Stocks Gap On NFP Miss And Sector Extremes

Below are some observations that have popped up in between reports. Some of these deserve more fleshed-out analysis, others are simply random observations as I cruise through the site and news feeds to get a handle on potential opportunities.

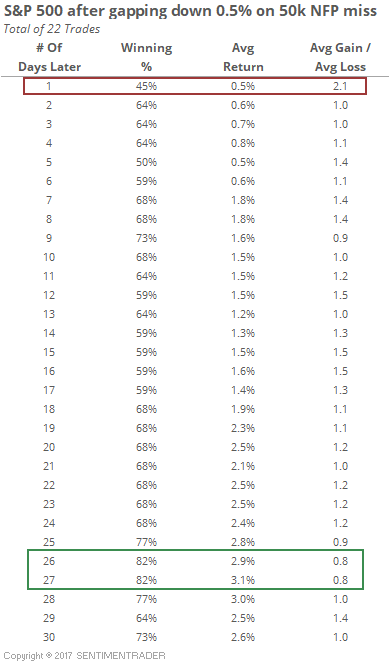

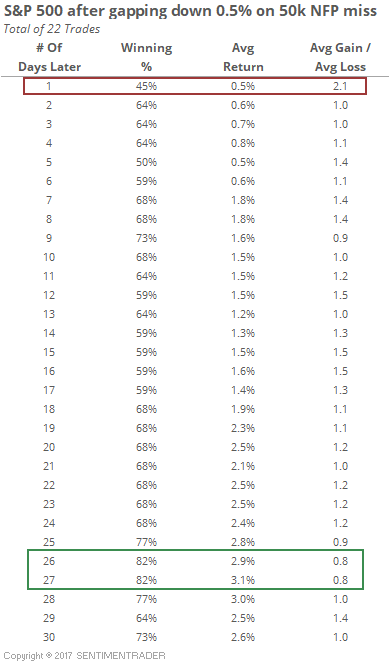

As we head into the final session of the week, futures remain lower after a miss in the Nonfarm Payroll report. That has had a slight tendency to lead to more very short-term weakness, but didn't have much impact beyond that. It's impossible to pin the pre-market losses on the NFP report, though, since losses were heavier overnight in response to the latest tariff headlines.

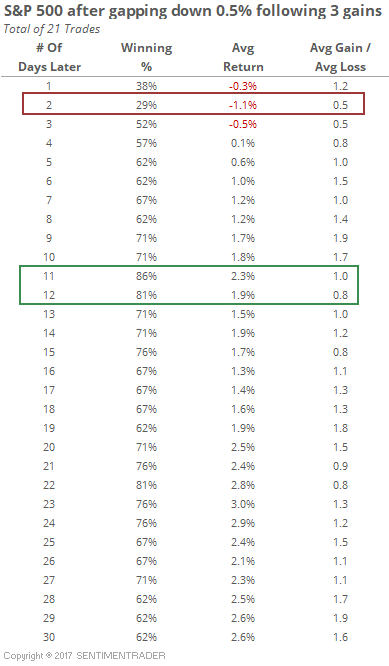

SPY is on track to gap down more than -0.5% following 3 straight days of gains of more than +0.5%. That has led to mostly lower prices in the very short-term, but by a couple of weeks later, almost all were higher.

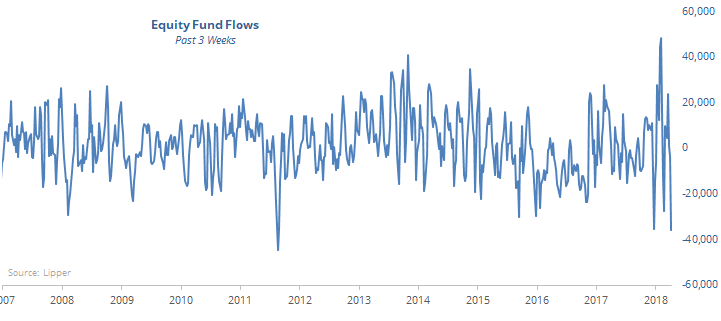

According to Lipper, investors pulled nearly $12 billion out of equity funds this week. They have now yanked a total of $35.6 billion from equity funds over the past 3 weeks, the 2nd-most in 15 years. The only 3-week period with a larger outflow ended in mid-August 2011.

