Straddling The S&P

With yet another day of almost no volatility, signs are piling up that things are about to change. The caveat here, of course, is that the signs piled up several times before, and we either got a limp response or none at all.

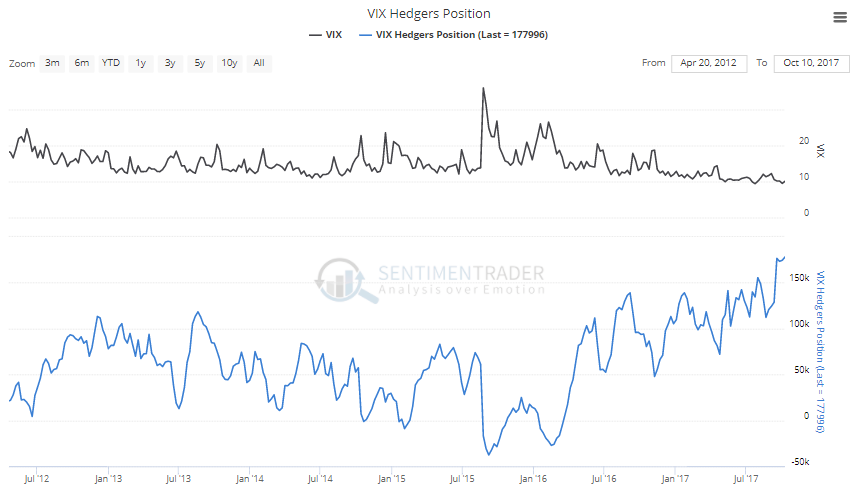

Among these signs, we're seeing that "smart money" hedgers are net long VIX futures to a record degree.

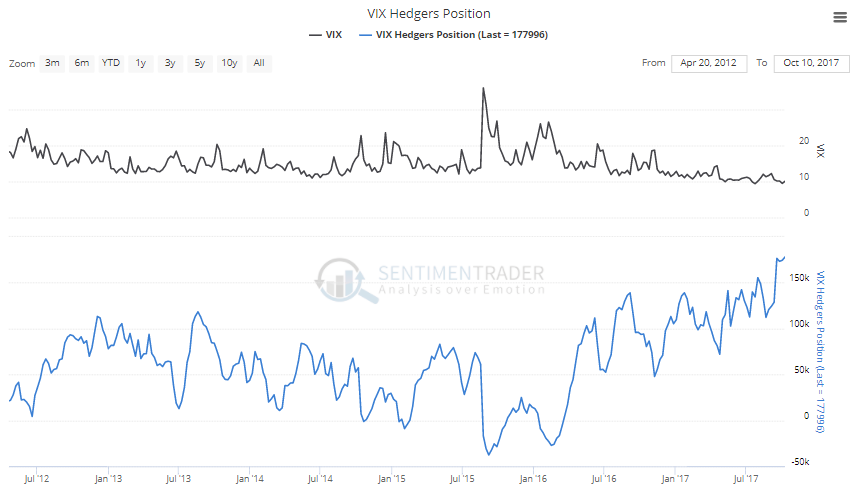

At the same time, traders are pouring into volatility products, which has not been a contrary indicator. Usually, this is the "smart money" and we typically see volatility tick higher after inflows.

