Stocks Never Lost After Industrial Metals Did This

When consumers are optimistic about the economy, they buy stuff. That stuff needs to be manufactured by somebody, and those somebodies need materials to make it.

So, manufacturers get busy, inputs are in demand, and industrial materials tend to rise. There's no doubt that's the case now.

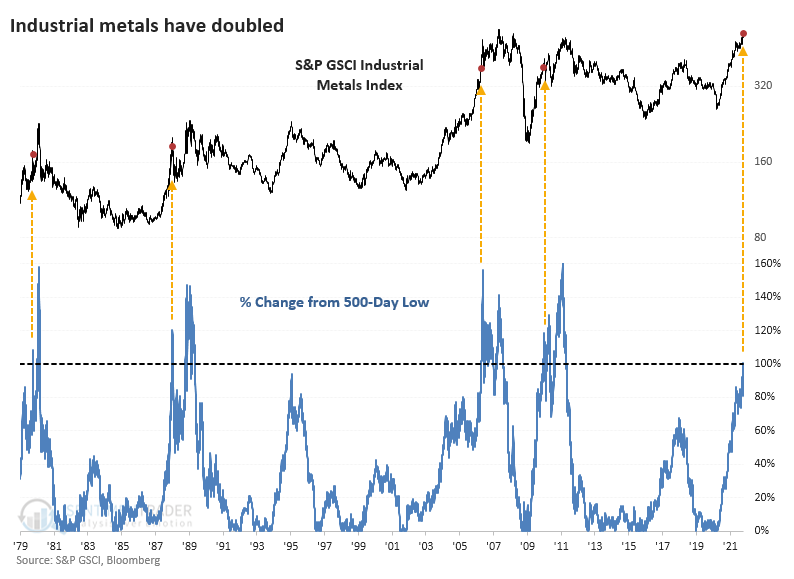

Dean has shown how some metals like zinc and copper have skyrocketed. That has helped to drive the S&P GSCI Industrial Metals Index to a new high. Just as impressively, the index has doubled from its pandemic-panic low.

After prices in this market doubled from a low, the metals have typically been about to cool off. High prices tend to generate higher production, leading to lower prices through the magic of market forces. Massive moves like this don't often happen, so the usual caveats about small sample sizes apply.

While it's iffy to automatically assume that potential good news about the economy necessarily equals good news for stocks, the S&P 500 never showed a loss a year after industrial metals doubled.

What else we're looking at

- What a surge in industrial metals means for the S&P 500

- Returns in other markets like gold and bonds after surges in metal prices

- Two signals that show an opportunity in emerging markets

- Why it's time to keep an eye on Health Care

- An update on absolute and relative trends in industry, sectors, and country ETFs

| Stat box The total put/call ratio as calculated by the CBOE dropped to 0.76 on Monday, showing that traders turned over 76 put options for every 100 call options. That's the lowest level in over a month, after a string of days with relatively heavy put trading. |

Etcetera

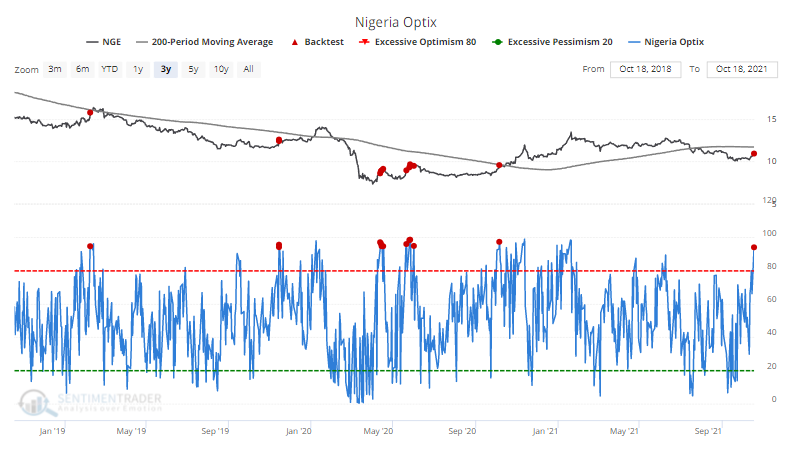

A lot to prove. Optimism on Nigerian stocks has soared, with an Optimism Index above 94%, the highest since January. Our Backtest Engine shows that of the 18 times the Optix has been this high during a downtrending market, NGE continued to rise over the next month 5 times.

