Stocks Up and Yields Down

The S&P 500 closed at a new all-time high on Thursday as the 10-year yield simultaneously closed at a 3-month low.

What is the bond market trying to tell us with the move lower in yields in the face of a strong economy and higher than average inflation?

While it's fun to make an educated guess, let's see what history has to say about the forward return outlook for stocks, commodities, and bonds.

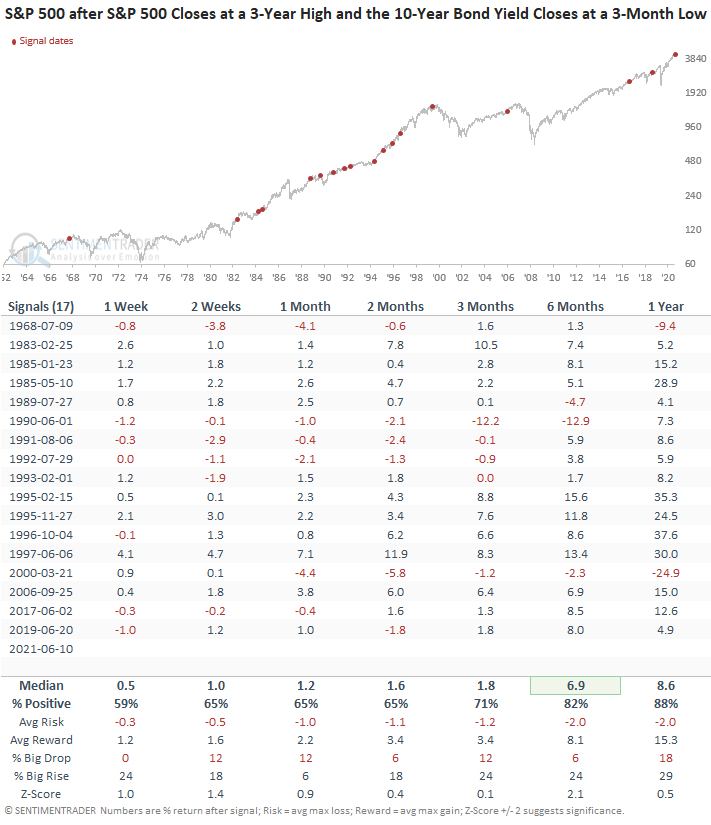

The following study identified each instance in history when the S&P 500 closed at a 3-year high and the 10-year bond yield simultaneously closed at a 3-month low. I screened out repeat signals by requiring the 10-year bond yield to register a new 3-month high before an additional signal could trigger.

HOW THE SIGNALS PERFORMED - S&P 500

Returns look constructive across the table except for the early 1990s and the March 2000 signal. I would note that most instances triggered between 1989 and 1997, a period where returns for value and growth were almost identical.

The S&P 500 performance table reflects price-only data. All other stock tables are total returns.

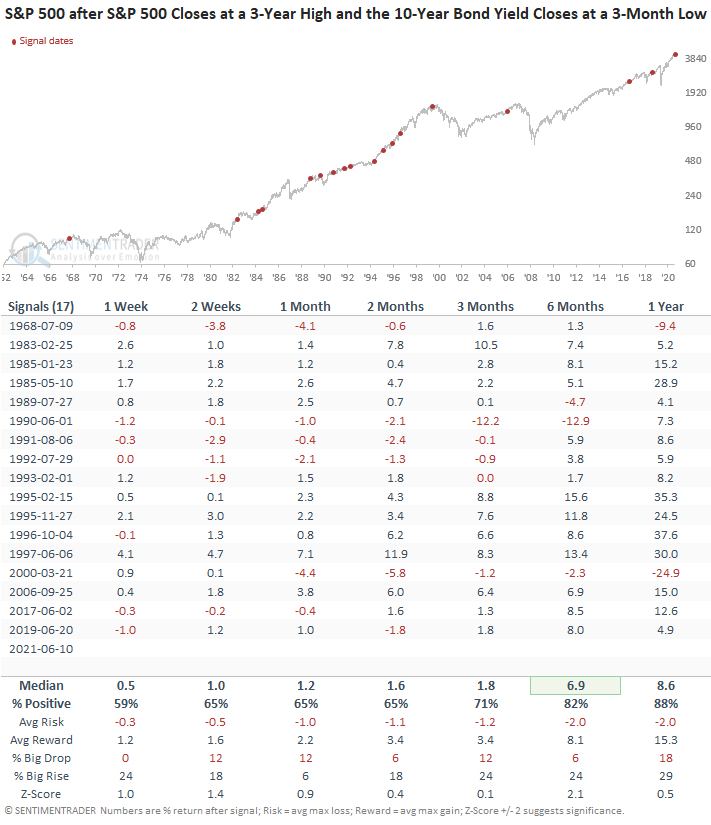

HOW THE SIGNALS PERFORMED -VALUE

Value performed very well with the best median returns of any group, especially in the 6-12 month timeframe.

