Stocks struggling as breadth recovers

We've spent a lot of time going over extremes in breadth over the past month. They were the most compelling metrics on the way down, with the most lopsided selling pressure in history, and on the way up, with some of the best breadth thrusts in history.

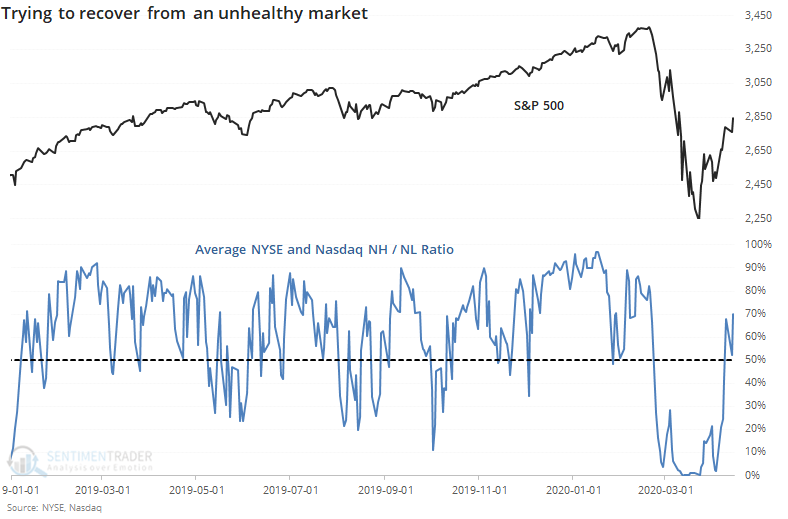

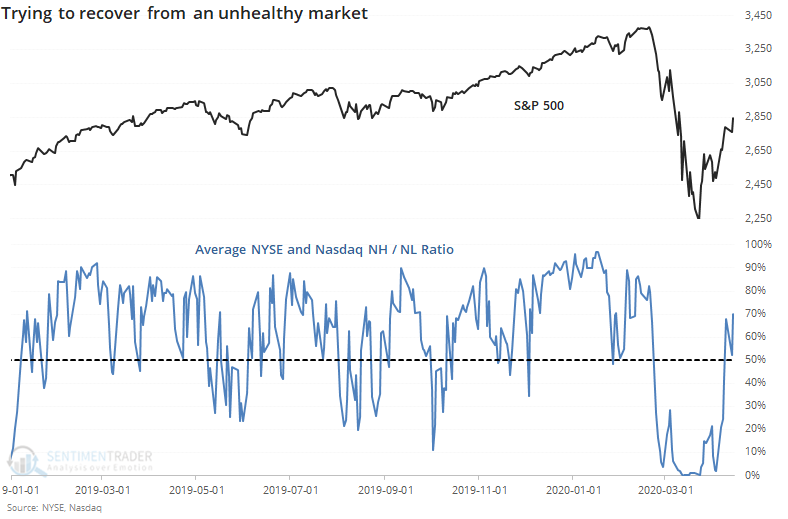

As Troy mentioned in a premium note, stocks on the Nasdaq have recovered enough so that the 52-week New High / New Low Ratio has recovered above 50%, after falling to 0% at some point in the past couple of months. Something similar occurred on the NYSE, with its ratio also recovering from an extremely low level.

The average of the two ratios has gone from less than 1% to more than 50% very quickly. Like most oscillating ratios like this, healthy markets typically hold above 50%, with only brief forays into oversold territory. Unhealthy markets see the inverse, and by the close on Wednesday this figure dropped back below 50%. Bulls should want to see this pop back above 50% in the coming days.

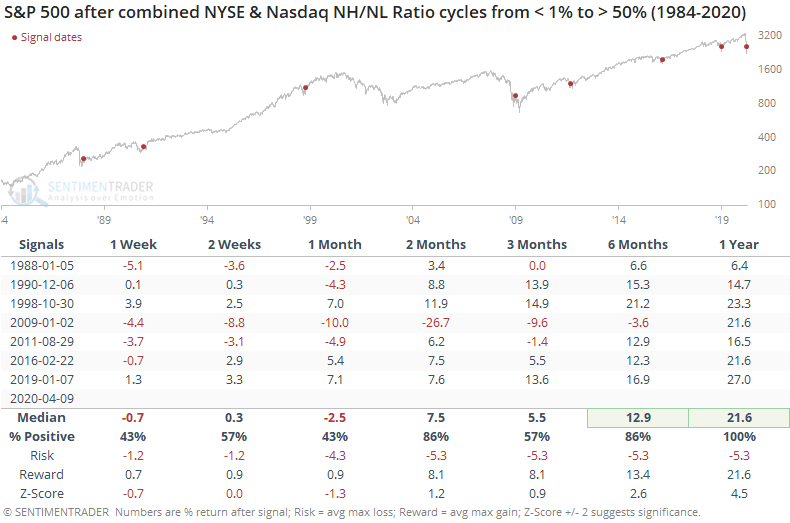

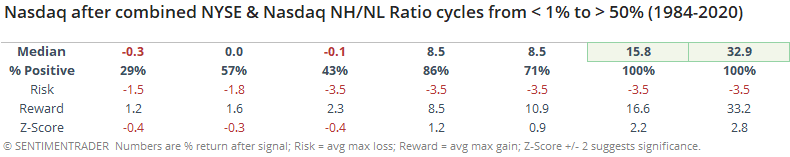

As Troy noted, when the Nasdaq ratio has cycled from essentially 0 to 50%, it's been a very good sign for the Nasdaq. When we look at a combined ratio, it's also been a good long-term sign, though with some heavy shorter-term volatility.

Returns for the Nasdaq were more impressive, with an average gain of over 32% during the next year.

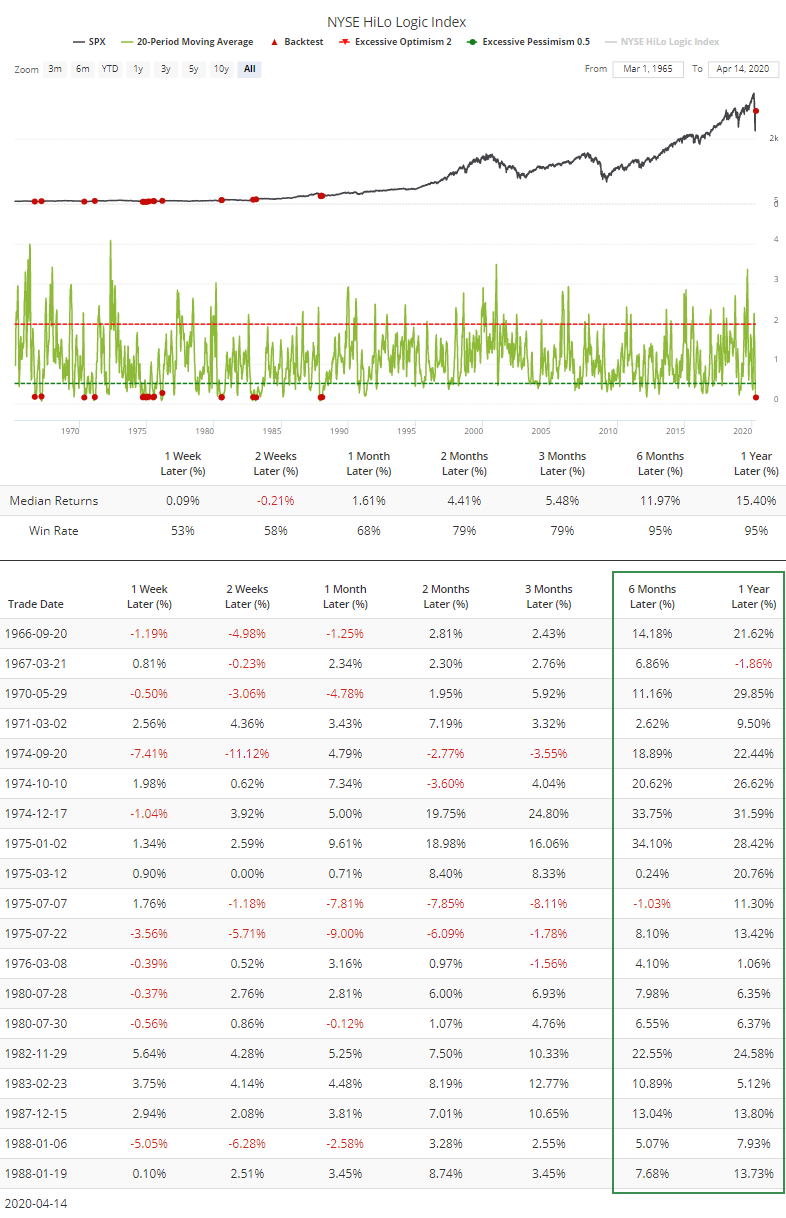

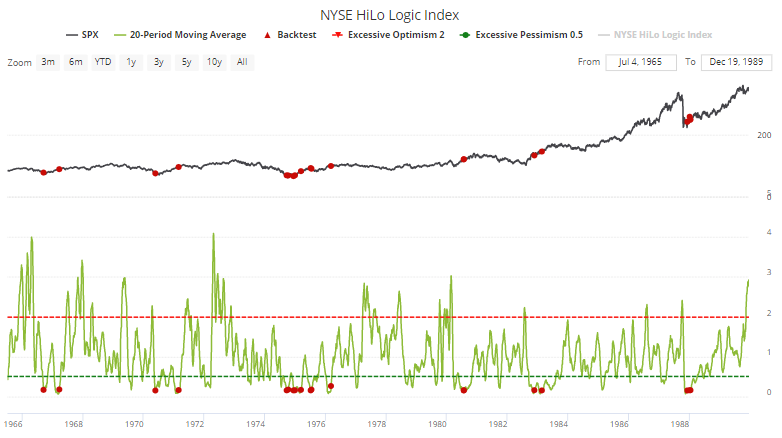

The extreme domination of stocks falling to 52-week lows in March caused the HiLo Logic Index to plunge to a near-record low. Now that highs are starting to outnumber lows, the 20-day average of the index is finally starting to curl higher. The Backtest Engine shows very good 6-12 month returns for the S&P 500 when this happened before.

Most of those triggered in the 1970s and early '80s.

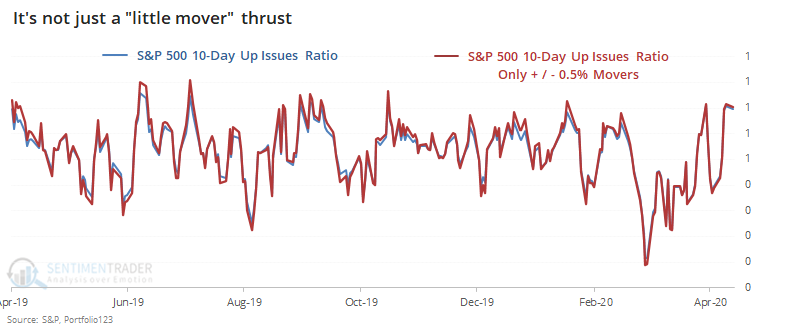

One of the knocks against the thrusts we've seen is that it could be due to computerized trading. There have been a lot of days with an overwhelming number of securities advancing, but perhaps a lot of those daily gainers are from stocks that only moved up a few cents.

To check, the chart below shows the S&P 500's 10-day Up Issues Ratio in blue. This compares each day's advancing stocks to the total number of advancing and declining stocks, no matter how much they advanced or declined each day. The red line is the same ratio, but only includes stocks that rose or fell more than 0.5% each day, so it excludes any stock that showed a small gain or loss.

There is virtually no difference between the ratios, which suggests that the current thrust is not due to a bunch of stocks showing small gains.

As most stocks attempt to recover from the March devastation, we're seeing more and more metrics return to a neutral level. That has caused some issues during prolonged bear markets, and it's something to watch for here. During recoveries from some of the worst sell-offs in history, these initial recoveries often led to some short-term whipsaws, but not major retracements.