S&P's 6-Month Analogs As Gold Diverges From Inflation

This is an abridged version of our Daily Report.

Highly correlated

The S&P’s path over the past six months has some highly-correlated analogs. They showed some weakness over the next couple of months, then strength. The bubble peak in 2000 came close but didn’t make the top 10 of most highly-correlated periods.

Investors aren’t using gold for inflation protection

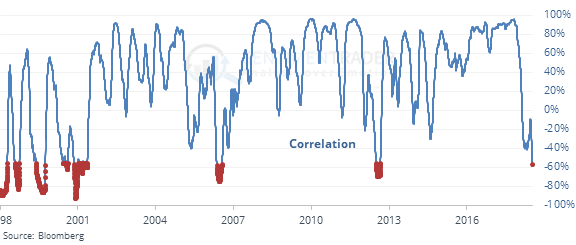

The correlation between gold and inflation-indexed Treasuries has turned highly negative.

This is abnormal, since the two have a high positive correlation over time. The few other times it inverted to this degree, gold provided good returns.

The latest Commitments of Traders report was released covering positions through Tuesday

There weren’t many big changes this week as hedgers mostly edged back on their extremes. They did move to a record long position in hogs, though. As a percent of total open interest, they’re holding the most exposure since 2009.

Small vs large

The small-cap Russell 2000 fund, IWM, closed near the day’s low on Friday while the Dow Industrials fund, DIA, closed near its high. That has happened 24 other times since 2000.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |