Stocks Hitting A Low On Monday

The major equity indexes are looking at another loss today, after a rough week last week.

This brings up the possibility of the Turnaround Tuesday phenomenon, which is related to the tendencies noted earlier about markets more frequently bottoming on Monday/Tuesday than other days of the week.

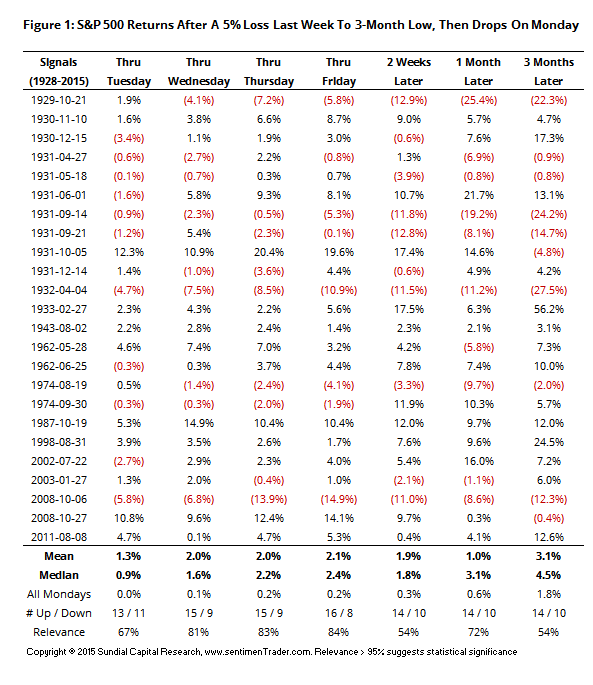

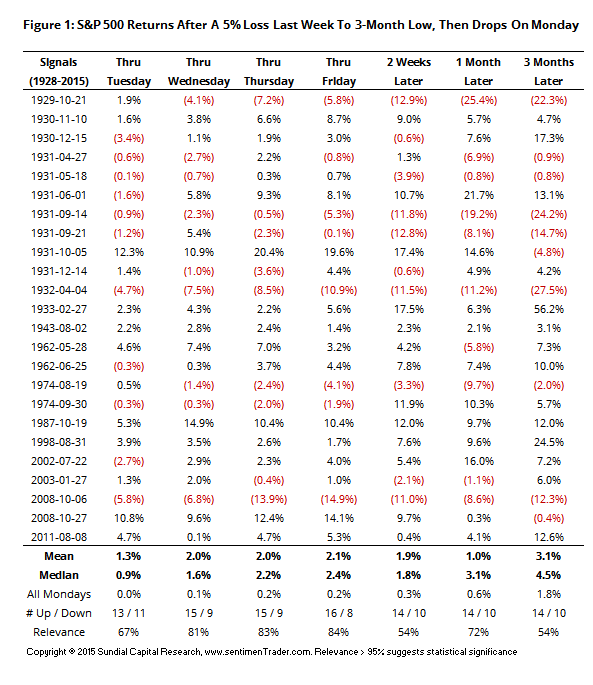

Figure 1 shows the returns through the rest of the week and in the weeks ahead when the S&P 500 lost at least -5% last week and closed at a 3-month low, then declined by any amount on Monday.

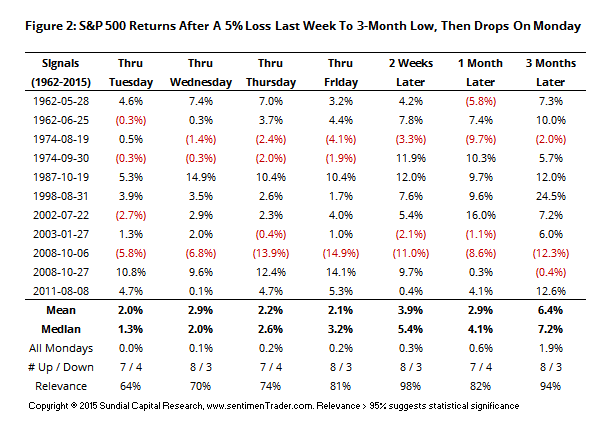

We can see that returns over the next several days were better than average. Figure 2 shows them since 1962.

Again, better than average returns and more consistent this time. There were two losses of note, in 1974 and 2008, both of which happened to be in the final "puke" phases of a bear market and not similar at all to where we are now in terms of market structure.

Out of all the occurrences from Figure 1, there was only one other than occurred when the S&P was within 10% of a 52-week high, which was the one from August 1943. That proved to be a bottom and the S&P rallied about 6% over the next few months.

There were four others that occurred within 20% of a 52-week high, from October 1929 (preceding a loss of more than 30%), August 1943 (noted above), August 1998 (preceding gains of +25%) and August 2011 (preceding gains of +15%).

Overall, mostly positive but not a slam-dunk.