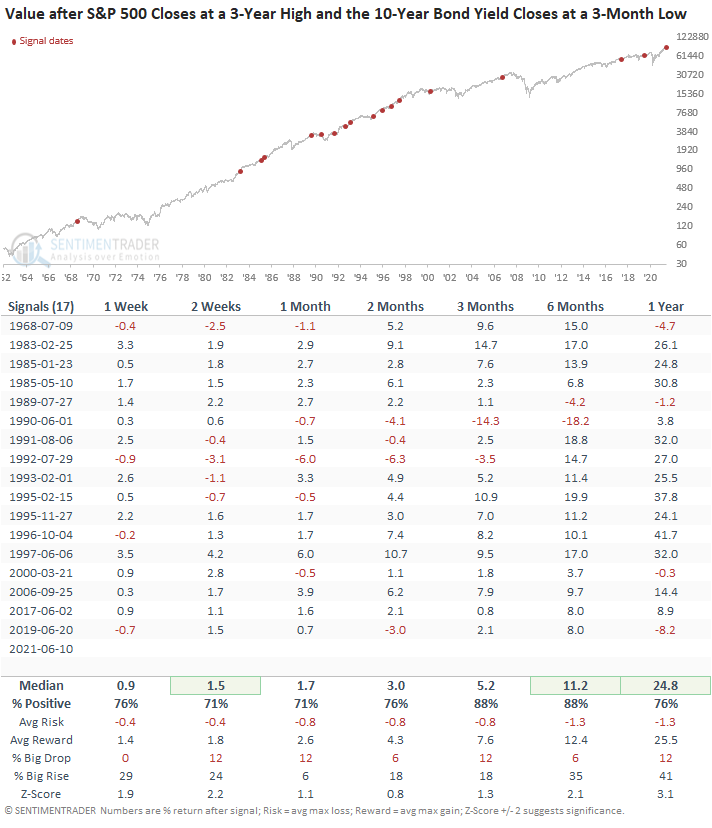

HOW THE SIGNALS PERFORMED -GROWTH

The short to intermediate-term returns were in line with more constructive performance in the 3-12 month timeframe.

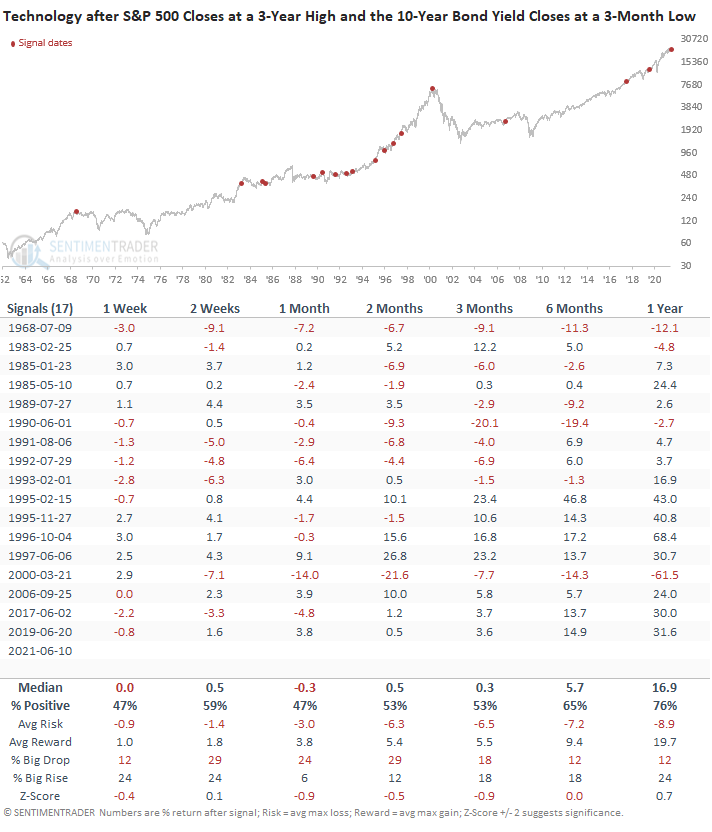

HOW THE SIGNALS PERFORMED - TECHNOLOGY

Technology returns were weak on almost all timeframes. However, one could argue that more recent instances were better.

