Strong breadth after a massive rally

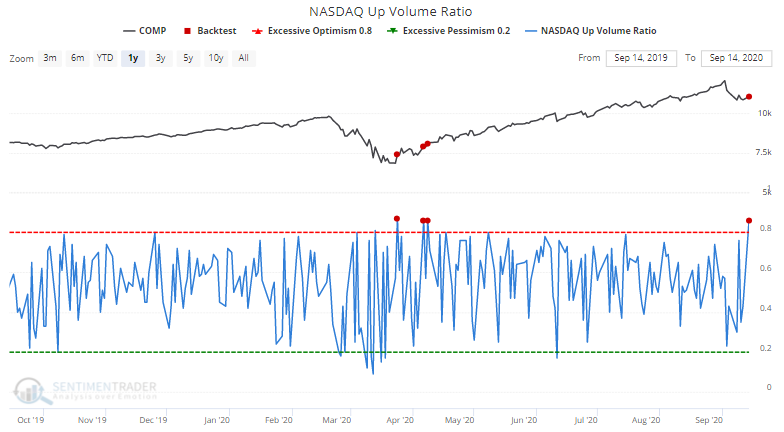

Weak breadth was one of the biggest problems for stock market bulls over the past few weeks. Few stocks were participating in the index rally. The NASDAQ Up Volume Ratio surged past 85% for the first time since this rally began.

Normally we'd assume that strong breadth is a good thing, as it was at the start of the March - present rally. But keep in mind that the cases in April occurred AFTER a big crash, whereas the present case occurs after a massive rally. So perhaps this isn't as bullish.

