Stocks have uncoupled from the dollar

Correlation and causation are a tricky pair, as we never really know if we can rely on one to suggest the other.

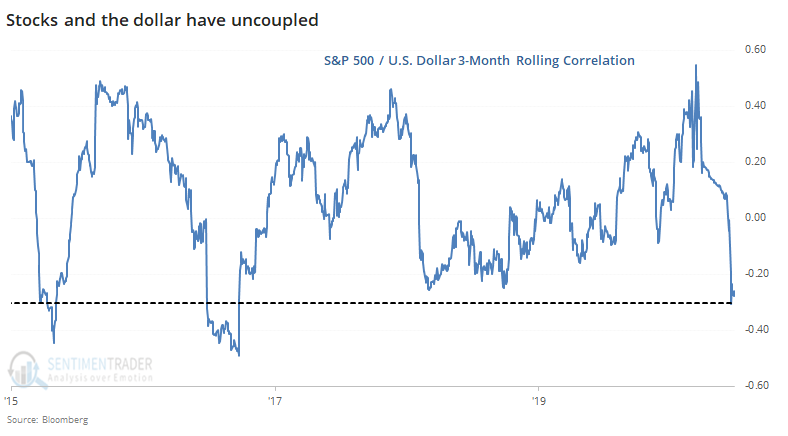

During the peak of pandemic panic in February and March, the correlation between stocks and the dollar was extremely high, as the economic forces on one seemed to be related to the other - mostly investors' perceptions about the influence of Federal Reserve actions.

As noted by the Financial Times:

"Strategists attribute the recent moves to the radical actions of central banks and governments to fend off the worst effects of the pandemic. Since the start of the Covid-19 crisis, interest rates in major economies have been slashed to near zero, wiping out an important metric for assessing currencies."

The rolling 3-month correlation between the two hit a 12-year high in March, then settled down as stocks rallied. Recently, it has dived, as they take their separate paths. Stocks have continued to rally while the dollar tanked.

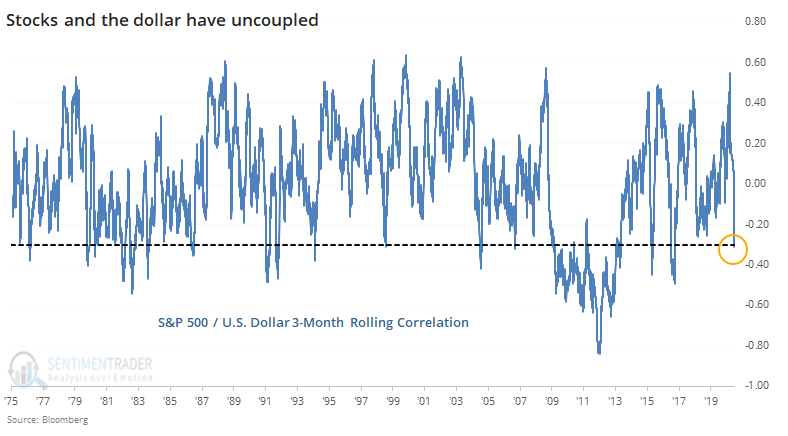

Going back to 1975, we can see that this large of a negative correlation between the two is unusual.

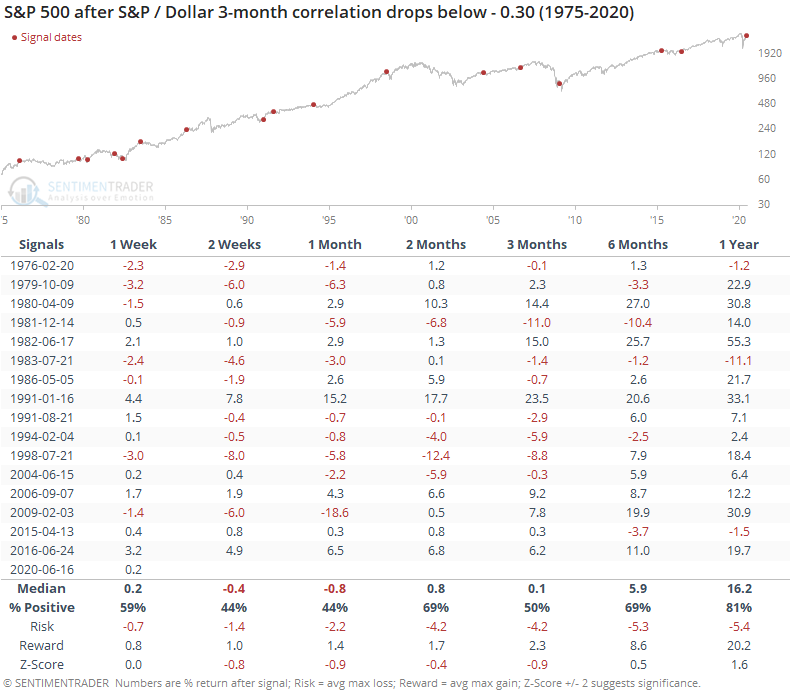

As for what it meant when the correlation first dropped below -0.3, it wasn't a great short- to medium-term sign for the S&P 500.

