Streaks End As Concern Rises

This is an abridged version of our Daily Report.

Streaks end as concern rises

Major indexes ended some notable streaks, which were nearing record lengths. The S&P 500 ended months without a 1% move by tripling that to the downside. The Russell 2000 and Nasdaq Composite both ended long periods above their 200-day moving averages.

It triggered signs of concern

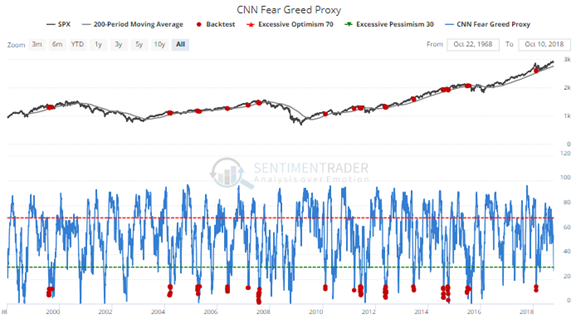

As the day wore on, there were few places to hide. That usually means traders flock to inverse ETFs which profit on a market decline, and Wednesday saw record volume. It also sent implied volatility jumping for the 2nd time in a week, with an inversion of the Term Premium and large drop in the CNN Fear & Greed model.

Indiscriminate selling

More than 90% of volume on the NYSE was focused on declining issues, and more than 90% of issues at 52-week highs or lows were lows. That kind of lopsided selling doesn’t happen often when the S&P 500 is still above its 200-day average. Since 1965, it has triggered on only 15 days.

Oversold (?)

Breadth momentum has been waning for a while, and now it’s getting extreme. The McClellan Oscillator dropped below -80 on Wednesday.