Survey Pessimism Pushes AIM Model To Low Level

With the latest survey results from the American Association of Individual Investors, most of the sentiment surveys we follow are showing extremely low levels of optimism.

As noted in last night's Report, the percentage of bears in some of them are not at "panic" levels, so there's that. It's mostly a historic lack of bullishness more than a high level of bearishness.

Because stocks have an upward drift, it's more rare to see extremely high levels of bearish opinion, and it's a better indicator of an imminent low in stocks. We're not seeing that yet.

Still, the overall depressed nature of the bulls will push the AIM Model down to 3%, one of its lowest readings ever. Because surveys were a lot more volatile prior to the past 30 years, we prefer to focus on more recent history, though as noted yesterday that introduces a more positive bias to the results as well.

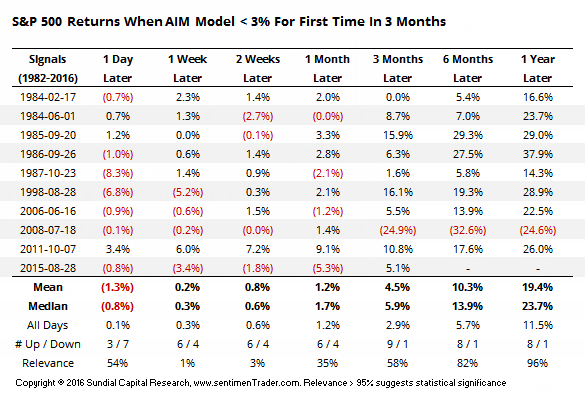

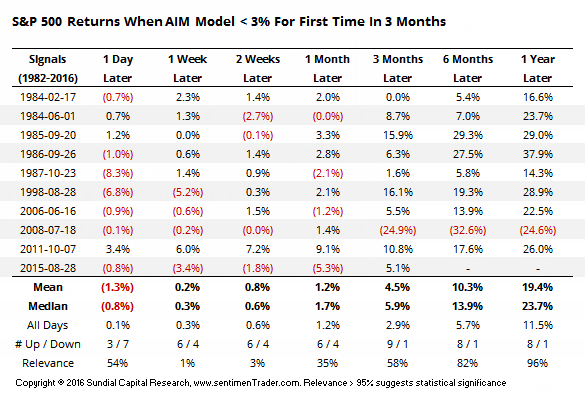

Here are the returns in the S&P every time the AIM Model first dropped to 3% or below for the first time in at least three months.

Clearly a positive bias, particularly in the medium- to longer-term. The only negative returns were from July 2008, though they were severe.

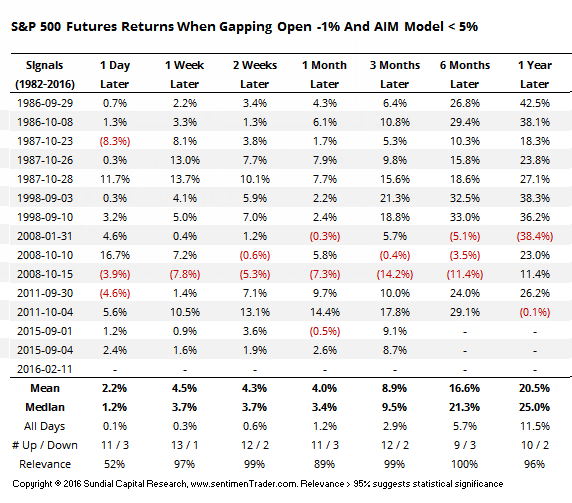

Stocks are indicated to open badly once again today, so here are the returns in the S&P 500 futures from the opening print of any day that they gapped down at the open by at least -1% and the AIM Model was at 5% or below:

Here the results are more positive on a shorter-term basis, especially over the next 1-2 weeks. Buying into a gap down like this, with many stocks and sectors plumbing new lows, is a scary idea. Typically, if there is to be a multi-day or multi-week rebound, then we'll see an intraday reversal or "tweezer" type of pattern where the next day more than makes up for the day of the decline. That helps to reduce the probability that we get sucked into a crash-type of decline where extremes simply don't matter.