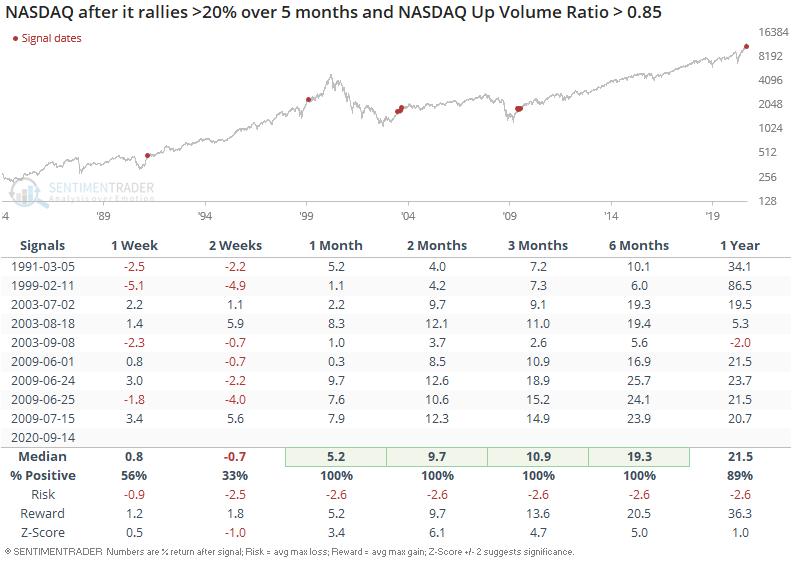

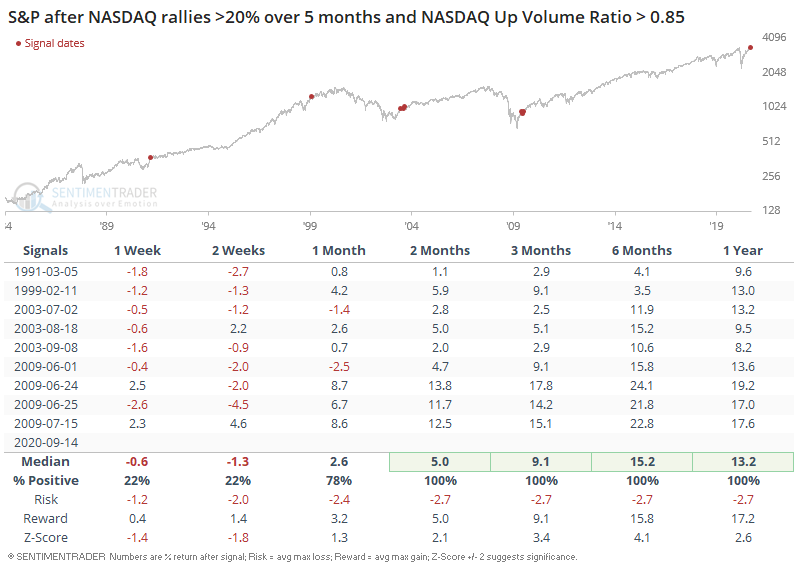

The following demonstrates what happened next to the NASDAQ Composite after it rallied more than 20% over the past 5 months, and then NASDAQ Up Volume Ratio > 0.85:

This was a minor bearish factor for the NASDAQ over the next 2 weeks, but after that consistently led to more gains.

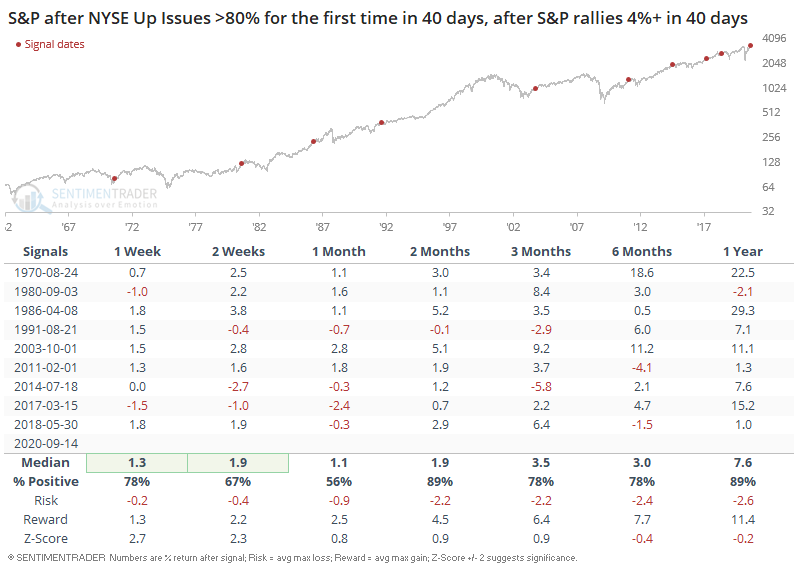

As for the S&P 500, this almost universally led to a pullback over the next 1-2 weeks, which were followed by more gains:

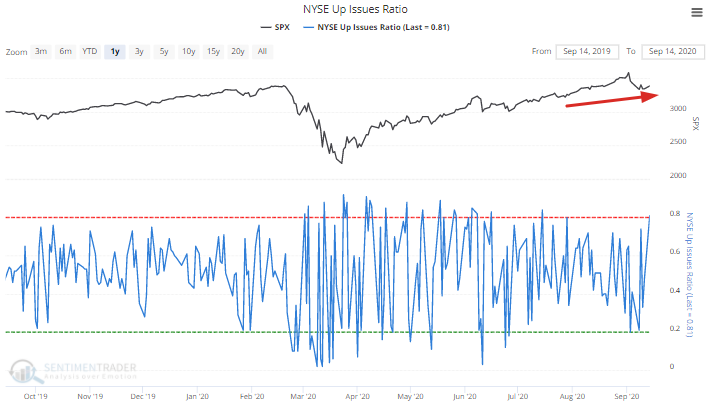

Similarly, NYSE Up Issues Ratio exceeded 80% for the first time in almost 2 months. Whether breadth will consistently improve has yet to be seen:

When the S&P rallied significantly over the past 40 days, but today was the first historical case of strong breadth, the S&P usually pushed higher over the next week: