Summation Indexes show complete recovery from devastation

The rally has lasted long enough, and has been widespread enough, that longer-term breadth measures are recovering from their March devastation.

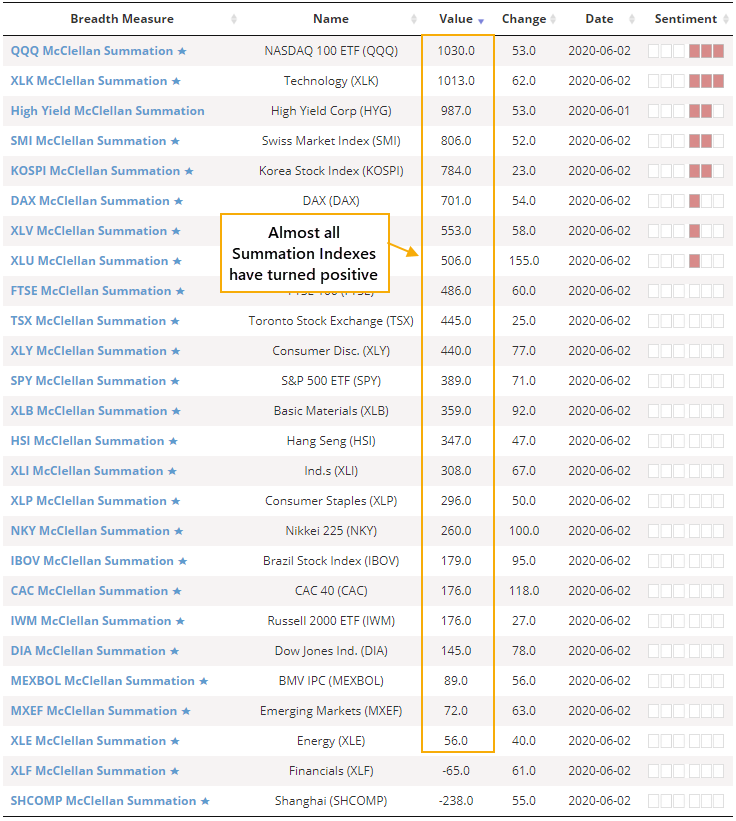

According to the Sector Breadth page, almost all major indexes, domestic and overseas, now have a positive McClellan Summation Index.

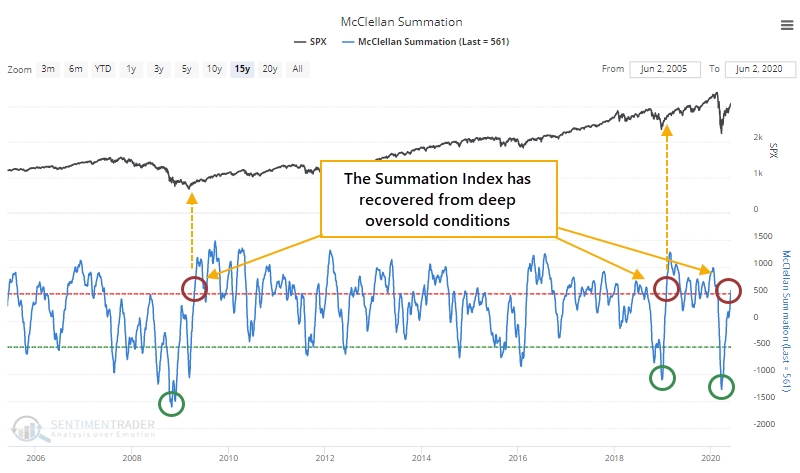

The Summation Index is based on work pioneered by Sherman and Marian McClellan. It is a longer-term look at the momentum of the underlying breadth of an index, adding each day's McClellan Oscillator reading to the day before. When it is above zero, momentum is positive; below zero, it is negative.

On the NYSE, the Oscillator has been gyrating but has recorded some very high readings over the past two months. That has pushed the longer-term Summation Index above +500 for the first time in months, following its plunge below -1000.

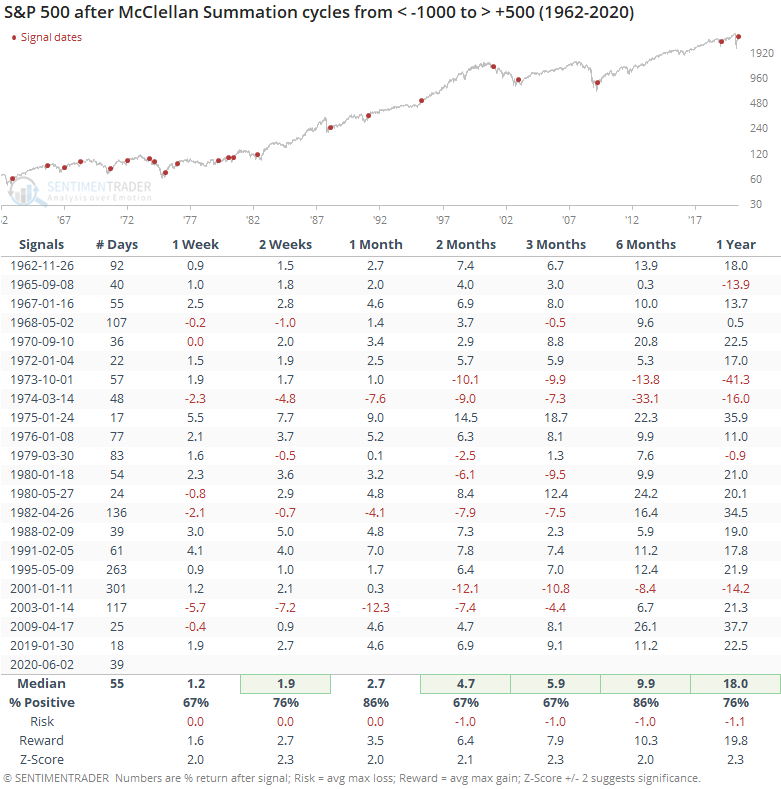

When the Summation Index has recovered from below -1000 to above +500, it has typically preceded sustained recoveries in the S&P 500.

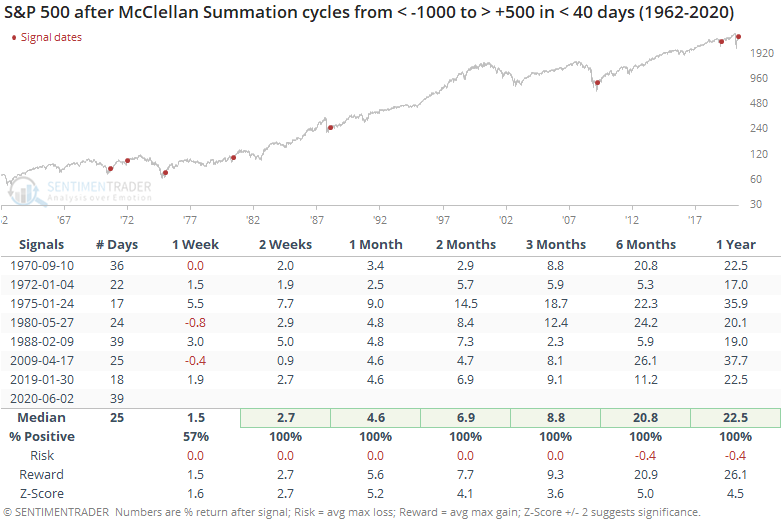

One of the keys here, though, is how quick the recovery has been. The Summation Index completed its cycle in only 39 trading days, among the fastest since 1962. If we filter the table to only include those cycles that completed within two months, then forward returns were even more impressive. We should always beware of anything that claims perfection, but these results were...perfect.