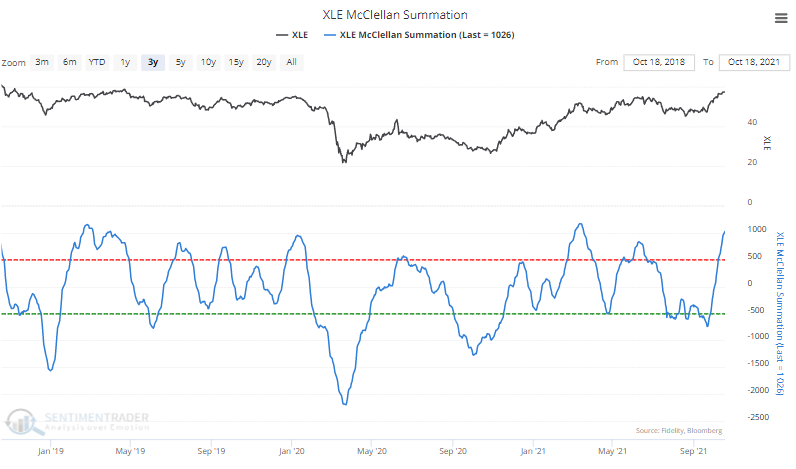

Energy to spare. Internal momentum among energy stocks has been so great that the McClellan Summation Index for the sector just crossed above +1,000 for one of the few times in the past three years.

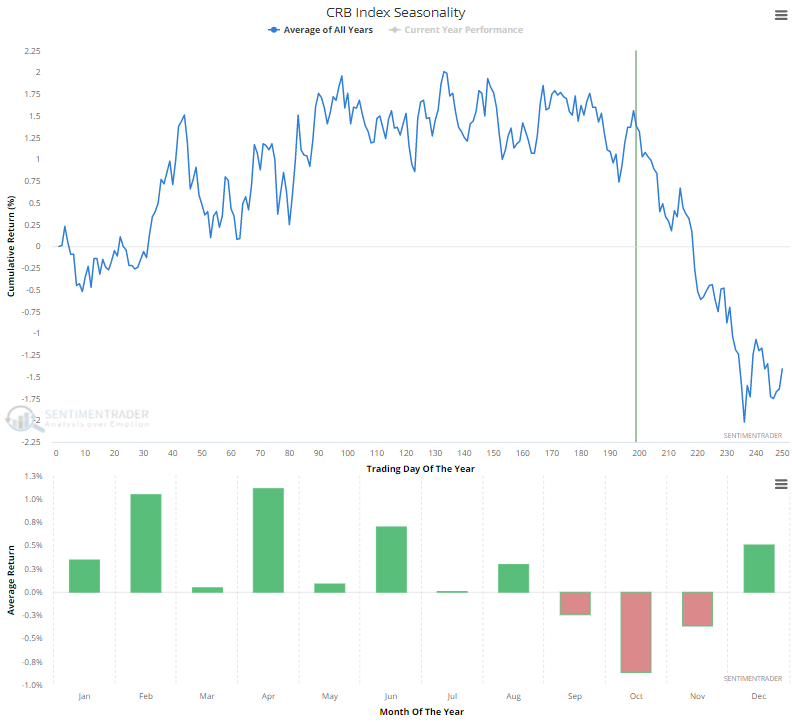

Seasonal headwind. The broader commodity complex has passed its seasonal peak. This just means that commodity contracts have shown relatively poor performance at this point in a typical year over the past 30 years.