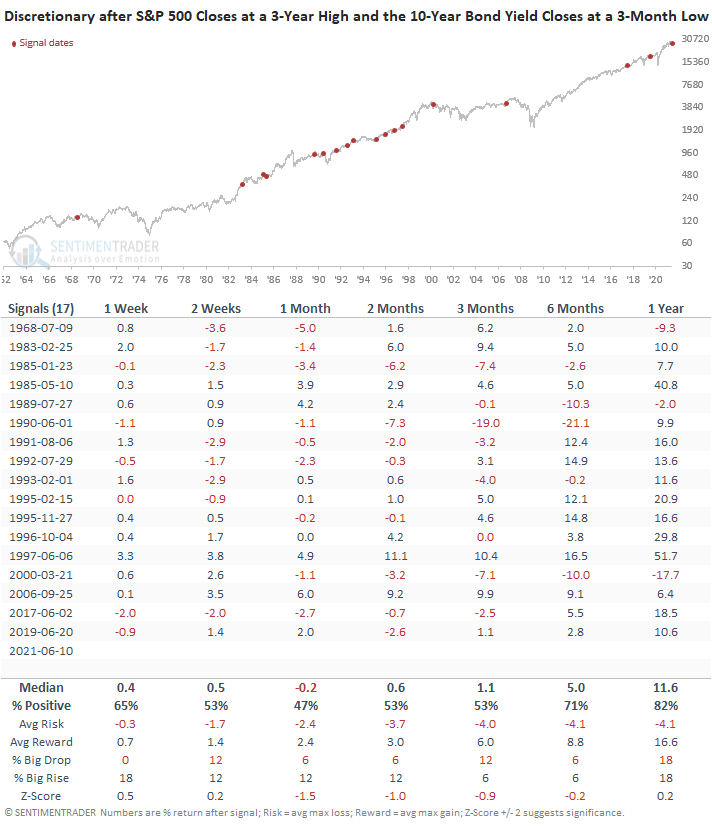

HOW THE SIGNALS PERFORMED - CONSUMER DISCRETIONARY

The short to intermediate-term returns look mixed to slightly weak with more constructive performance in the 12-month timeframe.

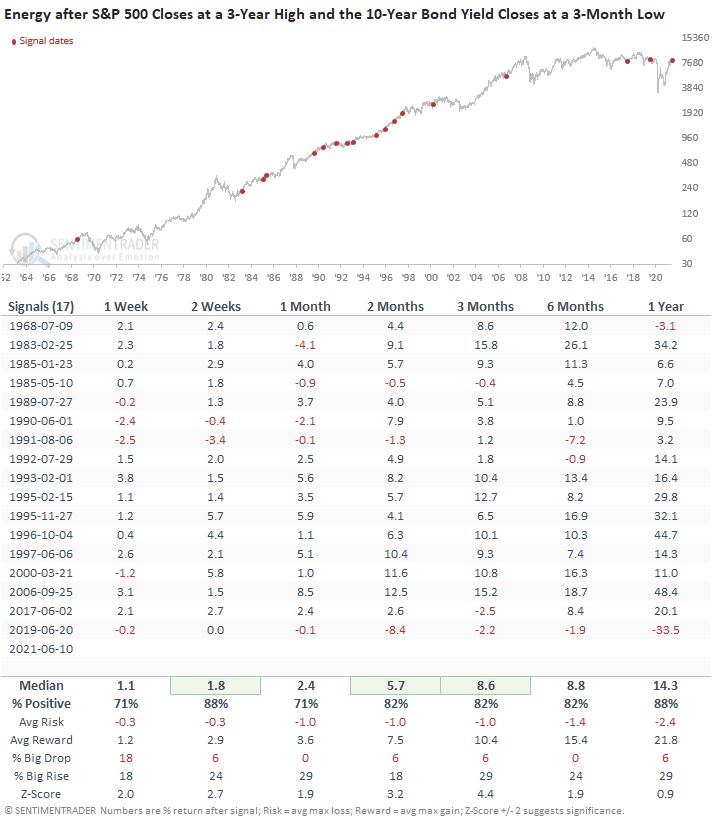

HOW THE SIGNALS PERFORMED - ENERGY

Energy performance looks solid on all timeframes.

