Stock market's abrupt reversal

The stock market's rally before Thursday was quite powerful, triggering extremes in various sentiment and breadth indicators. Many of these breadth indicators did a 180 when the stock market crashed on Thursday.

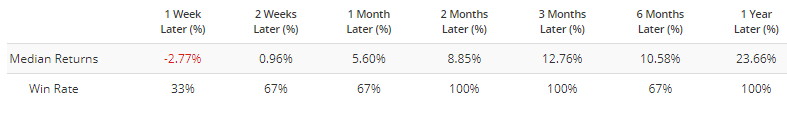

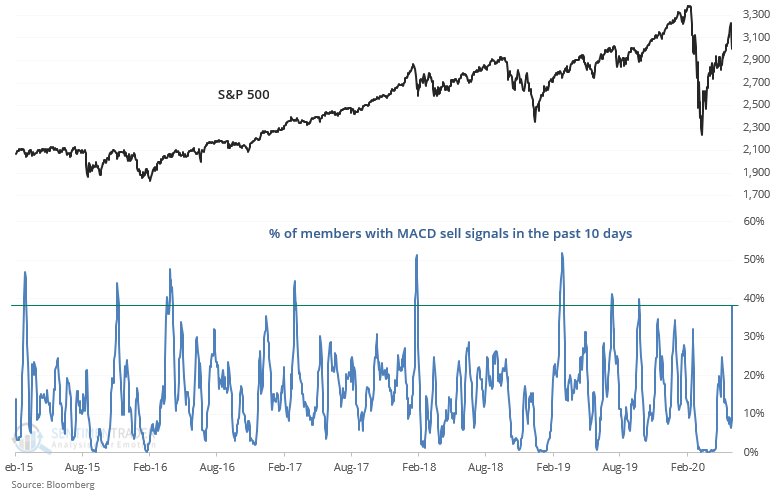

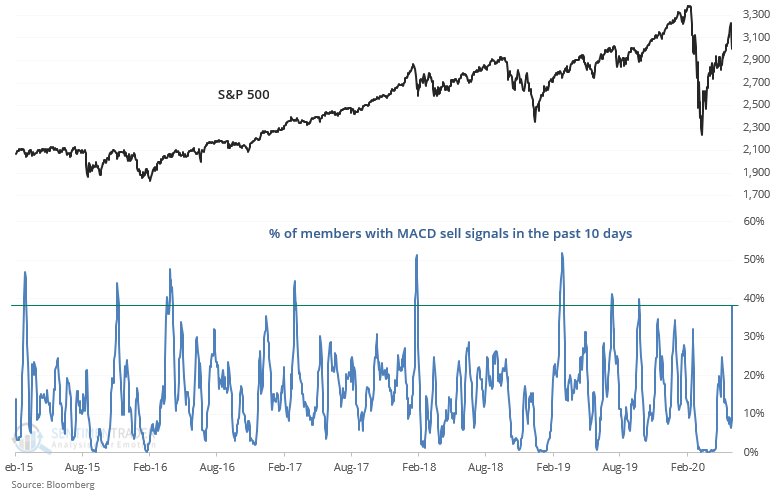

