Strong momentum in agriculture

Some investors and traders have been calling for a bottom in commodities for years. With coronavirus impacting global supplies, global commodity prices are rising, prompting speculation that this *could* be the start of a major commodities bull market. Then again, investors have been saying this for 9 years (XYZ could generate a major commodities bull market).

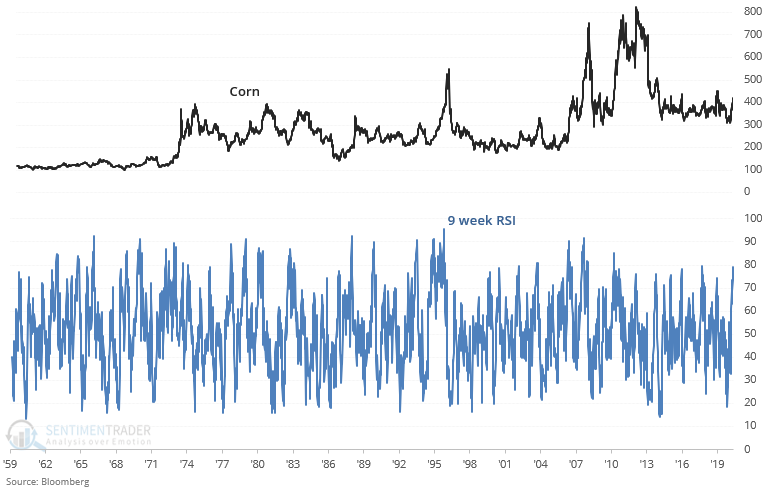

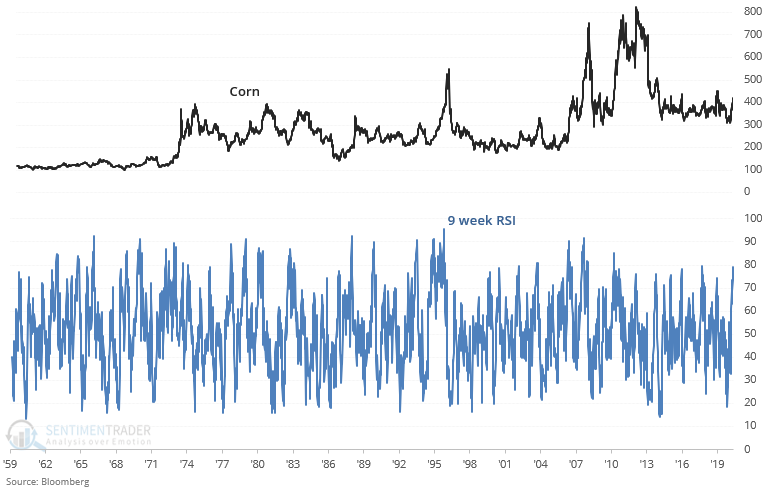

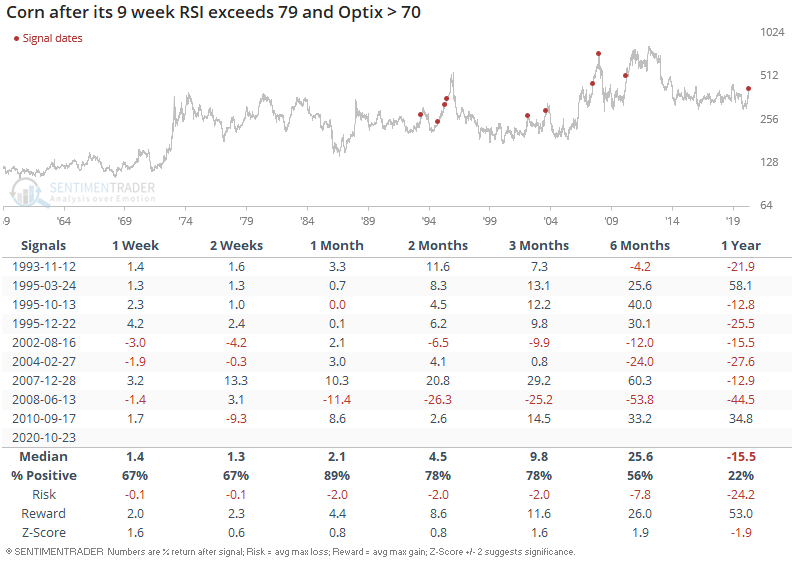

Corn has been rallying in recent weeks, pushing its 9 week RSI to 79:

