SPY Losing Assets As It Rallies

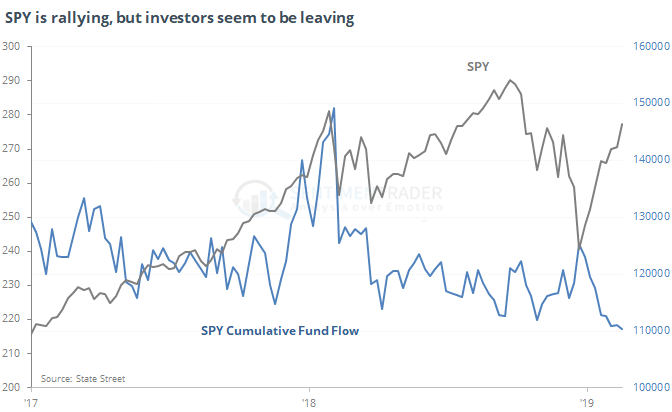

One of the charts pinging around Finance Twitter shows cumulative ETF flows in SPY ebbing even as the fund rallies. That certainly has been the case, and it certainly is unusual.

If you scroll through the comments on that Twitter thread, not something I would usually recommend, they are almost uniformly bullish. Investors think that this is evidence of a "wall of worry" and should lead to higher prices. Historically, though, that has not been the case.

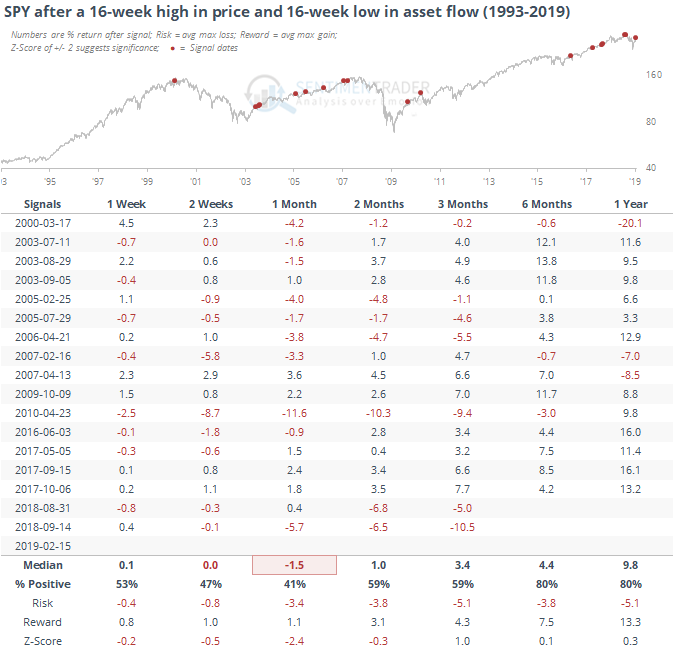

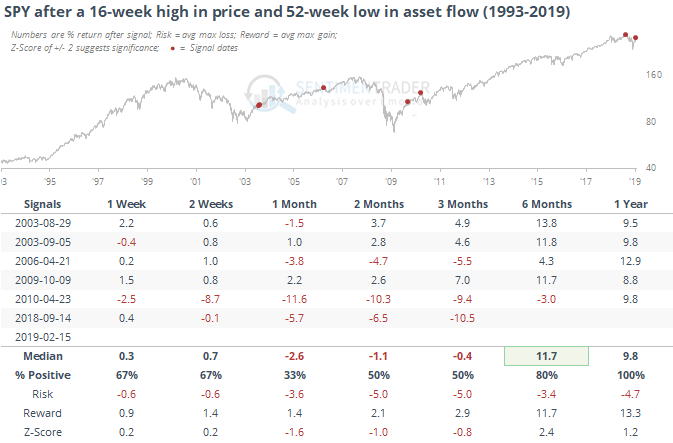

The tables below show every time in its history when SPY rallied to at least a 16-week high and its cumulative ETF flow sunk to a 16-week low. The second table shows times after even more extreme outflows.

Both show weaker-than-average returns for SPY going forward, up to one month later.