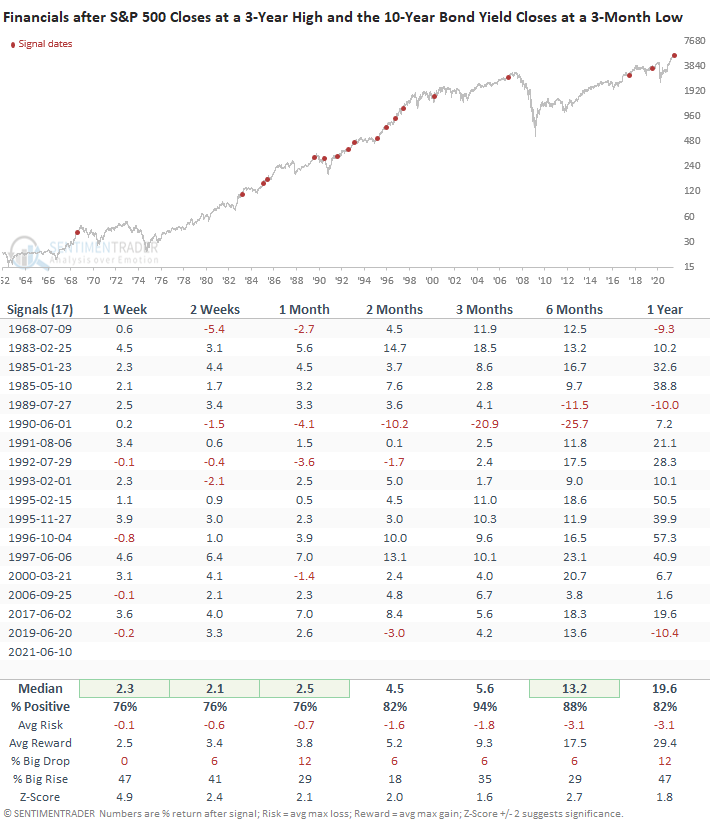

HOW THE SIGNALS PERFORMED - FINANCIALS

The Financials look fantastic on all timeframes. FYI, I had Jason double-check the numbers.

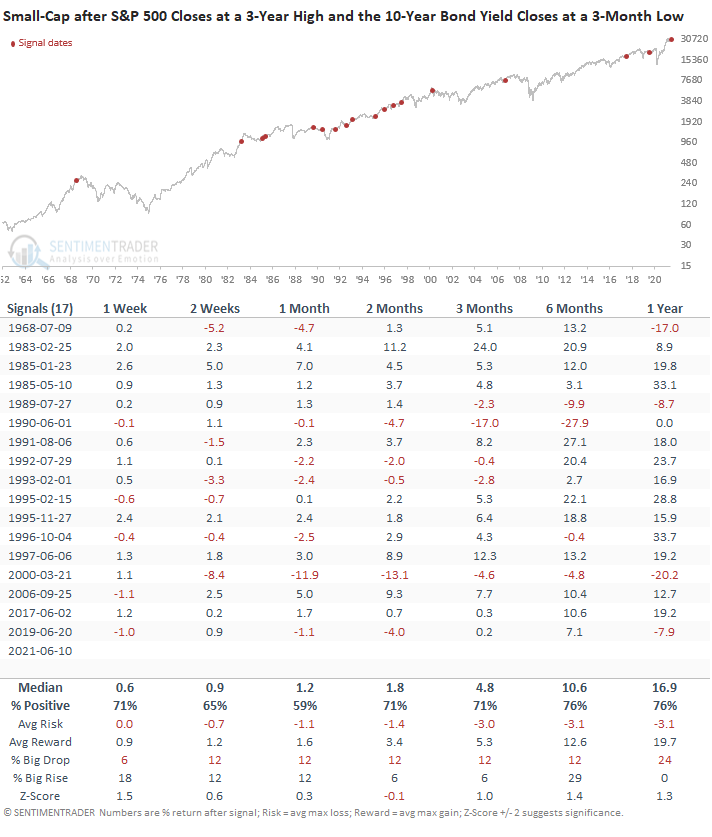

HOW THE SIGNALS PERFORMED - SMALL-CAP

Small-cap looks okay.

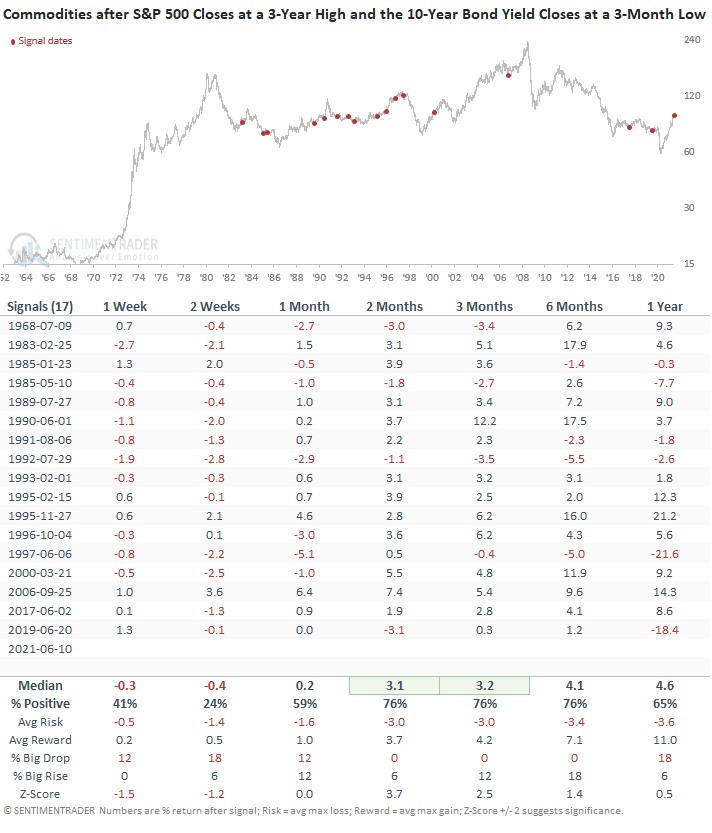

HOW THE SIGNALS PERFORMED - BLOOMBERG COMMODITY INDEX

Commodities look weak in the short-term, with better results in the 2-12 month timeframe.

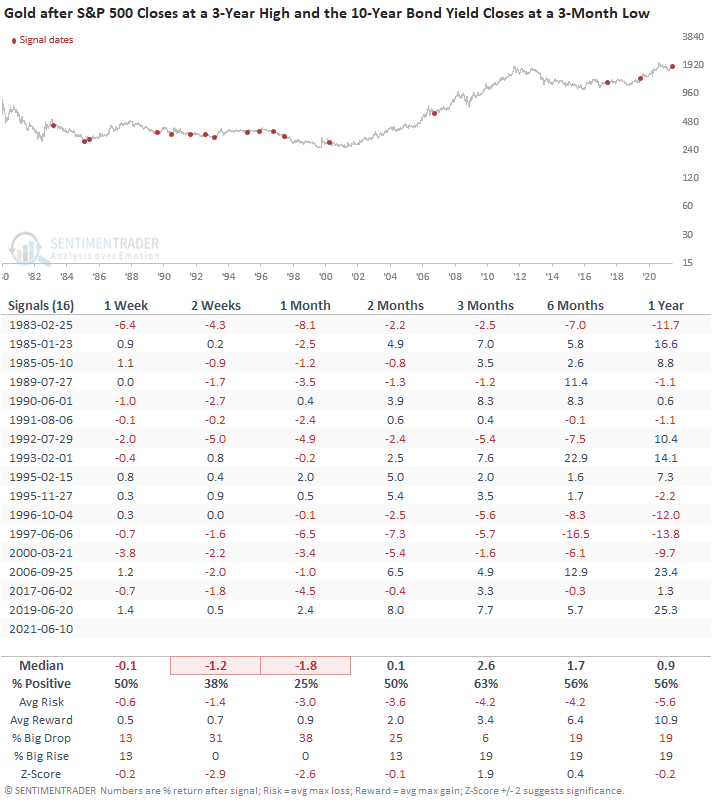

HOW THE SIGNALS PERFORMED - GOLD

Gold looks consistently weak on almost all timeframes. Due to data limitations, gold has one less signal.

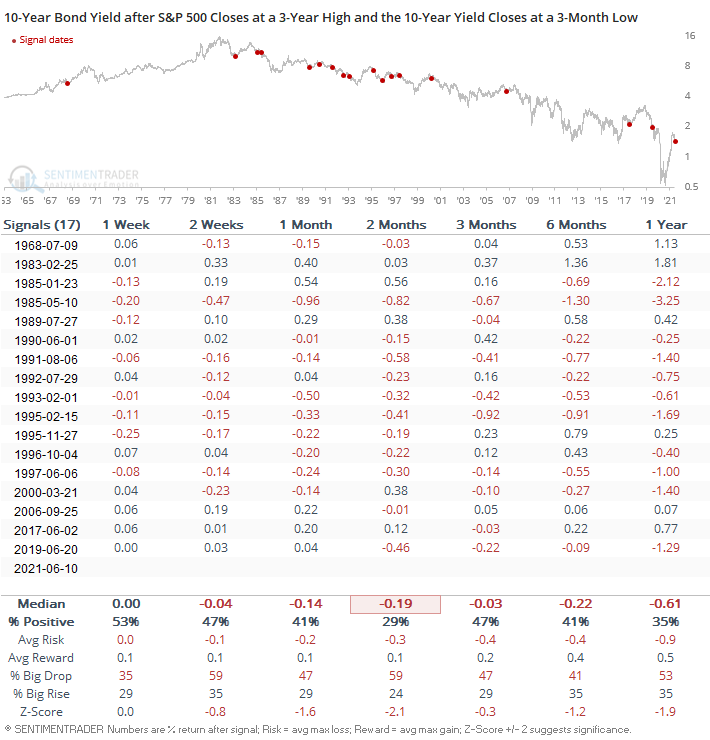

HOW THE SIGNALS PERFORMED - 10-YEAR YIELD

Bond yields consistently moved lower across almost all timeframes. I would note that all but one instance occurred during the long bond bull market that started in 1980.

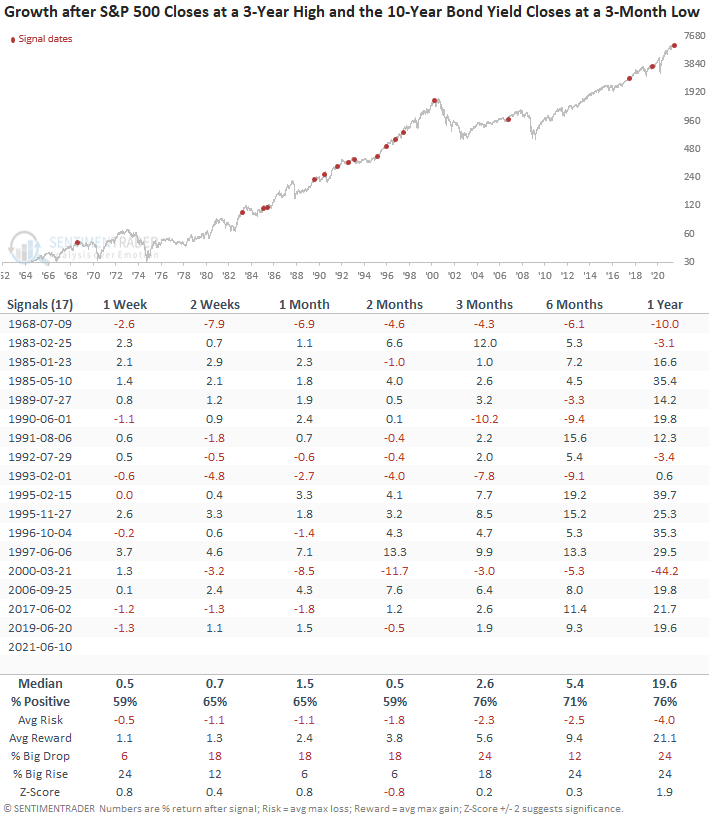

History suggests that the move lower in bond yields implies slower growth. Therefore, we should be thinking about rotating out of value/cyclical stocks and into growth-oriented issues. Based on the following study, the historical evidence suggests otherwise. However, we need to keep in mind that several instances occurred in a relatively narrow timeframe.