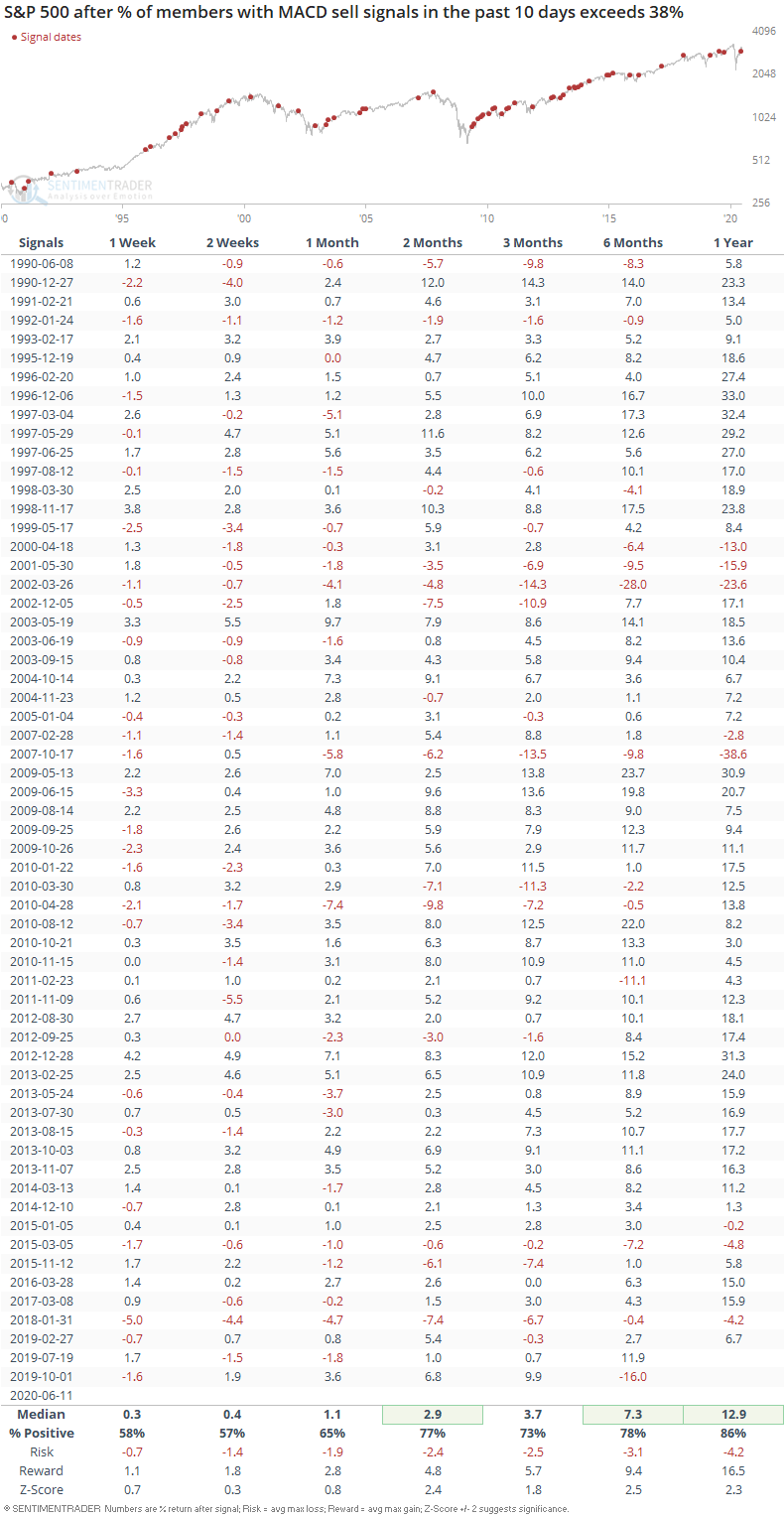

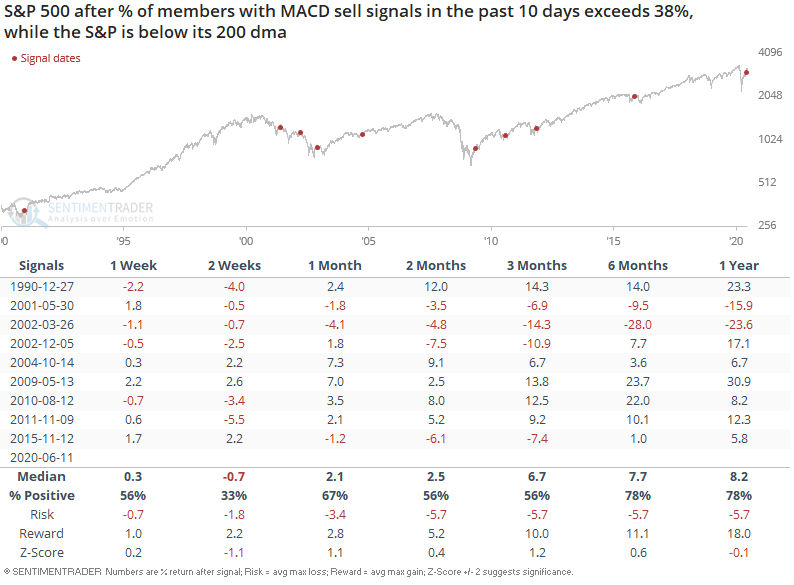

The selloff led more than 38% of S&P 500 stocks to trigger a MACD sell signal, which implies that a significant number of stocks are rolling over.

Similar large spikes led to further S&P pullbacks and more volatility, particularly in recent years.

Most of the historical cases occurred while the S&P was rallying above its 200 dma and just started to roll over. For the few that occurred while the S&P was in a downtrend (below its 200 dma), this was more of a bearish factor over the next 2 weeks:

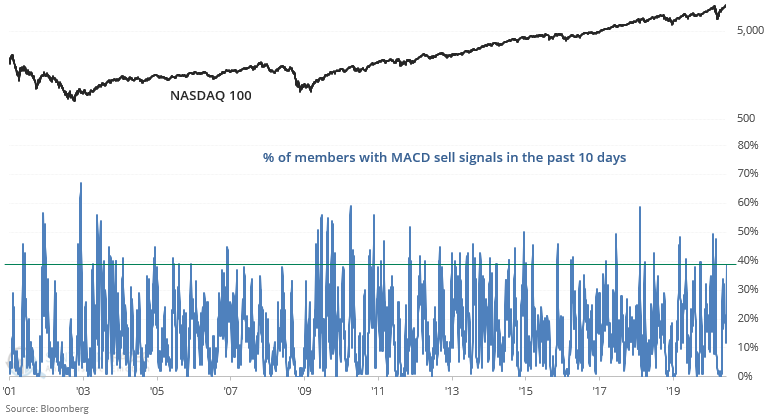

We can note the same behavior in other U.S. indices, such as the NASDAQ 100. More than 38% of NASDAQ 100 members have witnessed a MACD sell signal in the past 10 days:

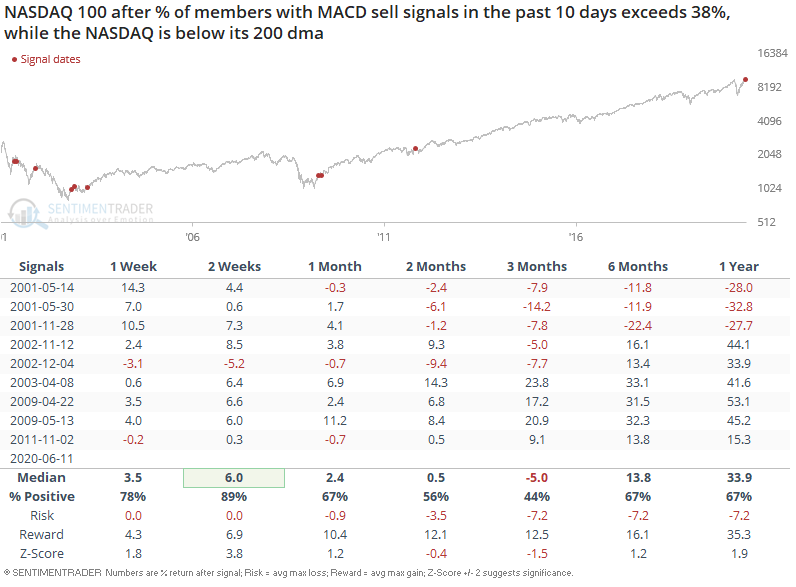

Historically, this was more bearish than random for the NASDAQ 100 over the next 3 months. This was moreso true during the 2000-2002 bear market:

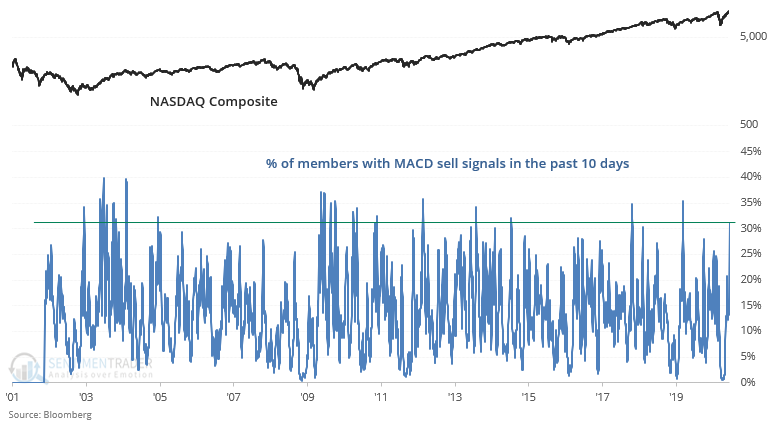

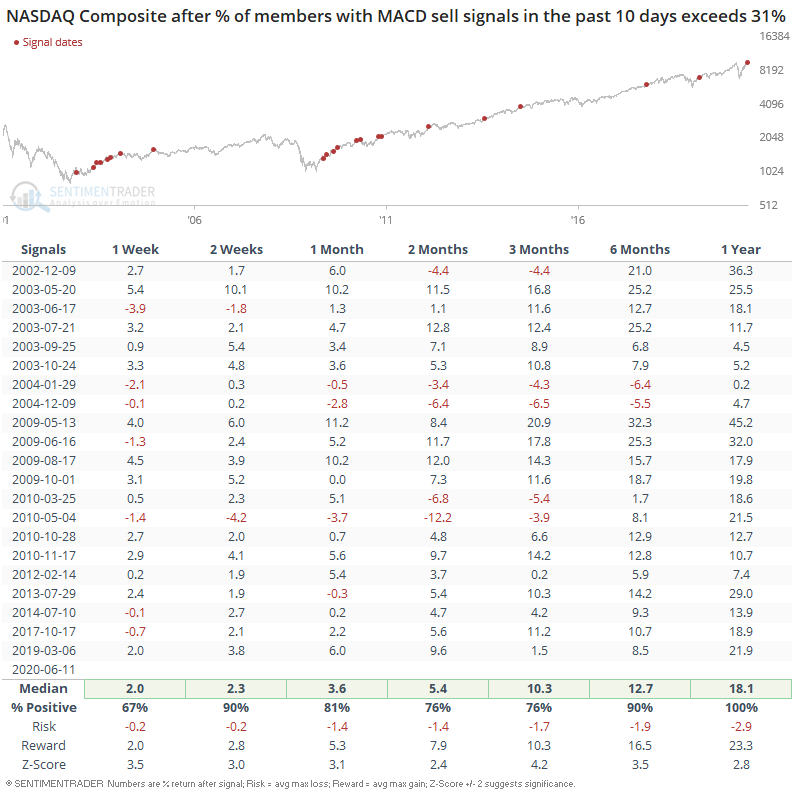

And 31% of NASDAQ Composite members have witnessed a MACD sell signal in the past 10 days:

This wasn't consistently bearish for the NASDAQ Composite on any time frame:

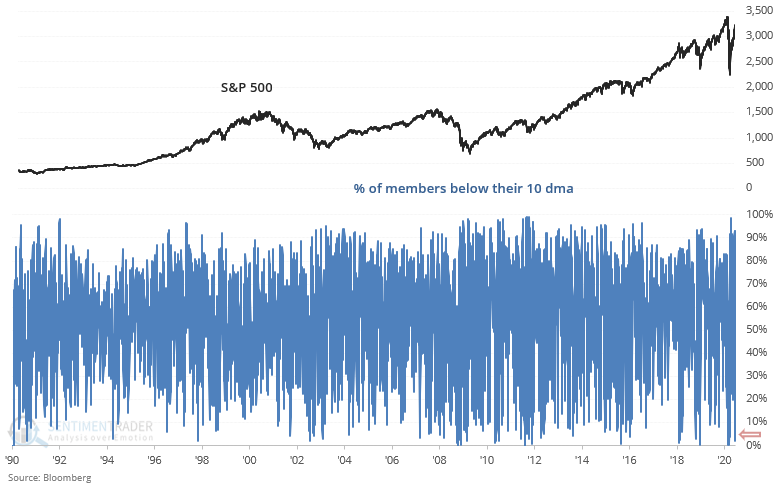

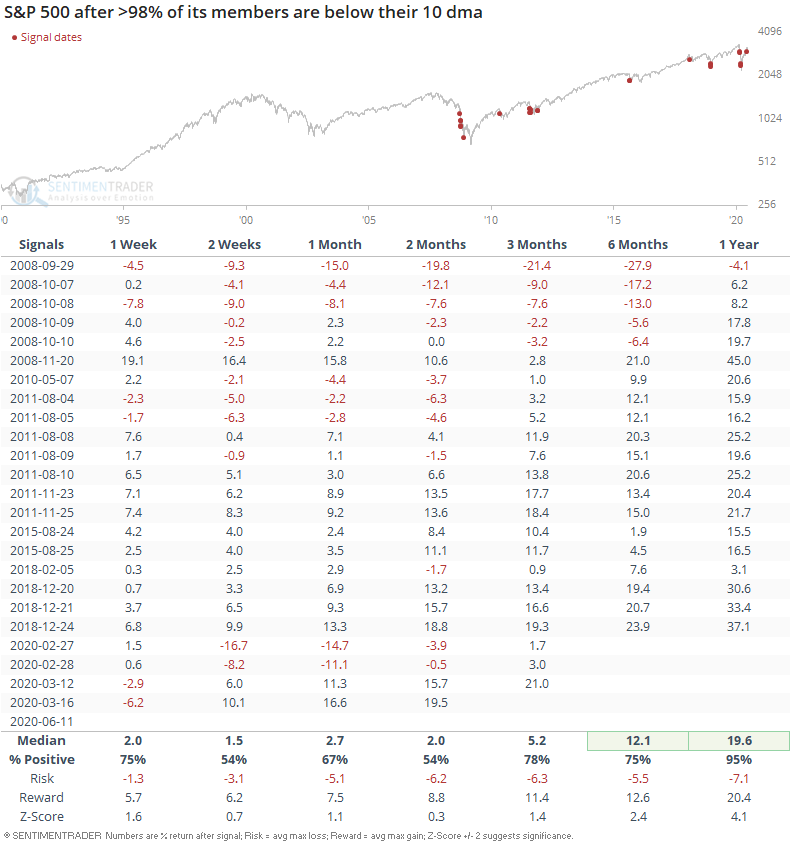

The sharp selloff has pushed more than 98% of the S&P's members below their 10 dma (short term moving average):

This was mostly bullish for stocks over the next year, although that's primarily because all of the historical cases occurred from the 2008 bear market - present. This comes to show that breadth readings are becoming more and more extreme, possibly due to the rising popularity of ETFs and the echo-chamber in many online trading rooms (e.g. Twitter, Reddit, Youtube).

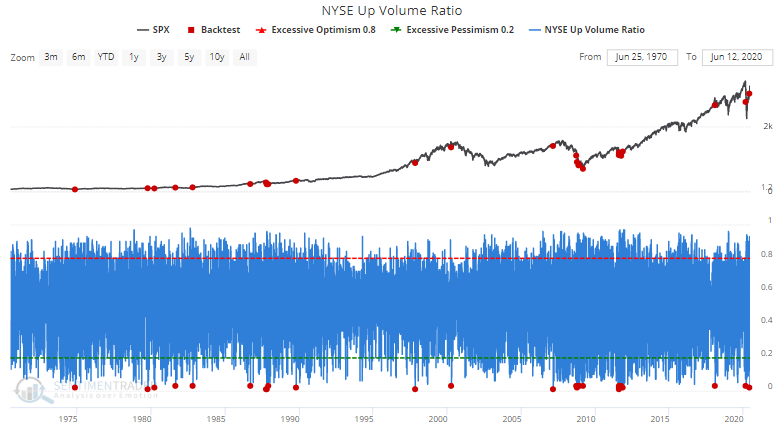

From a slightly different perspective, 98% of NYSE volume flowed into issues that fell:

When this happened in the past, the S&P could pullback further in the short term. But this was mostly bullish for stocks over the next 2-6 months:

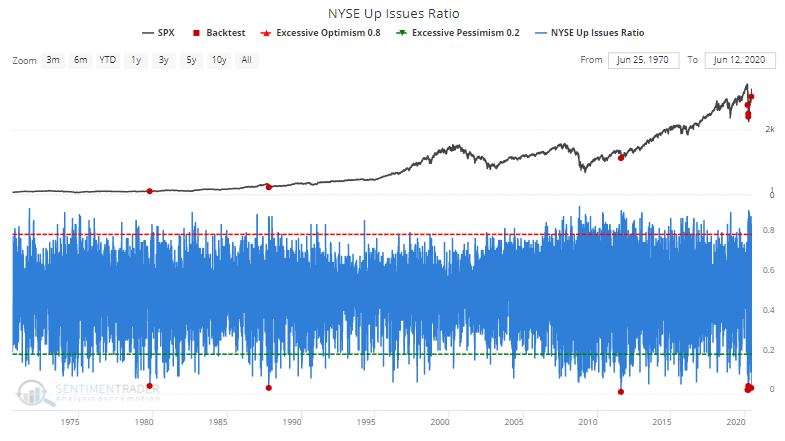

Similarly, 97% of NYSE issues fell:

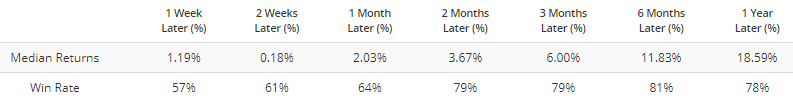

The few other times this happened in the past all saw the S&P rally over the next 2-3 months, even if stocks did fall further in the short term: