Successful Test As Pessimism Spikes

This is an abridged version of our Daily Report.

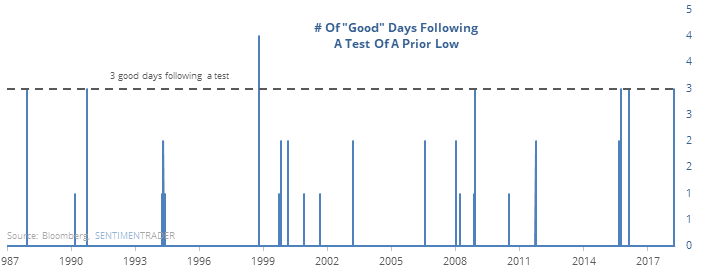

A few good days

The S&P dropped down to challenge its February low on March 23. Since then, 3 of the last 6 sessions have been “good” with either a 1% gain or 80% up volume.

Over the past 30 years, that has indicated a successful test of a low.

Forget the test

If we forget about testing a prior low and just look at times when the S&P slipped down to a 50-day low or very close to one, then jumped higher on lopsided breadth, forward returns were excellent. These only include times when the S&P was trading above its 200-day average after the surge, which Tuesday qualified for.

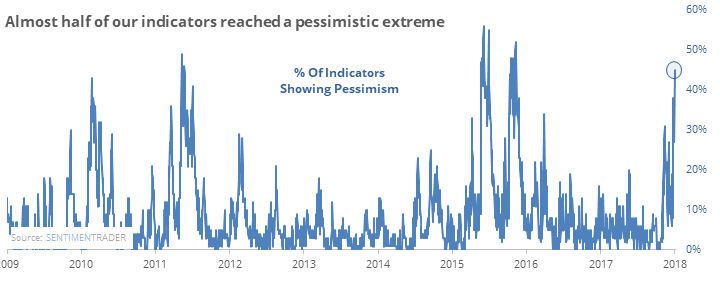

High pessimism

On Monday, nearly half of our indicators were showing an extreme in pessimism.

That’s the most in two years, and only the third time since the 2009 low there have been this many. Going back to 2000 and including bear markets, forward returns over the next 1-2 months were good.

Coffee can’t perk up

Coffee in again the most hated commodity, with an Optimism Index at 22. On a very long-term scale, the 200-day average of the Optimism Index has now gone below 30 for the 3rd time since 1990.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.