Stocks Just Did Something They Haven't Done All Year

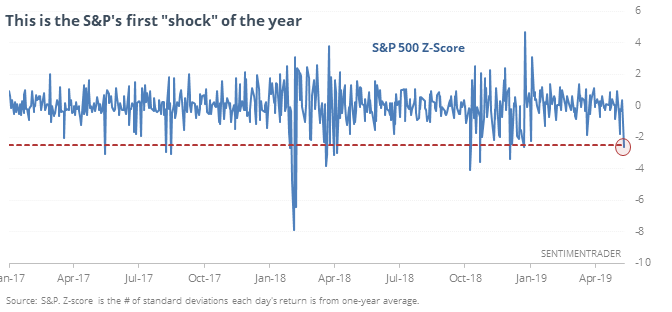

Shock day

Over the past year, investors have grown accustomed to certain magnitudes of market movements, and Monday’s session was far outside the norm. More than 2.5 standard deviations from the norm, which could be considered a shocking day.

When coming within a couple weeks of a multi-year high, these types of sessions have typically not morphed into something much more serious. There was only a roughly 35% probability of these shock days morphing into anything more sinister.

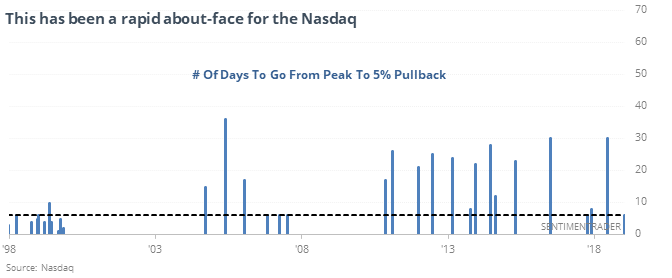

About-face

The Nasdaq Composite has quickly cycled from an important high to suffering a 5% pullback. This has taken about half the time it normally has since 1971.

Other times it made a quick about-face, it usually didn’t precede heavy additional selling.

Same goes for the Dow Industrials Average, which dropped from within 1% of its peak all the way down to a 3-month low. Going forward, risk in the index tended to be very low and rarely slid into serious declines.

Options oops

We saw recently that small options traders were very confident. That has very recently started to chance, especially among a broader group of traders. On the ISE exchange, traders have bought fewer than 62 calls for every 100 puts over the past few days. Per the Backtest Engine, only 27 other days have seen activity this skewed.

Jumpy

This is the 7th time in its history that the VIX “fear gauge” has jumped at least 25% twice within a week. After all 6 of the others, the S&P rallied over the next week.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.