Style and Sector Performance 1-Year after the Pandemic Low

As many of you know, the team at sentimentrader.com is a big proponent of studying market history to find an information edge. While every business cycle is different, certain styles and sectors perform better than others in the early stage of a new cycle. On Tuesday, the market celebrated the first anniversary of the pandemic low. Let's review performance for several styles and sectors to see how the most recent early cycle phase compares to history.

Mark Twain was credited with saying, "History does not repeat, but it often rhymes."

Let's see for ourselves.

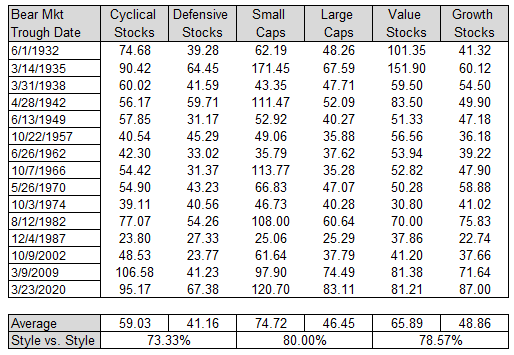

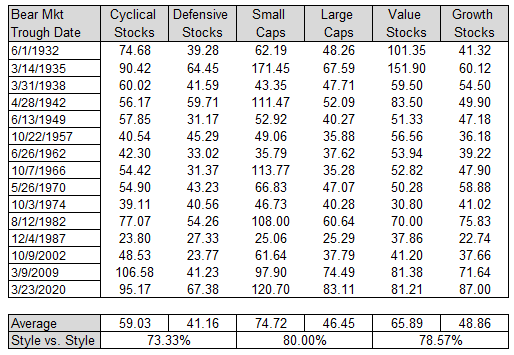

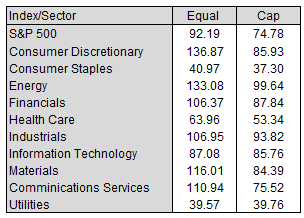

Style Performance (% Total Return)

Cyclical vs. Defensive - Cyclical stocks have outperformed defensive issues 73.33% of the time one year post a bear market bottom, and this time was no different. The group also registered the second-best absolute performance in history.

Small-Cap vs. Large Cap - Small stocks have outperformed large-cap issues 80% of the time one year post a bear market bottom, and this time was no different. The group also registered the second-best absolute performance in history.

Value vs. Growth - Value stocks have outperformed growth issues 78.57% of the time one year post a bear market bottom. However, this time they underperformed growth. Growth stocks registered their best performance in history.

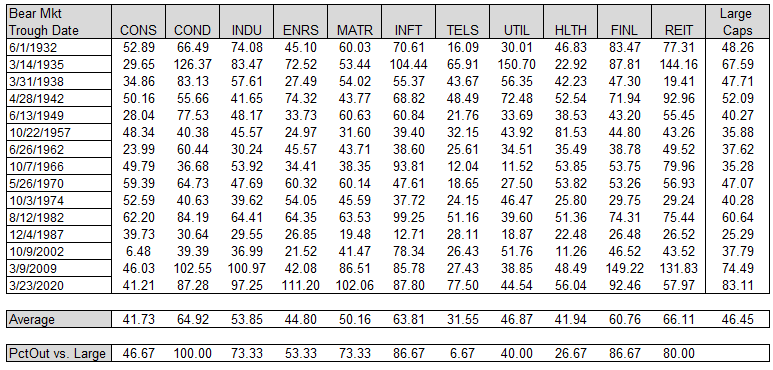

Sector Performance (% Total Return)

The traditional early cycle leaders like Consumer Discretionary, Industrials, Technology, Financials, and Materials all performed as one would expect during the first year. Consumer Discretionary maintained its perfect record of outperforming versus large-cap stocks. As expected, the traditionally defensive sectors underperformed. The one big surprise was the noticeable outperformance in the energy group, as it normally performs in line during the early cycle phase. The energy group was ripe for a mean reversion pop, as we will see in a chart at the end of the note.

Equal-Weight Sector Performance (% Price Return)

Large-Cap equal-weighted indexes and sectors traditionally outperform the cap-weighted version, and this time was no different.

