Style and sector performance in year two after a bear market low

On Wednesday, I posted a note to review style and sector performance as the market celebrated the pandemic low's first anniversary. The note's purpose was to review the 1-year return for styles and sectors since the pandemic low and compare it to other bear market lows since 1929. I'm happy to report that the traditional early cycle return patterns since the low offered very little in the way of surprises as measured against history. The relationships held up well.

In today's note, I want to review year two after bear market lows to see if we can gain some perspective on what the future might have in store for us over the next 12 months.

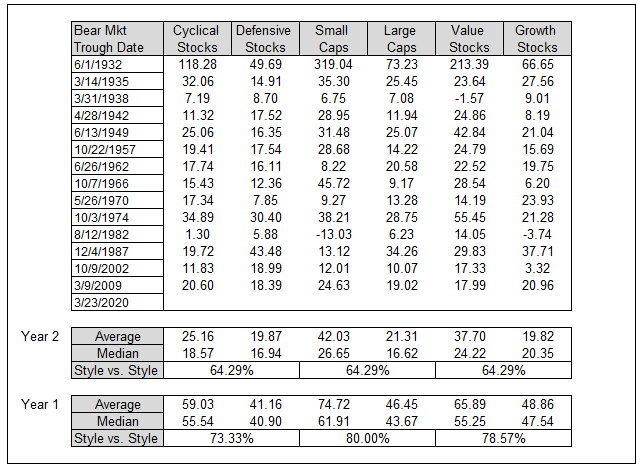

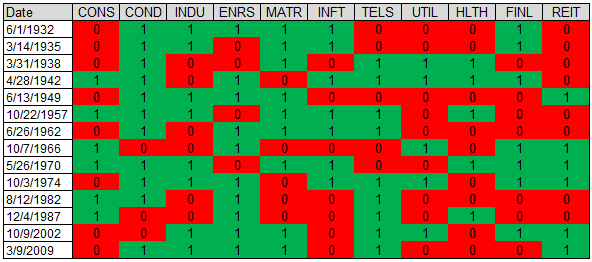

Style Performance Year 2 after Low (% Total Return 12 Months Forward)

While still good, average and median gains are cut in half as the momentum thrust off the low cools down. That's to be expected. The percentage of time one style bucket outperforms the other drops in all three cases. Small over large shows the largest decrease going from 80% in year one to 64.29% in year two.

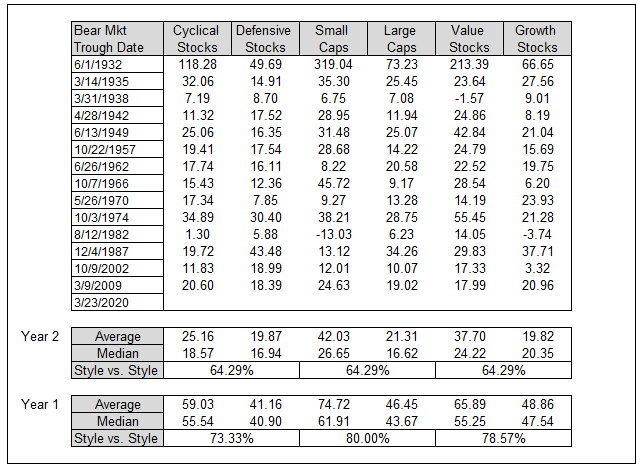

Sector Performance Year 2 after Low (% Total Return 12 Months Forward)

Let's focus our attention on the relative performance as measured by the percentage of time a given sector outperforms large-cap issues from year one to year two in the following table. Consumer Discretionary continues to show the best results on a relative basis versus large-cap stocks even with a decrease from year one to year two. The other early cycle leaders like Technology, Industrials, Financials, and Real Estate show a noticeable decline in the percentage of time they outperform the benchmark. I would also note that Technology is currently on the longest losing steak in year two with four consecutive periods of underperformance. Interestingly, the defensive telecom/communications sector shows a noticeable jump in relative performance and is currently on a five consecutive period win steak. The energy sector shows a nice jump in relative performance in year two with a 71.43% win rate. I would also note that the sector has outperformed for five consecutive periods, matching the telecom/communications group.

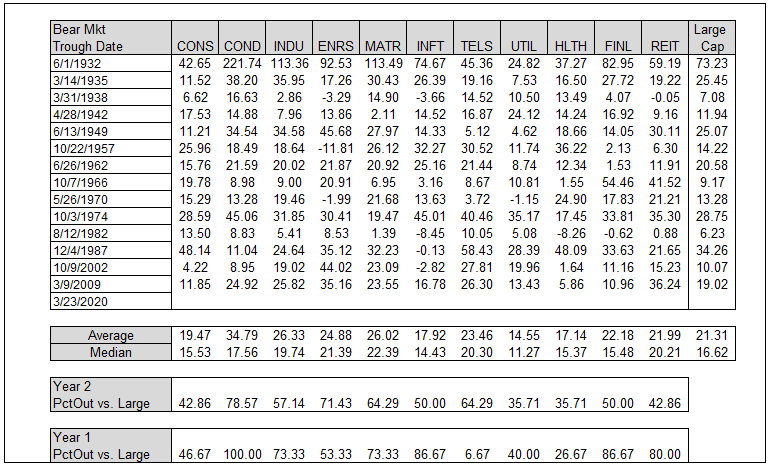

Year Two Sector Relative Performance vs. Large-Cap (1 Outperform - 0 Underperform)

Crude Oil

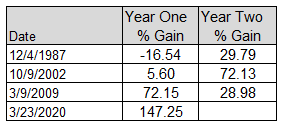

Given the jump in relative performance for the energy sector in year two, I thought it would be a good idea to show crude oil performance in years one and two after the equity bear market lows.

Please note, the former Telecommunications sector was reshuffled in 2018. Technology companies like Facebook and Alphabet were added to what is now a new communications sector. As a result, the sector may not be as defensive as the former group.