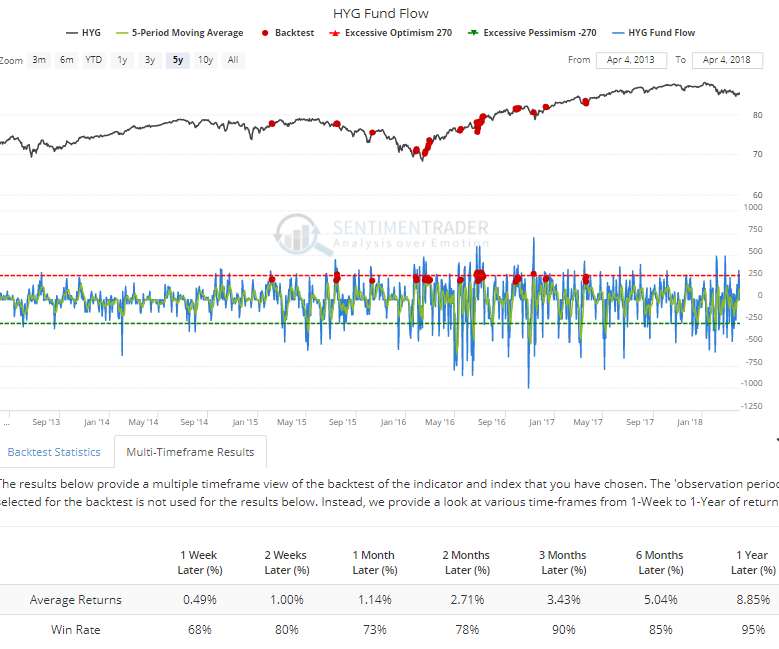

Fund investors are moving back into the high-yield ETFs, with more than $200 million flowing into HYG over the past week. Fund flows can be a difficult area to analyze and need to be done on a case-by-case basis. But when so much has started to flow back into the fund in recent years, it has led to more gains more often than not.

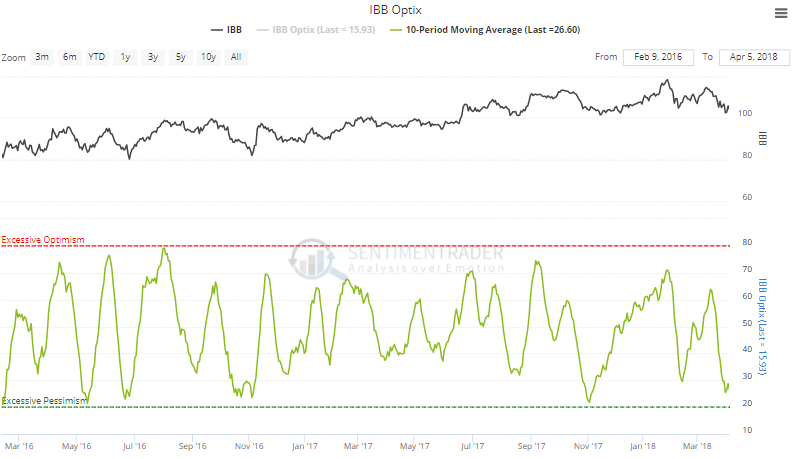

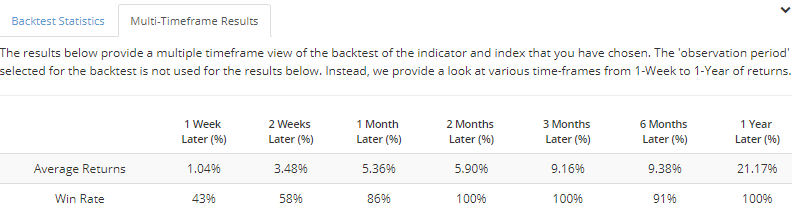

Biotech is the most-hated sector, with the 10-day Optimism Index on IBB falling below 30. In the past two years, that has preceded good medium-term returns.

It's also worth noting that it's now entering one of its best times of the year, for those who put any weight on seasonal tendencies in stocks (I don't give it much weight at all).

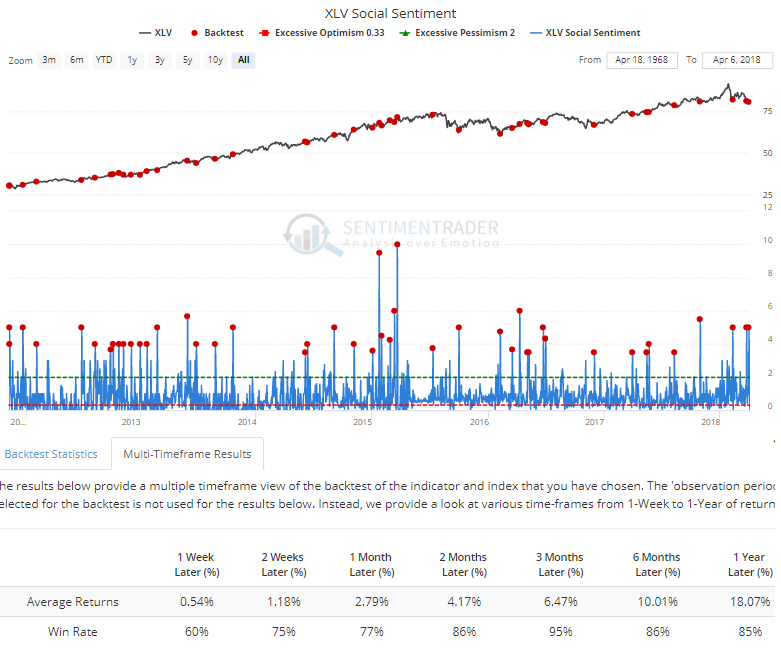

Twitter users have become the most pessimistic on XLV, the health care ETF, with more than 4 times as many bearish messages as bullish ones.

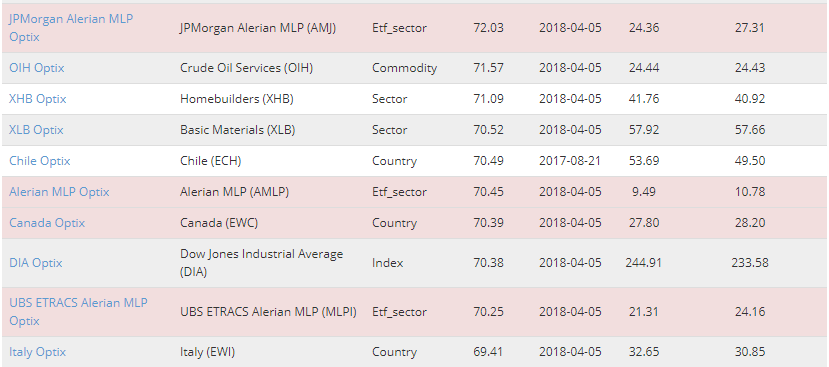

Our Sentiment & Trend screen is showing a few funds that have high optimism but are trading below their 200-day moving averages. Three of them are MLPs. Like always, a market that's able to continue to rally in the face of resistance like this is sending a positive longer-term signal...but they need to prove themselves first.

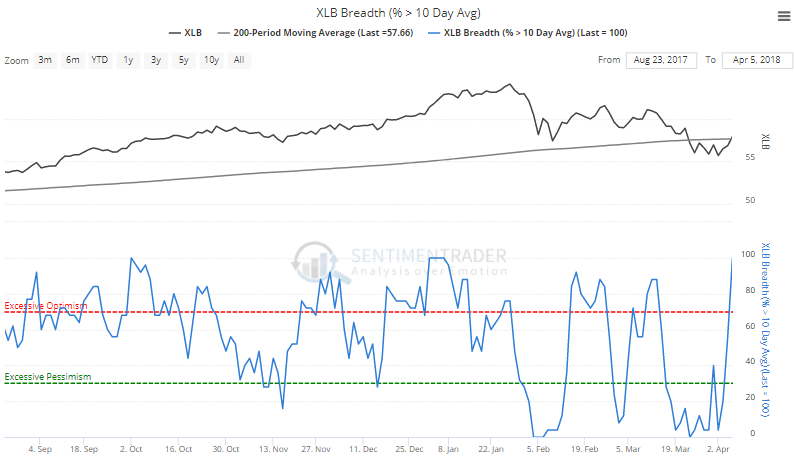

Every one of the stocks in the Basic Materials sector is above their 10-day moving average. The XLB fund *just barely* is above its 200-day average.

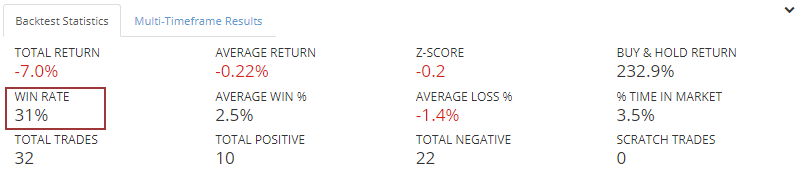

If we fudge a bit and assume it's below its average, the fund has struggled to hold onto its gains over the next week, rallying over the next week only 31% of the time.