SPY Liquidity Premium Strategy

In yesterday's report titled No New Highs In S&P 500 As Fear-Based Fund Volume Surges (published Sept 14 2016), Jason mentioned a stat regarding the SPY Liquidity Premium indicator. Jason's comment was:

There are few signs of extreme pessimism, but ETF volume is one. Even just looking at the main S&P 500 fund, SPY, volume has been extremely heavy relative to volume in the underlying stocks, suggesting extreme discomfort from investors in holding individual stocks, and pushing the SPY Liquidity Premium to 35%. That has been a consistently good sign that sentiment is stretched, with the S&P returning an annualized gain of 37.3% when the Premium is above 35%. It's one of only a handful of our indicators showing pessimism.

I wanted to see what this particular stat looked like from an automated trading strategy standpoint.

Using SPY Liquidity Premium and SPY, I built a quick strategy similar to the previous ones I've built. The rules are:

- Long only

- No Margin. Starting Account size is $250K.

- 1,000 shares of SPY ETF

- Commission of 0.01% per trade

- $0.01 per share slippage

- Go long when:

- SPY Liquidity Premium is greater than or equal to 0.35 (Jason's Highlighted level in this note and above the Pessimistic Extreme of 0.2)

- SPY is above the 200 day Moving Average

- Close Longs when:

- SPY Liquidity Premium is less than or equal to -0.2 (Optimistic Extreme)

- All orders are entered at the open of the next day’s trading session after a signal is given.

- There are no stops used. Positions are held until a close signal is given.

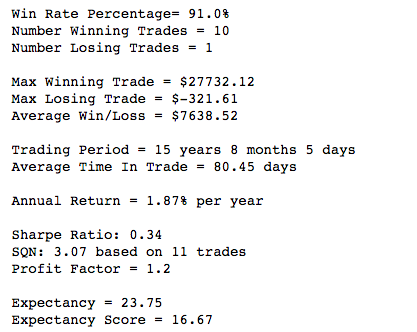

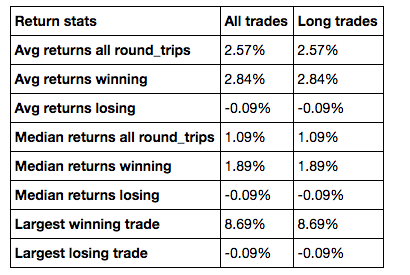

The strategy covers the timeframe from Jan 1 2001 to Sept 14 2016. The strategy resulted in only 11 trades total with 10 wins and 1 loss (91.0% win rate). The trade stats are shown in Table 1.

[caption id="attachment_820" align="aligncenter" width="417"] Table 1: Trade stats - SPY Liquidity Premium[/caption]

Table 1: Trade stats - SPY Liquidity Premium[/caption]

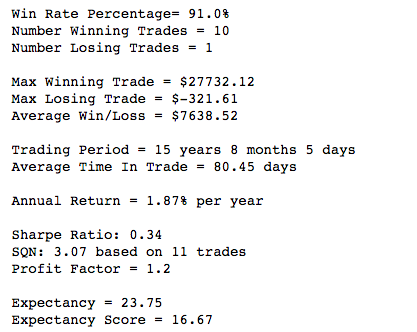

As you can see, this strategy generates a 1.87% annualized return on a simple entry/exit strategy but it generates about a 2.5% per trade return (see Table 2 below).

[caption id="attachment_814" align="aligncenter" width="410"] Table 2: SPY Liquidity Premium Return Stats[/caption]

Table 2: SPY Liquidity Premium Return Stats[/caption]

The strategy's maximum drawdown was 9%. With only 11 trades, you can't really get too excited about the strategy, but the results do hint at some positive bias when the SPY Liquidity Premium closed at 35% or higher.

Note: The 200MA filter on this strategy removes quite a few trades but increases the return (and reduces drawdown). Removing the 200MA filter reduces returns to 1.33% per year from 1.87% and also increases volatility / drawdown significantly.