Stocks and volatility drip lower

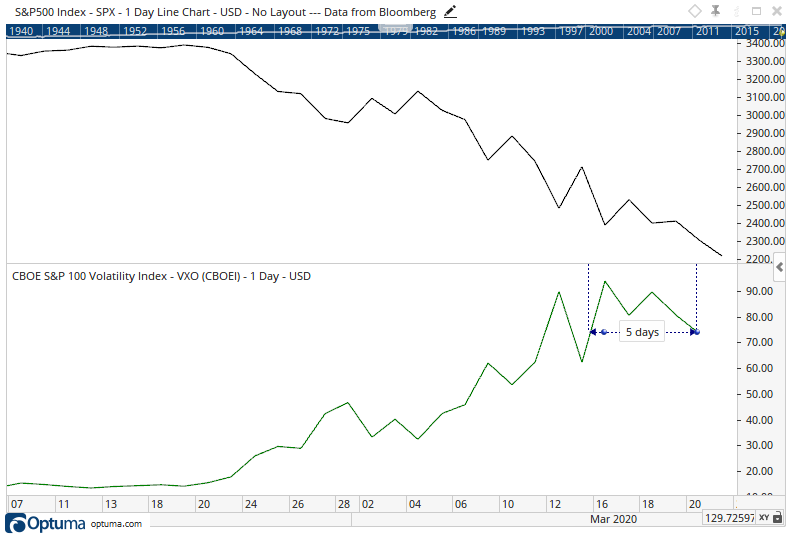

Stocks dripped lower again on Monday. Oddly, so did implied volatility. We saw earlier that options traders are pricing in lower volatility ahead even though historical volatility continues to rise, but even so this is not something we've seen before.

Until Friday (and again today), the VIX or VXO (the old VIX calculation) had never closed at a 5-day low on a day the S&P 500 closed at a 52-week low. Or even a 26-week low.

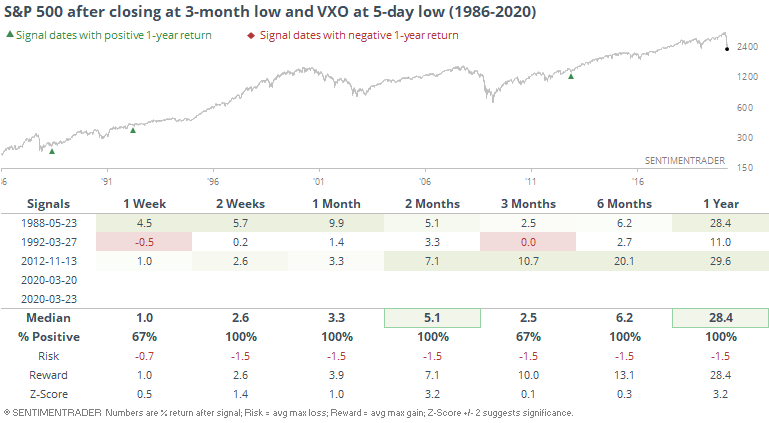

There have been a few times the S&P closed at a 12-week low then the VIX or VXO sunk to its lowest level in a week.

It's getting hard to find any precedents with more than n=3 lately, so it's hard to put a lot of weight on the signals. Generally, it's a good sign to see implied volatility tick lower, so it should be a positive.