SPY gaps and tail hedges

There was a whole litany of concerns tearing at investors heading into October, the "scariest month of the year." It's been scary all right, but only for the new wave of short-sellers.

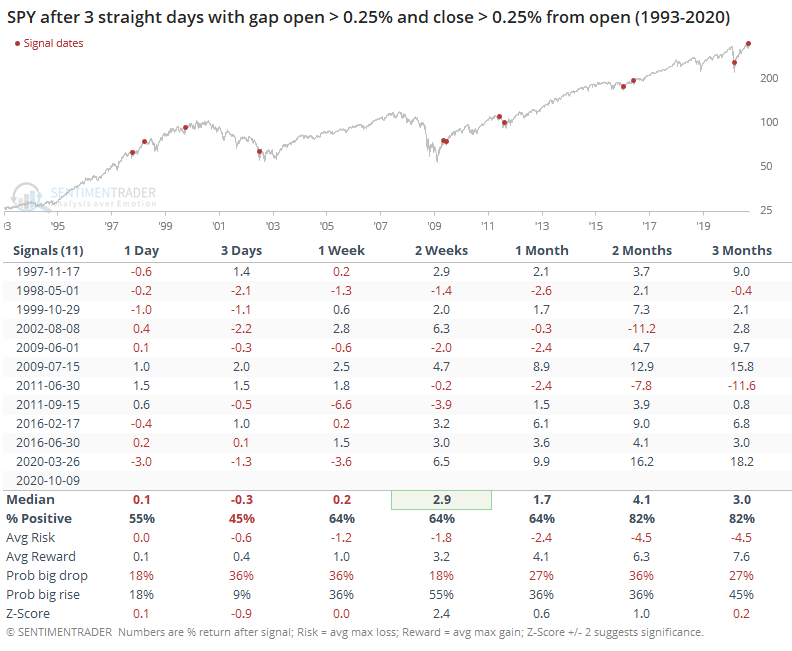

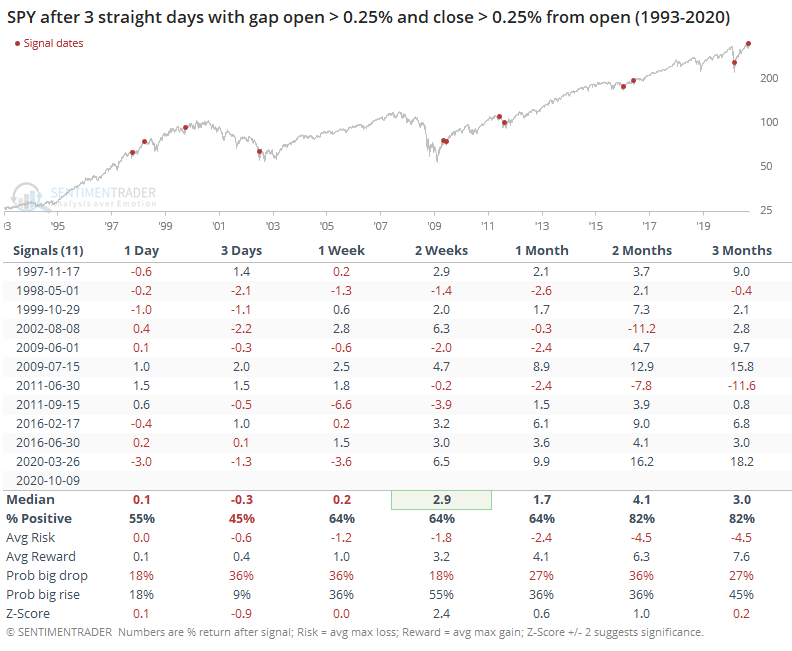

Heading into Monday, the most important ETF in the world had gapped up at least 0.25% at the open for 3 straight days, as eager buyers pushed stocks higher overnight. Not only that, latecomers kept up the pressure, and the fund closed higher than the open by at least 0.25% each of those days as well. It doesn't seem like much, but it's never happened before.

Monday marked the 1st time in the nearly 30-year history of SPY that it gapped up and then added that much for 4 straight sessions. It went 3 consecutive days a handful of times.

The persistent short-term buying led to more weakness than strength in the very short-term, but 2 weeks later, SPY was higher most of the time. It was more consistently higher 2-3 months later. While there were a couple of hefty losses mixed in, this kind of buying pressure tended to persist.

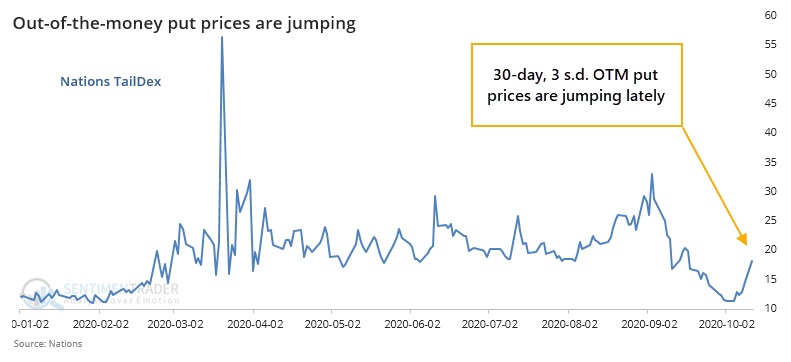

Despite the big gains on Monday, implied volatility actually increased, with a slight uptick in the VIX "fear gauge." As noted by Scott Nations, president of Nations Indexes, this was mostly due to a big jump in extremely far out-of-the-money put options.

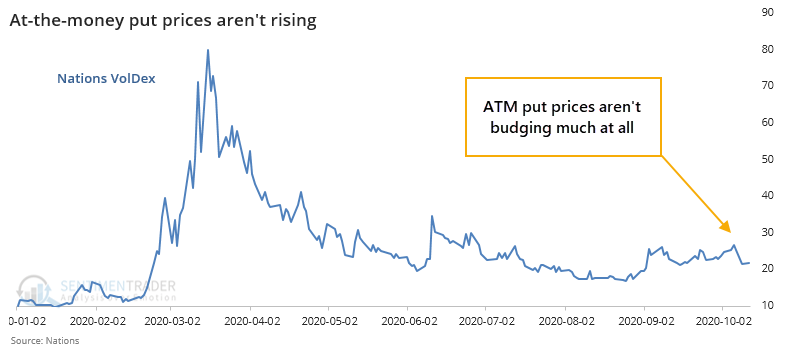

At the same time, at-the-money put options have barely budged.

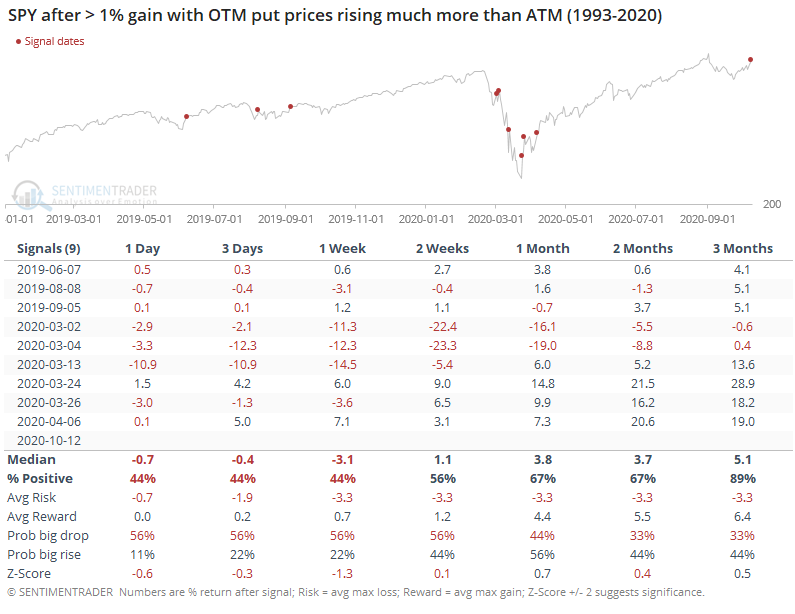

This kind of scramble for lottery-ticket hedges on a big up day doesn't happen very often, all since 2019.

Again, this was more negative than not in the very short-term, but nothing much beyond a week.