Studying The Studies

This is an abridged version of our Daily Report.

Studying the studies

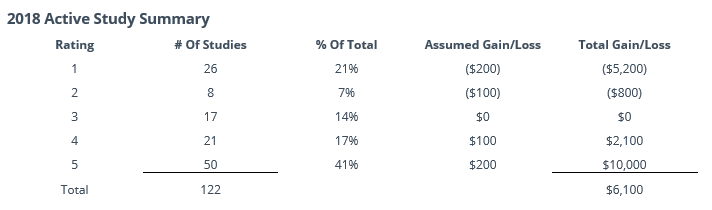

Like last year, we take an objective look at the studies posted to the site in 2018. Using a conservative estimate of their expected value, we can see that it still makes sense to observe the markets in this way. When we establish a very conservative cash value to each of the 5 possible ratings for the studies, and compare that to how often they occurred, there was a profitable outcome.

When we look at the current state of the studies, they’re skewed heavily to the upside. Since we started tracking them this way three years ago, there haven’t been this many positive studies for the S&P.

2-point summary

There were so many extremes this week, it has led to “extreme fatigue” with each additional one becoming redundant. If we sum it up in 2 points, it’s that sentiment has become stretched to a historic degree, and this kind of price volatility has preceded an immediate bottoming process.