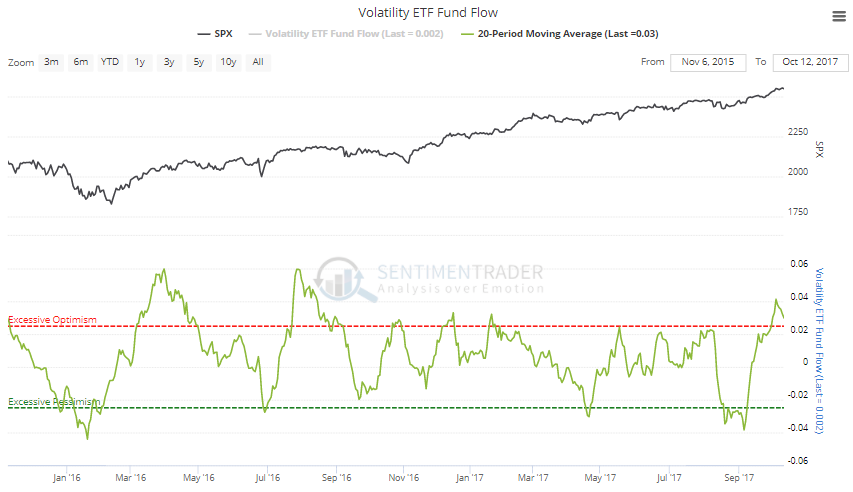

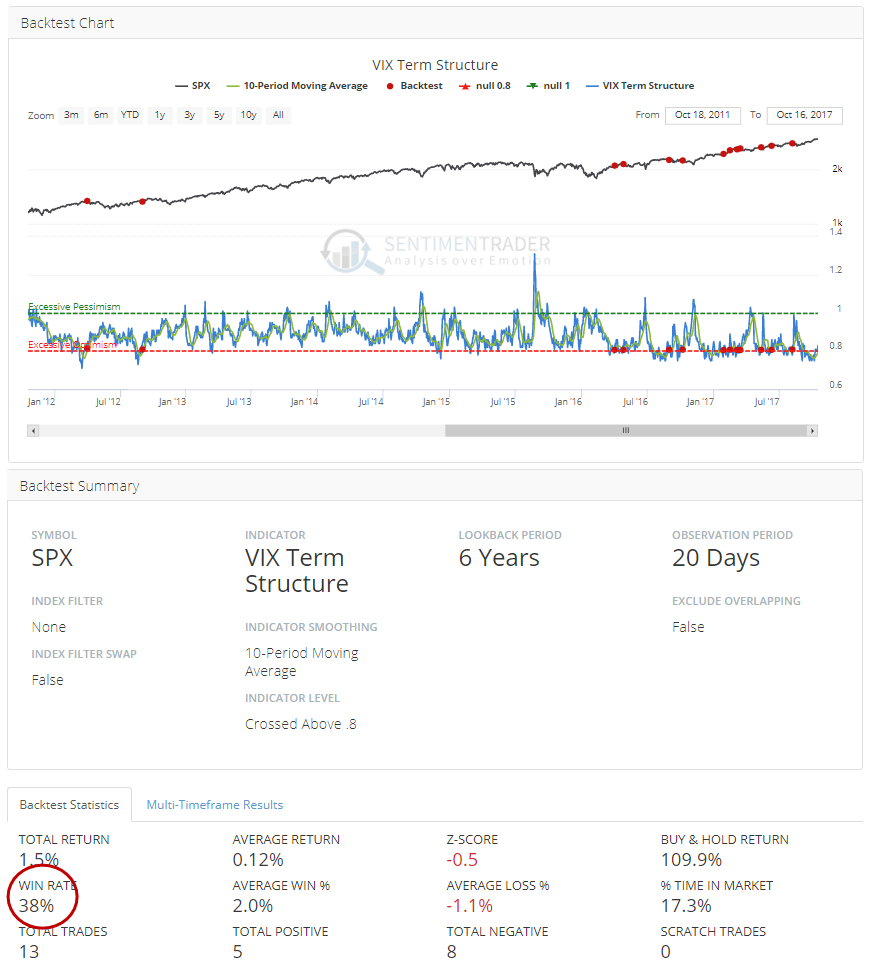

The Term Structure of the VIX is starting to normalize after being suppressed to a record degree. The 10-day average is just emerging out of extreme territory, meaning that options traders are just now starting to price in the possibility of rising volatility in the nearer-term compared to what they have been. Even during the irrepressible rally in recent years, this has often led to a negative return in the S&P.

Anecdotally, it's interesting that there is news about Wells Fargo have to pay out damages for having the audacity to steer clients into some of these volatility ETFs. They are exceptionally poor products and not suitable for just about anyone, but that's not the point. The point is we wouldn't see this during a time of normal market movements.

Besides the iPath S&P 500 VIX ETN, other products that Wells Fargo doesn’t offer include the iPath S&P 500 VIX Mid-Term Futures Exchange-Traded Note, which has plunged more than 40% this year, and the ProShares VIX Short-Term Futures Exchange-Traded Fund, which is down about 65% in 2017.

Whether hedge funds can be considered the smart money is up for debate, but they're also starting to more aggressively move into the space that those Wells customers have been so burned on.

That should be music to the ears of hedge fund managers like Brevan Howard. The firm is expected to start a long volatility fund soon, people with knowledge of the matter said. Funds planning similar launches this year include Astrid Hill, founded by Millennium Management alumnus Arun Singhal in Singapore, and One River Asset Management, a manager of $700 million led by Eric Peters in Greenwich, Connecticut, according to Singhal and One River marketing materials obtained by Bloomberg News.

They're doing this after the tail-risk category has been among the worst categories for years on end.

While the funds surged 46 percent as a group during the crisis in 2008, they’ve lost 9.1 percent this year and are down 17 percent over the last five years, according to Eurekahedge Pte. The five-year drop is the second worst among 20 categories after tail risk, a supercharged cousin of long volatility that bets on extreme market swings.

These are not necessarily new developments, and like I said, they've failed at other points in 2017, or at least didn't lead to reactions like they did in the past. So it's more of a spidey-sense that this time might be different.

Like the Wells Fargo customers have discovered, though, there isn't a pure, clear-cut way to bet on the potential for rising volatility. And like we've been noting in recent reports, momentum in stocks has been remarkable, on a par with only a couple of times in history, and those both led to further gains over the next six months before any kind of notable correction.

So that leaves us with a confusing backdrop.

- There is an extremely high probability the VIX will spike at some point in the coming months.

- But that goes against the upside argued by momentum and seasonality - it would be rare to see a major pullback during this time of year, after seeing this kind of momentum.

- But seasonality isn't perfect - it bucked the usual summer/September pattern so perhaps some of that positive drift has already been used up.

- And a historic percentage of our indicators are showing excessive optimism.

So what to do? I am personally holding a very high amount of cash, which has been a major drag. I'm not willing to go outright short the market, due to the positives of momentum and seasonality. But I do think there is the potential for a spike and would like to participate. Volatility funds and poor choices since the time frame is uncertain.

About the best basic strategy (for me) is a straddle on the S&P. That's buying an at-the-money call and put option of the same strike and expiration. With volatility so low, it's a relatively cheap trade that will constantly bleed value unless stocks make a big move - up or down - before expiration. Since I believe both upside and downside are relatively limited, I don't think a strangle, which uses out-of-the-money options, would pay off.

Using March 255 options, the straddle would lose money as long as SPY was between 241 and 269 at expiration. That's more than a 6% move in the next five months. I don't think we'll see a sustained move greater than that in either direction, so my plan would be to sell the call option if we rally in the coming month(s) and be left with a "free" put option, or to sell the put if we finally do see a pullback and be left with a "free" call option.