Speculative volume skyrockets as smart money sells

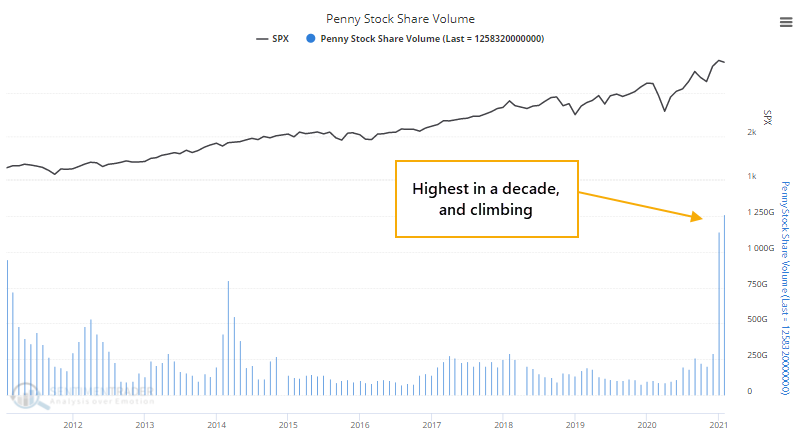

Last month, there was a remarkable jump in the most speculative corners of the market, including leveraged vehicles like options and margin trading, and lottery ticket shares in the form of penny stocks.

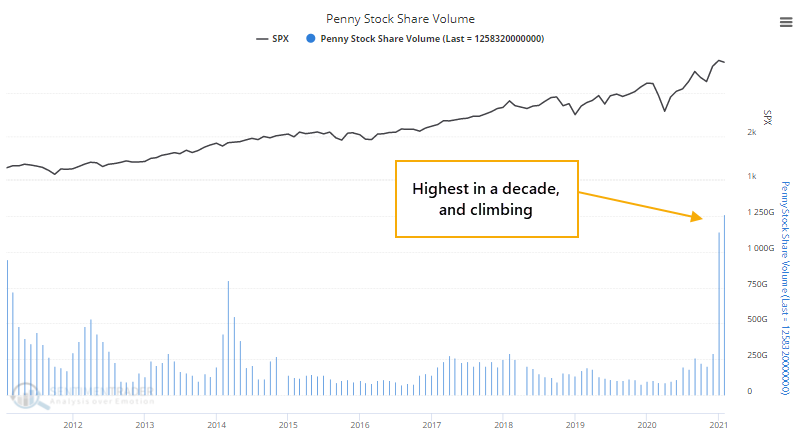

The roaming horde of speculators found that niche in December, with more than 1 trillion shares traded. It picked up even more in January.

A Bloomberg calculation of over-the-counter activity has continued to rocket higher in recent weeks. We haven't seen anything anywhere near this type of speculative activity in the past 5 years, at least.

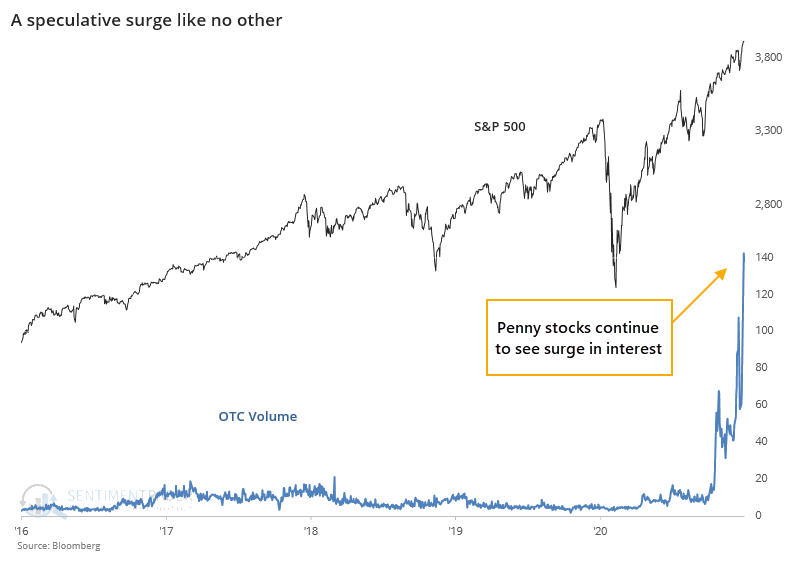

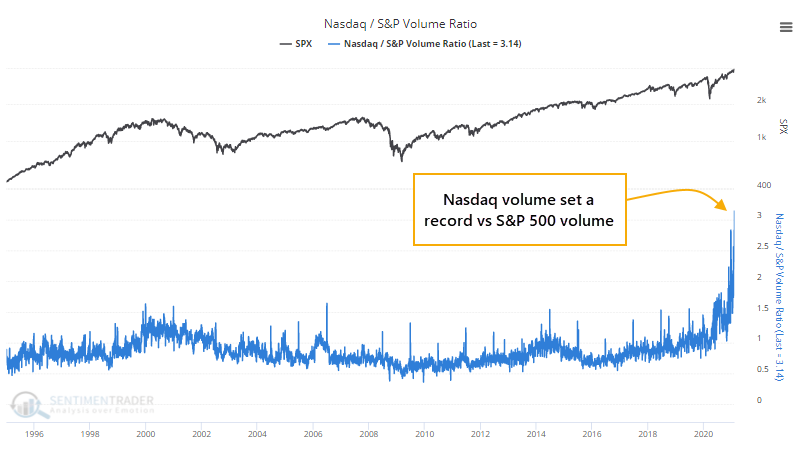

All of this activity has pushed the ratio of Nasdaq volume to S&P 500 volume to a record high. As a proxy for trading activity among speculators versus investors, once again we've never seen anything like the past month.

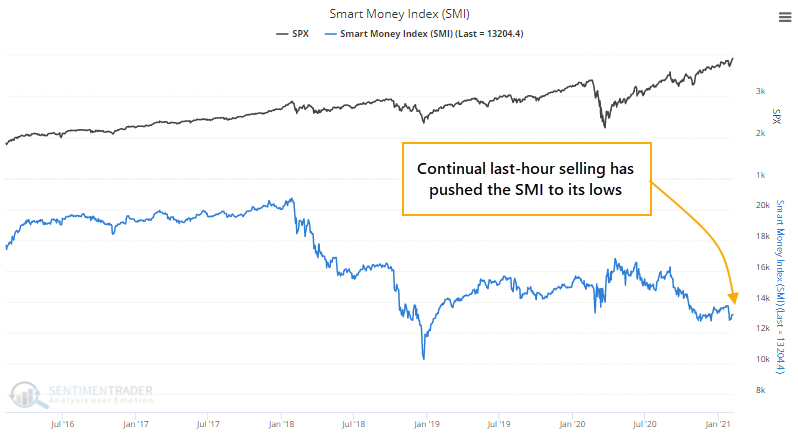

At the same time, the smart money is selling. At least, if we can consider activity during the last hour of trading to be the work of more informed investors, the theory behind the Smart Money Index. As calculated by Bloomberg, this measure is hanging near its lows despite indexes being at new highs.

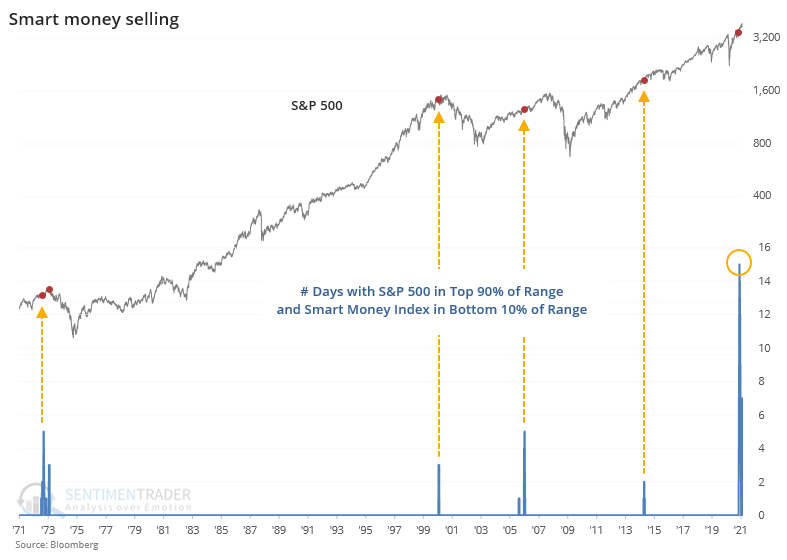

This has been the case for much of the past few weeks. So much so, that never before have we seen so many days when the S&P 500 was in the upper 90% of its 1-year range while the Smart Money Index is in the bottom 10% of its own 1-year range.

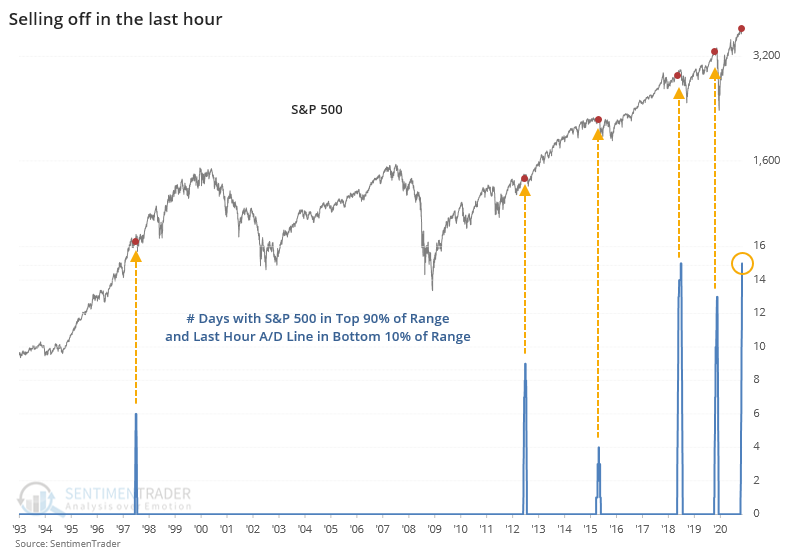

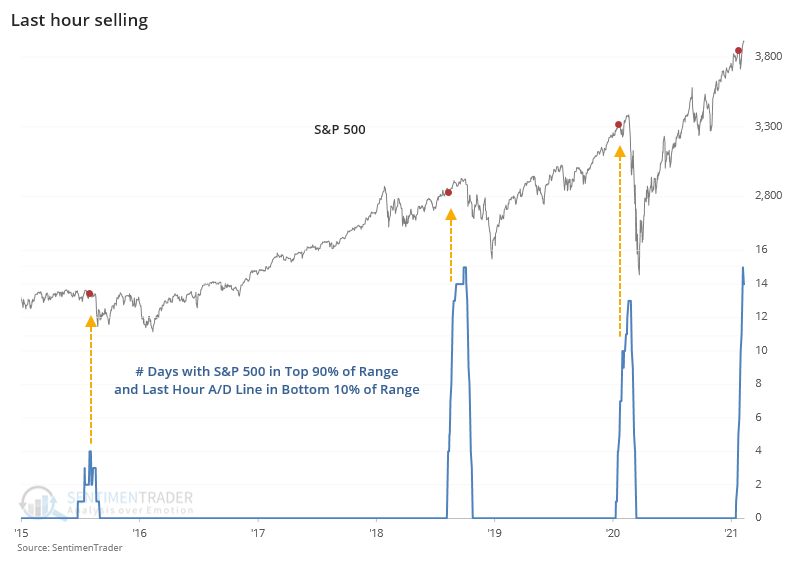

A little while back, Dean outlined a risk-off model he calculates using the last hour of trading. This is a cumulative advance/decline line of last-hour activity. If the S&P 500 rises during the last hour, then this indicator adds 1 to its running total; if the S&P sees selling to end the day, then the indicator subtracts 1. We've seen so much last-hour selling lately that this has been hovering near its lowest level since 2016.

Again, we've never seen so many days with this measure near its lows while the S&P is near its highs.

Its recent record is especially troubling.

There has been no shortage of signs of extreme, even record, speculation in recent weeks. The biggest counter-point to that has been widespread and impressive buying interest. That started to show some cracks in the past few weeks, but recent days have started to make up for it. It's a challenging dichotomy but risks in the short- to medium-term appear high, and the persistent last-hour selling adds to those concerns.