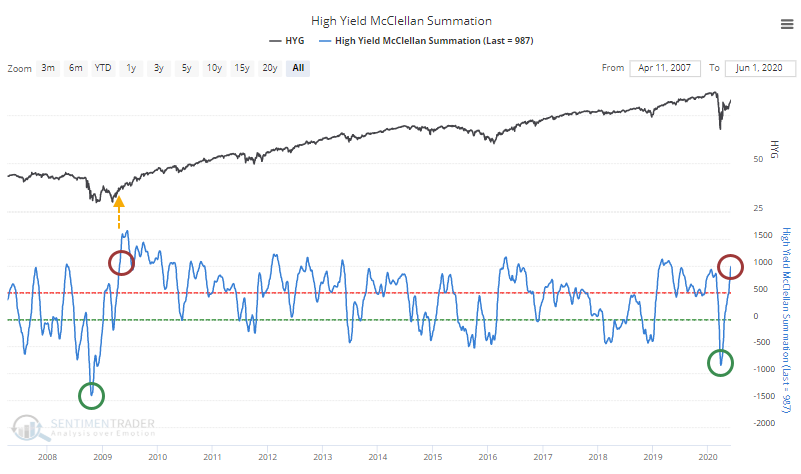

What makes this recovery more impressive is how broad it is. Not just within the S&P 500 or even the NYSE, but across markets and across regions. The Summation Index for high-yield bonds has fully cycled as well, with 2009 being the only precedent.

We've seen signs that investors have soured on overseas markets, pulling massive amounts from funds, with even large money managers avoiding them.

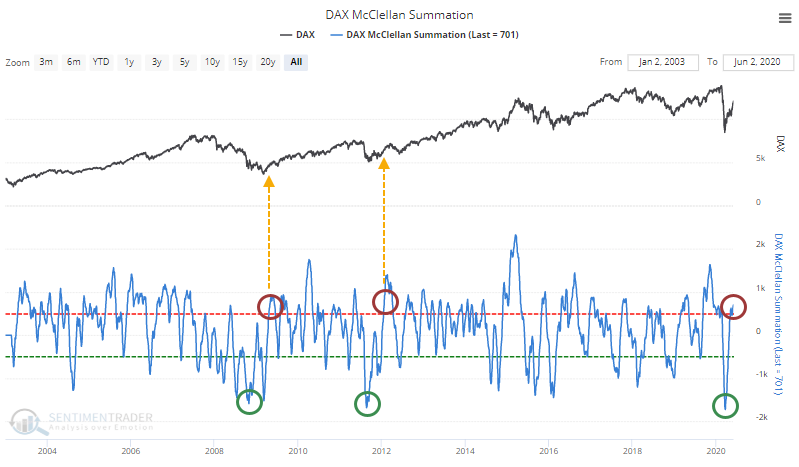

Yet markets like the German DAX are seeing a long-term breadth recovery. The only other times the Summation Index for the DAX cycled like this were April 2009 and January 2012, both leading to large, sustained gains.

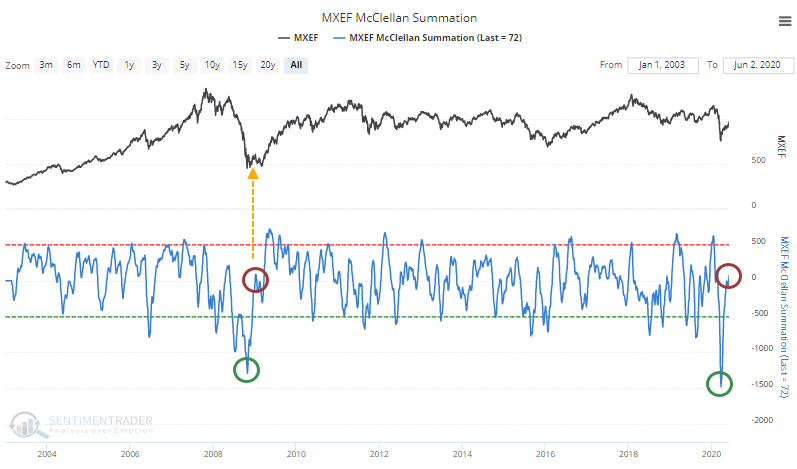

The Summation Index for emerging markets is even recovering, rising above zero after recording a record low reading.

Most other markets are showing similar gains, with similar repercussions.

Like the other signs of breadth recovery and historic thrusts that we've looked at, it's hard to ignore this. Investors always face the same struggle - okay, this looks great, but now I have to buy into a rising market. Outside of pure momentum traders, this is a difficult ask. Ideally, we'd see some kind of medium-term digestion to work off signs of shorter-term speculation and overbought conditions, but markets aren't obliged to accommodate our ideals.