Stocks, Gold And Bond Yields All Rally On Rate Hike

There is still time before the close, but so far on the day we're seeing stocks and gold rally, while bonds sell off.

The S&P 500, gold and 10-year Treasury note yield are all up by more than 0.5% on the day. The knee-jerk assumption from that would be that traders are pricing in higher inflation.

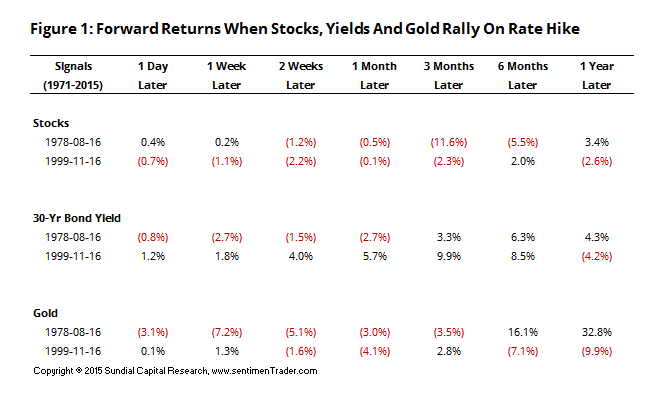

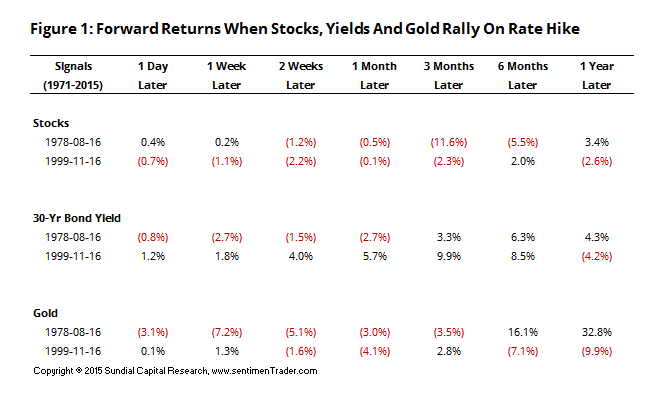

This is occurring on a day the FOMC raised its Federal Funds target rate. If we go back to 1971 and look for every time all three rallied at least 0.5% on a day the Fed hiked rates, we get the following future performance:

Basically, negative for stocks, negative for bonds (yields rose) and negative for gold. Only a sample size of two, so this is FWIW.