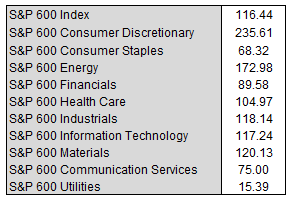

Small-Cap Sector Performance (% Price Return)

Small-cap discretionary stocks were nothing short of spectacular. The 235.61% gain easily beat the 142.90% gain they registered from the March 2009 low. Energy also registered the best performance from a low in history.

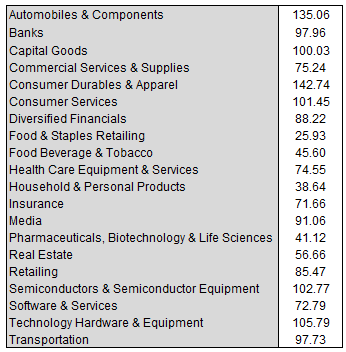

All-Cap Industry Group Performance (% Price Return)

All-Cap Sub-Industry Performance (% Price Return)

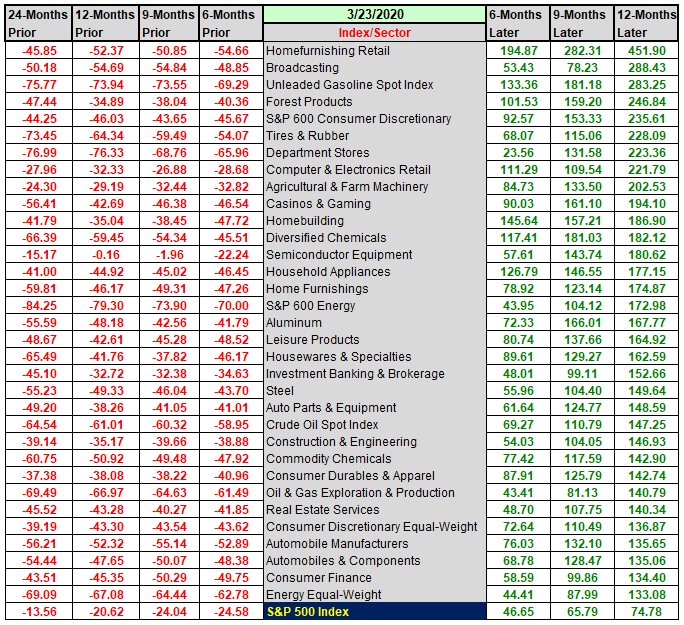

I monitor the following table whenever the market is in a major correction or bear market for mean reversion opportunities. As one can see, some of the most beaten-down groups performed the best off the 3/23 low. The energy group was clearly a beneficiary of a major oversold condition.

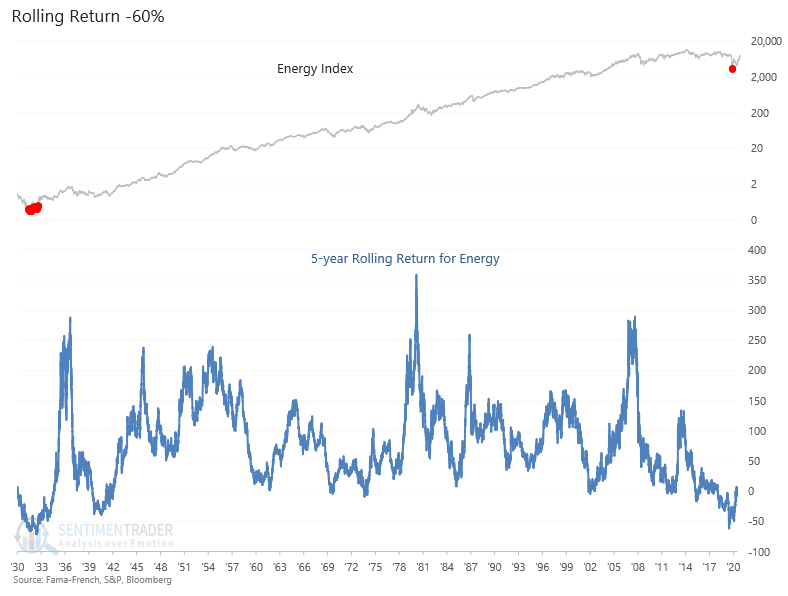

Energy Mean Reversion Chart (Total Return)

The energy sector was ripe for a mean reversion trade as it reached an oversold level not seen since 1932.