But the positive momentum combined with apathetic sentiment led to consistently positive medium- to long-term gains, with all of them showing a gain a year later.

The pervasive pessimism in surveys has pushed the 5-week average of the model to a lowly 13%. And with the rally in recent weeks, the S&P has been able to hold above its rising 200-week average. According to the Backtest Engine, that's been a good - though not perfect - sign over the medium-term.