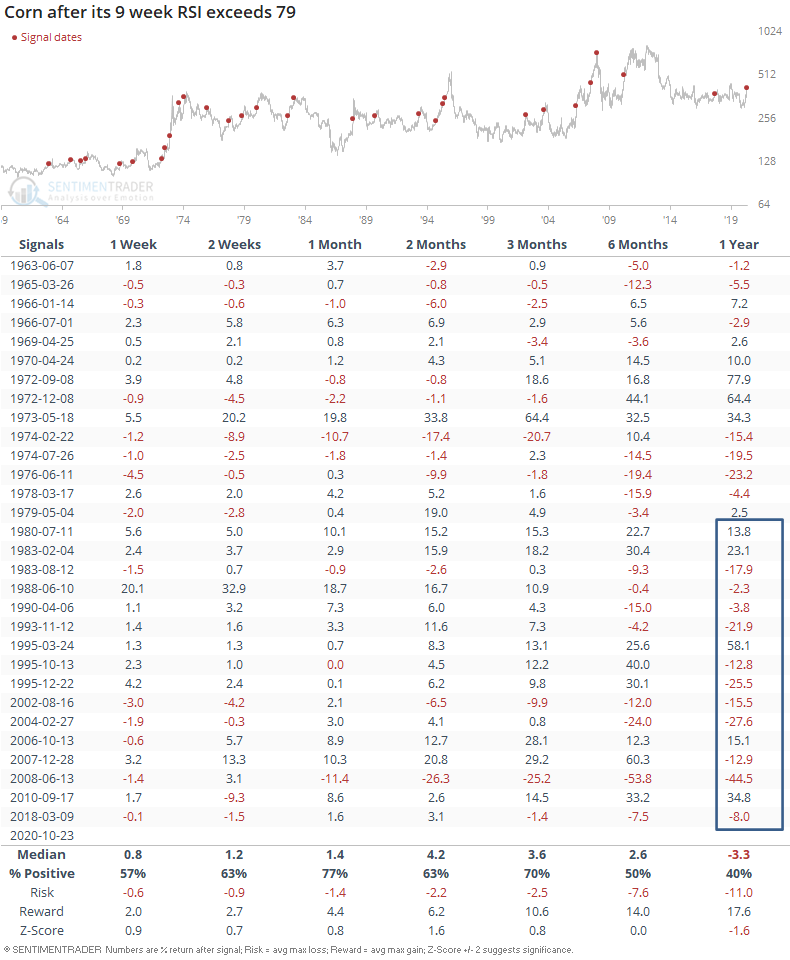

In recent decades this has been a bearish factor for corn over the next year:

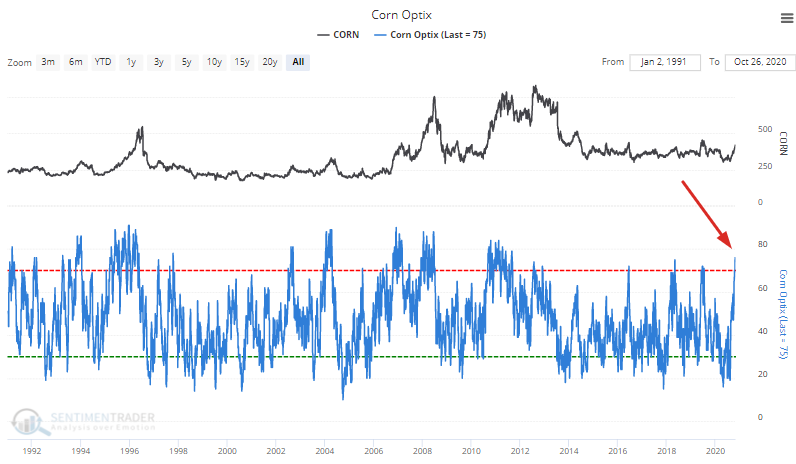

When we combine corn's strong momentum with once-in-a-decade sentiment readings...

...corn's forward returns over the next year are consistently bearish:

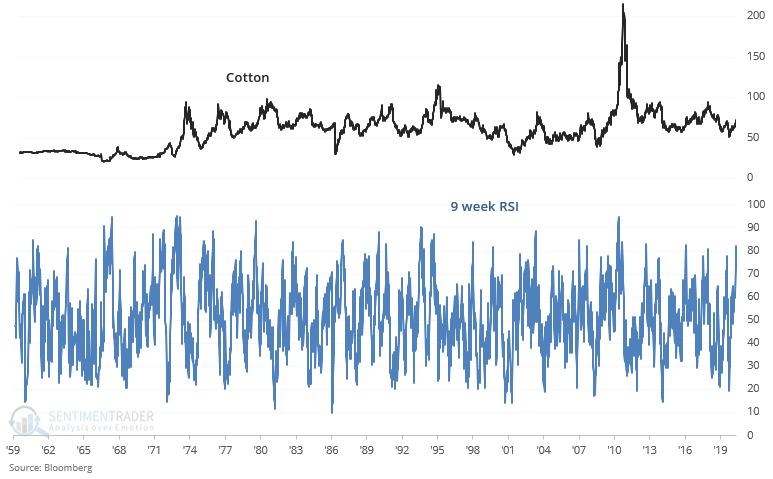

Similarly, cotton's rally pushed its 9 week RSI to 80:

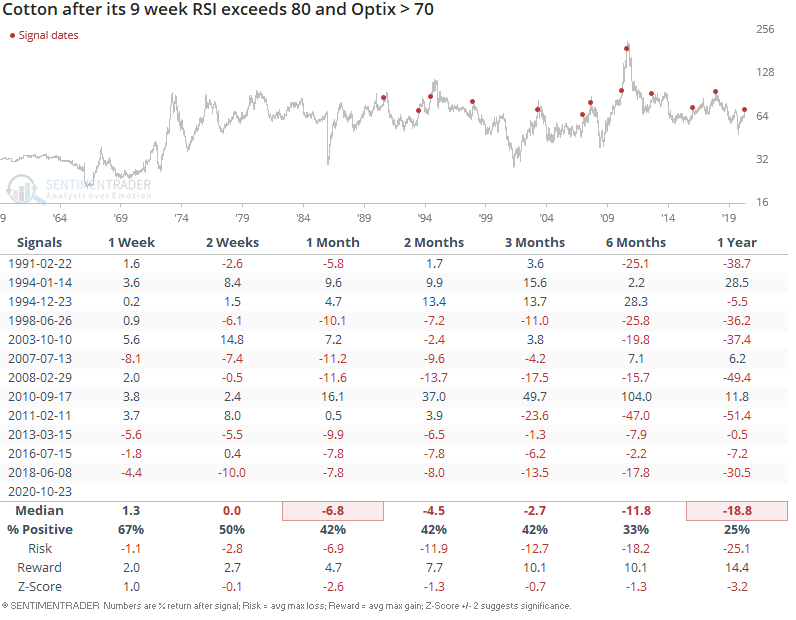

Historical cases of strong momentum led to mostly mixed forward returns for cotton:

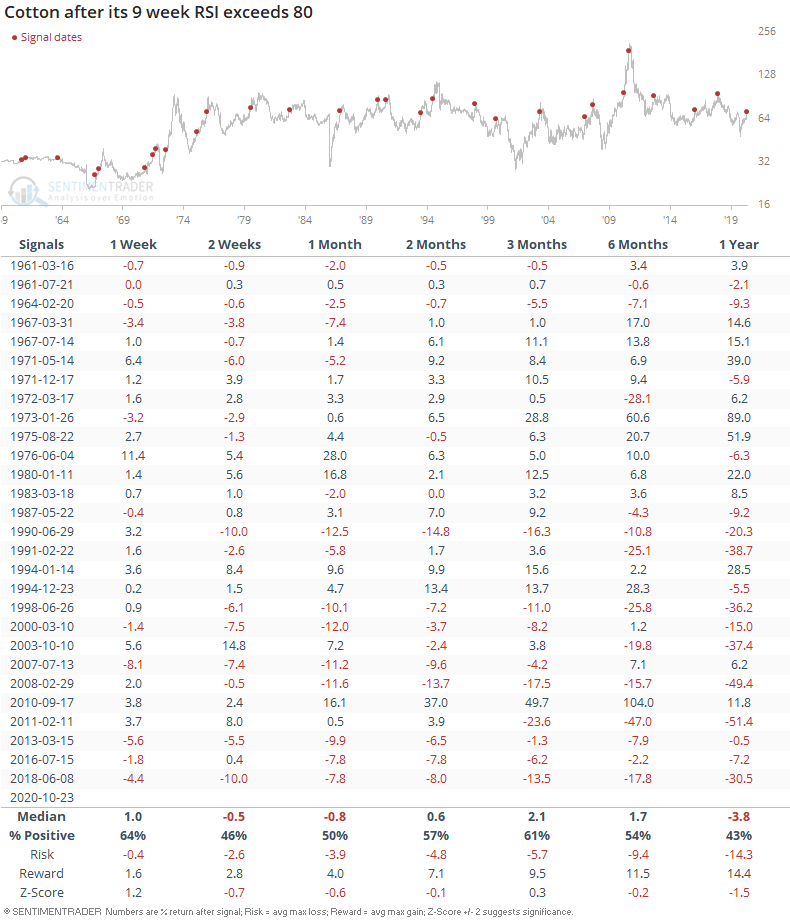

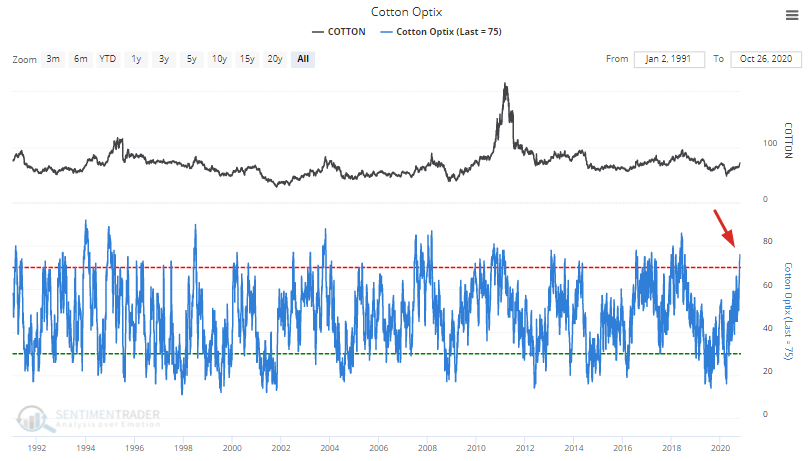

But when we combine this fact with cotton's high level of optimism:

Cotton's returns over the next 6-12 months are drastically more bearish.

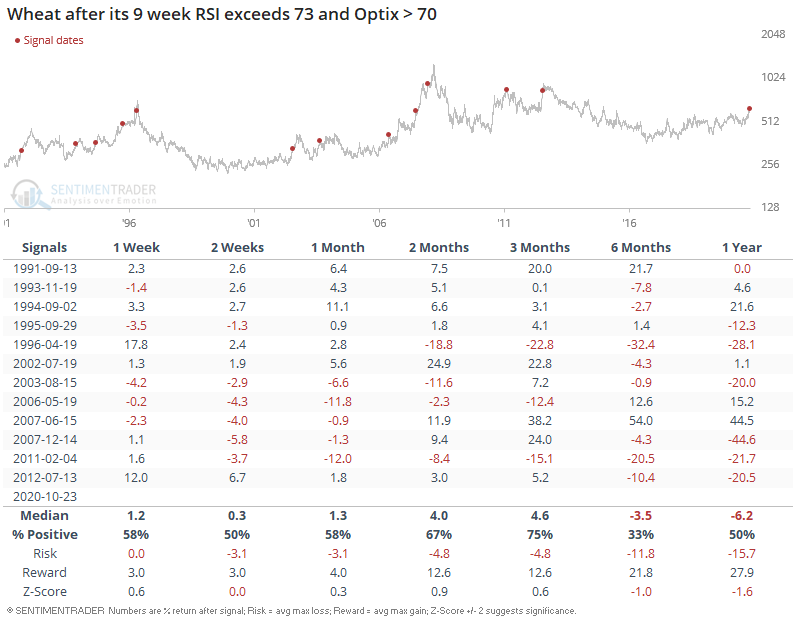

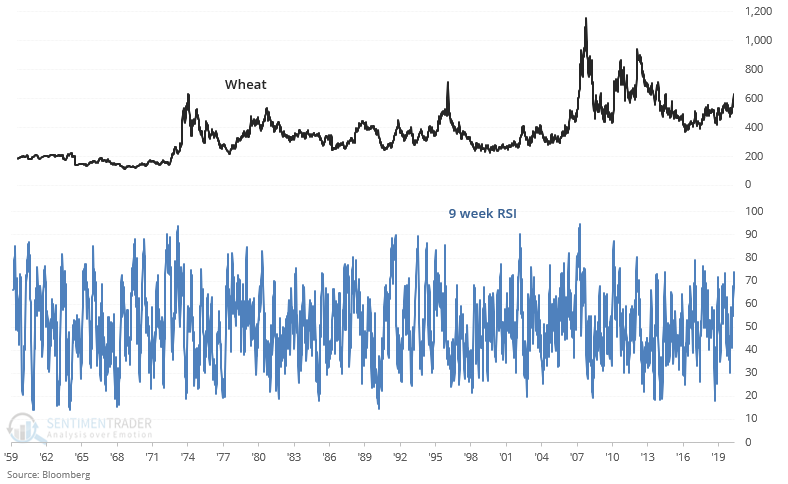

Looking at other agricultural commodities, wheat's 9 week RSI is elevated:

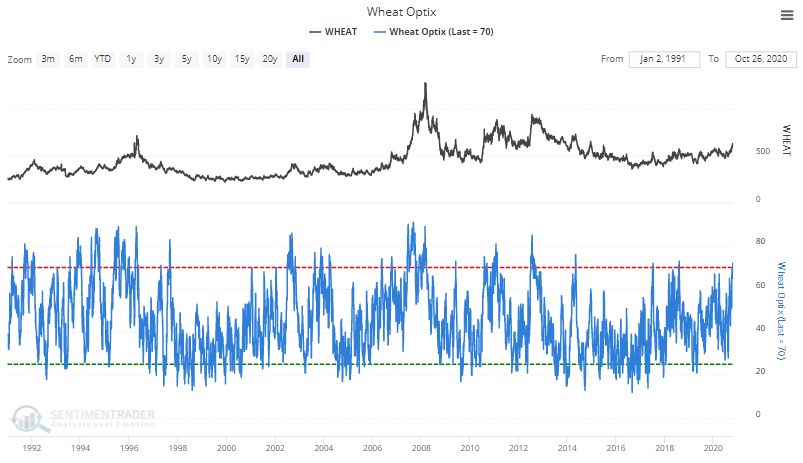

As is wheat's sentiment:

High levels of optimism and momentum led to more losses than gains for this agricultural commodity over the next 6 months: