Stocks, Oil Diverge As Corrections Spike

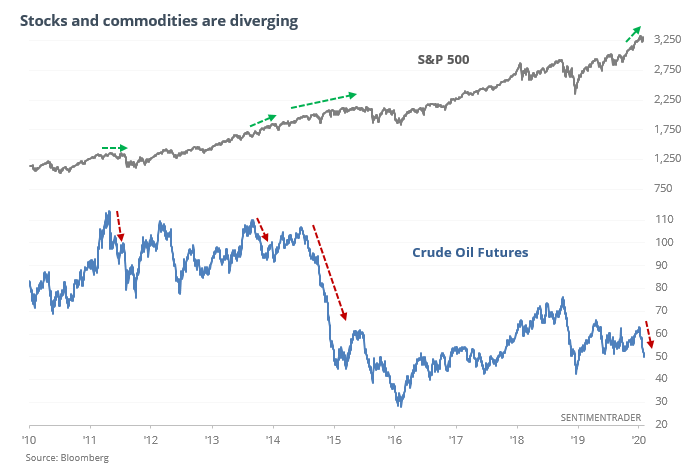

Diverging markets

Stocks surged again and neared (or hit) 52-week highs, yet crude oil fell again and closed at a 52-week low. Typically, there is more of a positive correlation between them.

Going back to 1985, when oil diverged so much from stocks, it led to mixed returns for stocks, with slight weakness shorter-term. It was mostly the same for oil prices.

The last two signals, in 2007, and 2014, proved to be more worrisome. After those, the S&P 500 declined over the next 1-2 months, and also over the next year.

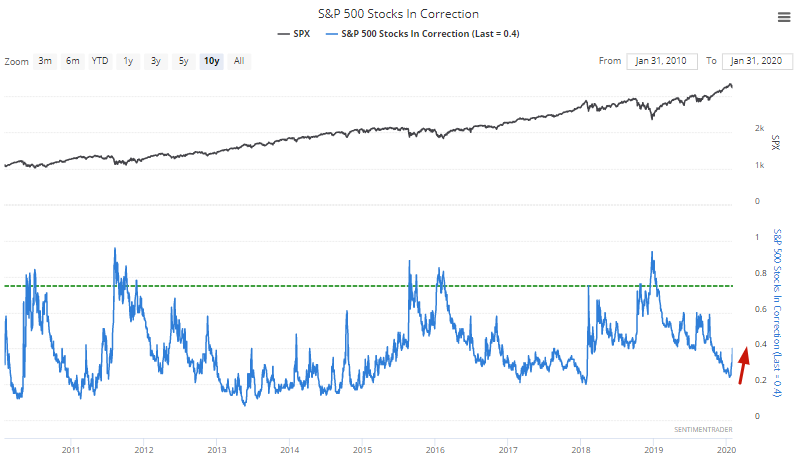

Fewer Corrections

The percentage of S&P 500 stocks in a correction, more than 10% below 52 week highs, fell over the past few months to the lowest level since early-2018 as the stock market rallied.

Various studies demonstrated that when this happened in the past, the S&P's returns over the next 6-12 months were mostly bearish since this typically happened after a major correction or a bear market:

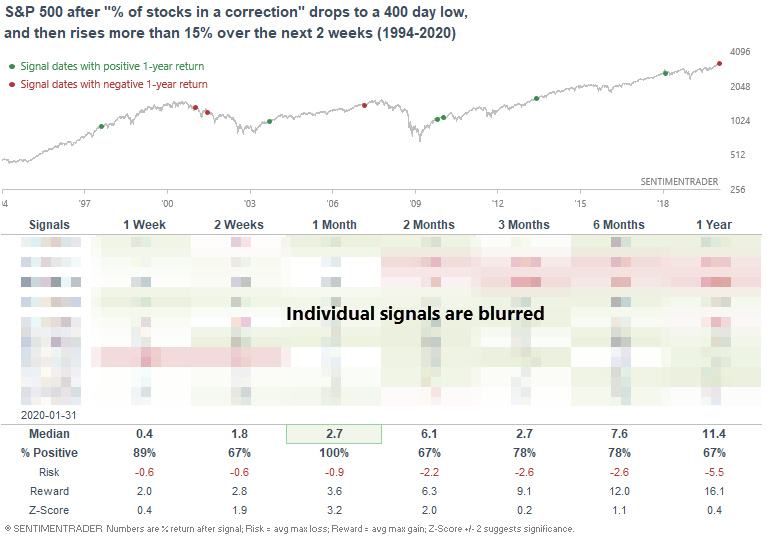

But as the S&P made a recent pullback, the % of stocks in a correction jumped more than 15%. When this figure hit a 400 day low and then jumped more than 15% over the next 2 weeks, the S&P typically rallied over the next month.

In a bull market this is typical when the market experiences a period of strong momentum and then makes a quick pullback.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- The Nasdaq's quick recovery from a shallow pullback

- Yet more technical warning signs

- Short-term breadth panic in emerging markets

- What happens after copper ends a historic losing streak

- Oil producer sentiment is historically pessimistic