The S&P's median return was below average (a negative z-score) up to three months later, but it wasn't particularly large or consistent. The most worrisome part is the very poor risk/reward ratio, which was especially bad during the next two months.

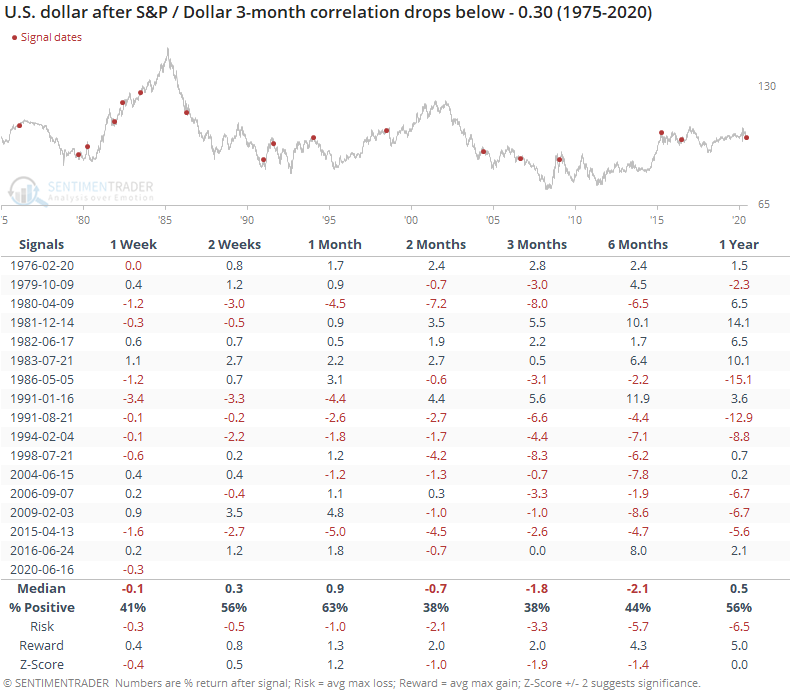

It wasn't a great sign for the dollar, either.

Over the next 2-3 months, the buck had a consistent tendency to decline, especially since late 1991. Every signal since then saw the dollar at a lower level either two or three months later.

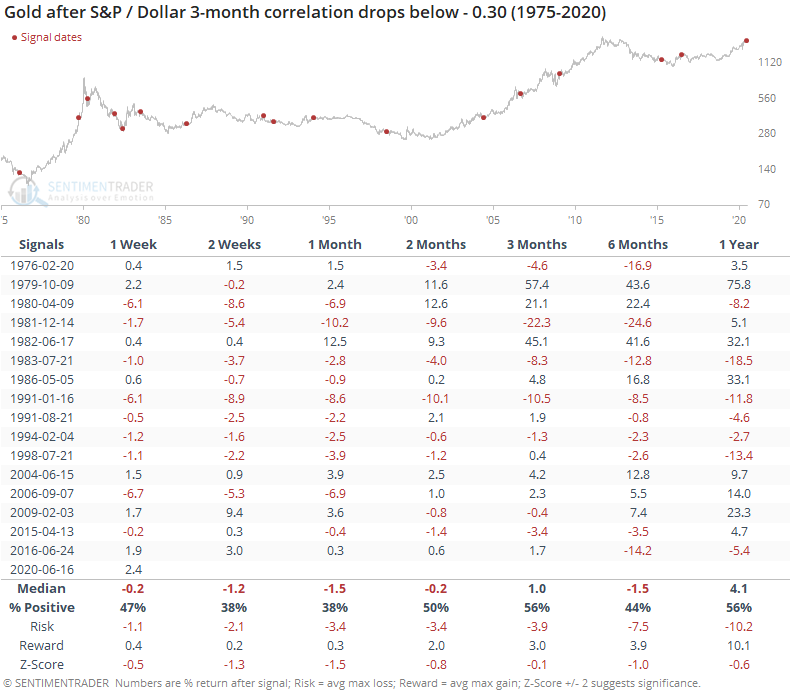

Gold often rallies when the dollar falls, but after these signals, the metal struggled shorter-term.

Intermarket correlations get a lot of attention among analysts and the media, but they're extremely hard to use since they change all the time. There aren't many markets that have had a consistent and predictable correlation over the decades. While it seems like it might be positive that stocks have uncoupled from the same forces driving the dollar, there isn't much evidence to support that historically.