Stocks are calming down after near-record volatility

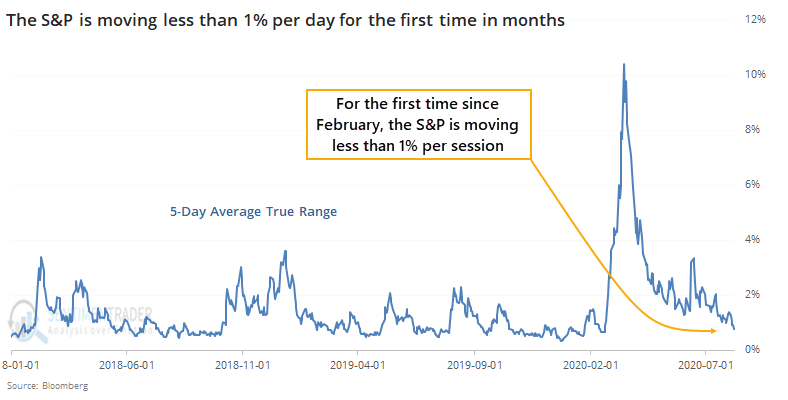

In March and April, we spent a lot of time looking at the historic volatility in indexes and stocks. On some measures, it was the most volatile stretch in history, with the others essentially showing a perfect record of higher prices over the next 6-12 months.

Since then, volatility has ebbed. As Troy showed in a premium note, the VIX has declined for 16 out of the past 20 weeks, a record stretch. The four other times it declined 15 out of 20 weeks, it jumped during the next 2-4 weeks.

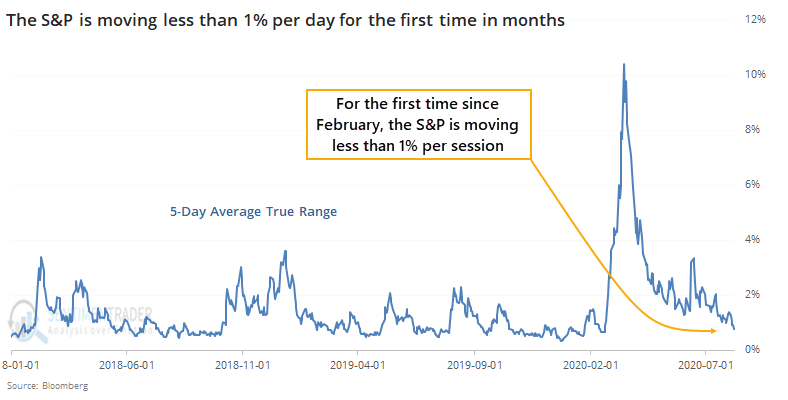

Over the past week, in particular, stocks have calmed down. The 5-day average true range for the S&P 500 dropped below 1% for the first time in months. The end of August is often the least volatile, with the lowest volume, out of the entire year (including holidays) but this is early.

Of course, this follows what had been one of the wildest periods ever.

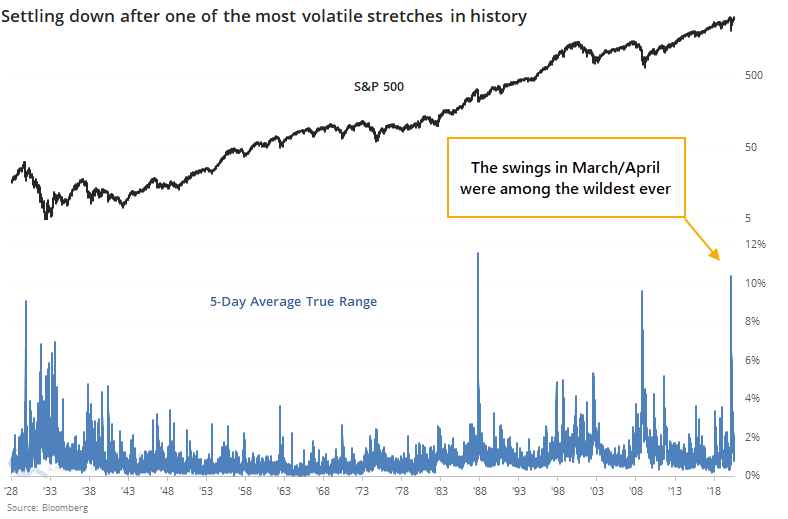

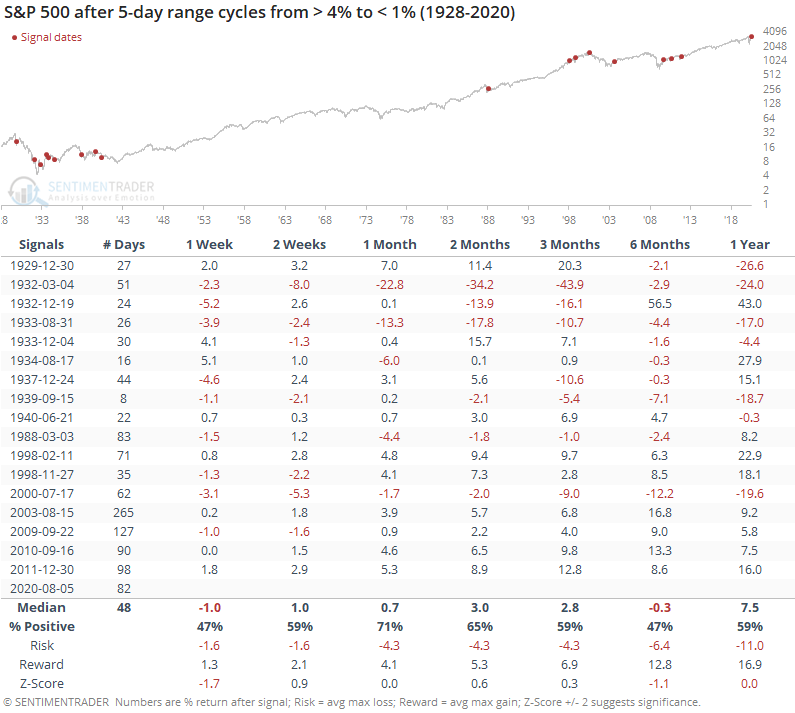

Once the S&P's average true range cycles from above 4% to below 1%, theory suggests that investors have come to grips with whatever crisis was at the forefront at the time, ostensibly ushering in calmer conditions and higher prices.

Let's check.

An argument could be made that this is the case, as the S&P rose most of the time, across most time frames. It was no slam dunk, however, and six months later it was down more often than up, with a poor average return.

The risk/reward skew across all time frames was poor as well, though much of that is due to the multiple signals in the 1930s. In recent decades, it has been more of a medium- to long-term positive, but with worse performance shorter-term.

Prior to the last 5 years or so, very narrow ranges, on light volume, as stocks neared previous highs was a decent suggestion that selling pressure was about to hit. Price and volume patterns have become less reliable in recent years, however, and we wouldn't place much weight on that.

There also isn't much evidence that this new regime of calm is necessarily a good sign for bulls - the best signals triggered coming out of major declines, which we have. And some of the worst came when stocks were near their highs, which we are. Seems like a wash.