Speculative options traders double down during a bad week

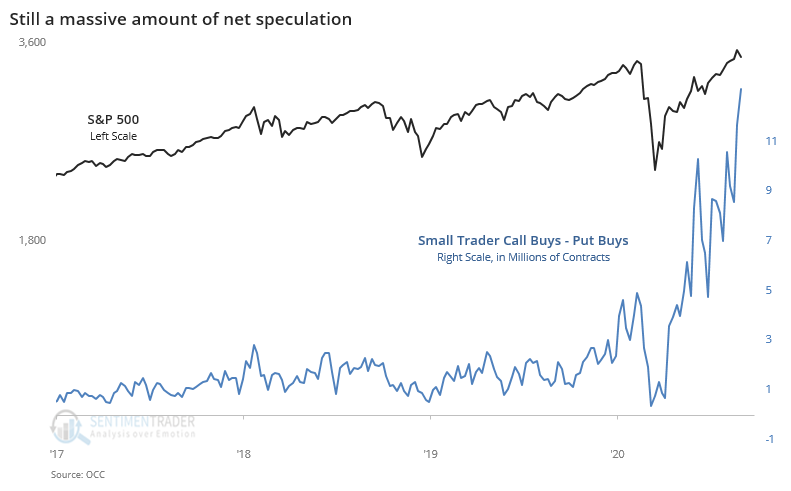

The hope among bulls was that maybe the drop in markets late this week would have bled some air out of the speculative options balloon.

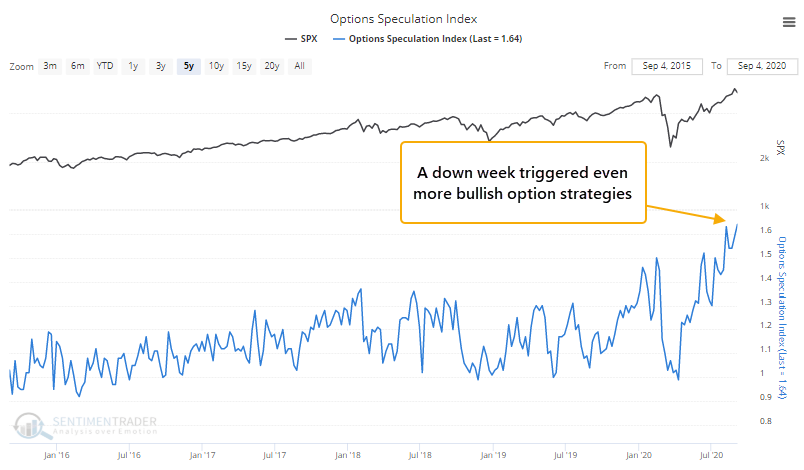

But it wasn't so. For the week, the Options Speculation Index actually increased, with traders spending 64% more on bullish options strategies than bearish ones.

The biggest story in sentiment this week, and surely the most "buzzy", are reports surrounding the Softbank conglomerate being a huge buyer of options on large technology stocks. The Wall Street Journal notes that:

"Investors watching the vertigo-inducing rise—and this week’s fall—of technology stocks are buzzing about a single trade, a giant but shadowy bet on Silicon Valley big enough to pull the market up with it.

The investor behind that trade, according to people familiar with the matter, is Japan’s SoftBank Group Corp., which bought options tied to around $50 billion worth of individual tech stocks. Investors and analysts, aware of the activity but in the dark as to who is behind it, say it has turbocharged the tech sector, whose sheer size drives broader market moves."

This follows earlier reports from the Financial Times and Zerohedge speculation prior to that. It seems safe to say that there has been a large buyer of call options on big tech names and that buying led to massive upside pressure in the underlying stocks as traders on the other side of the options trades had to offset their risk.

The problem is that it's not true.

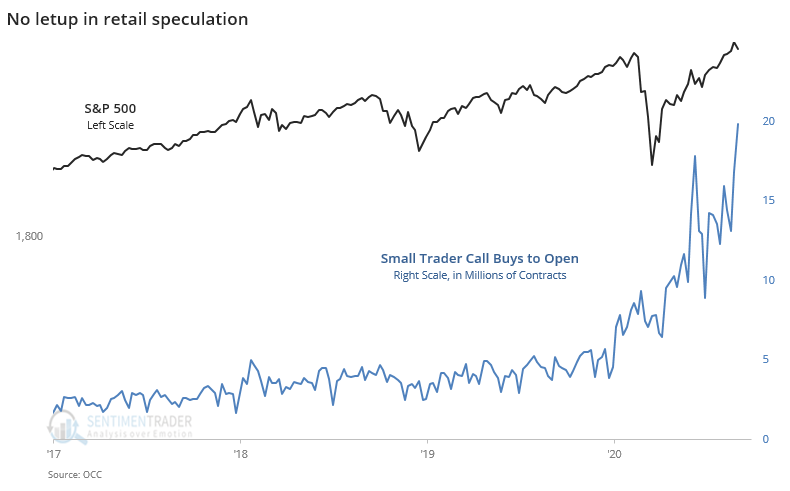

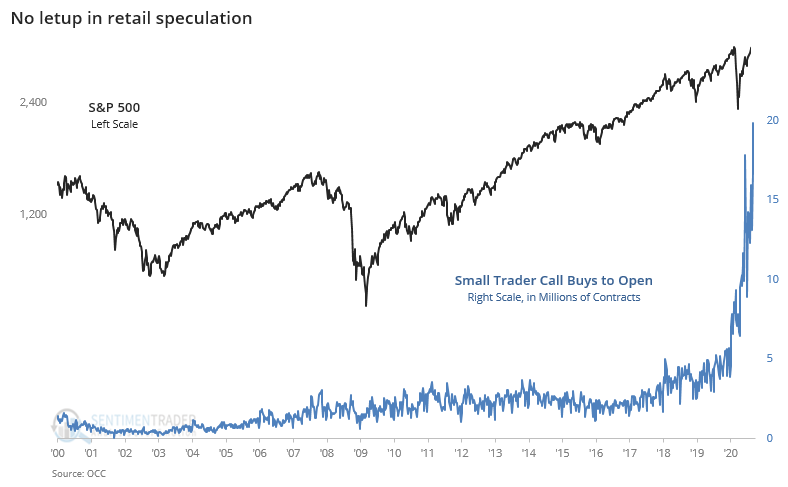

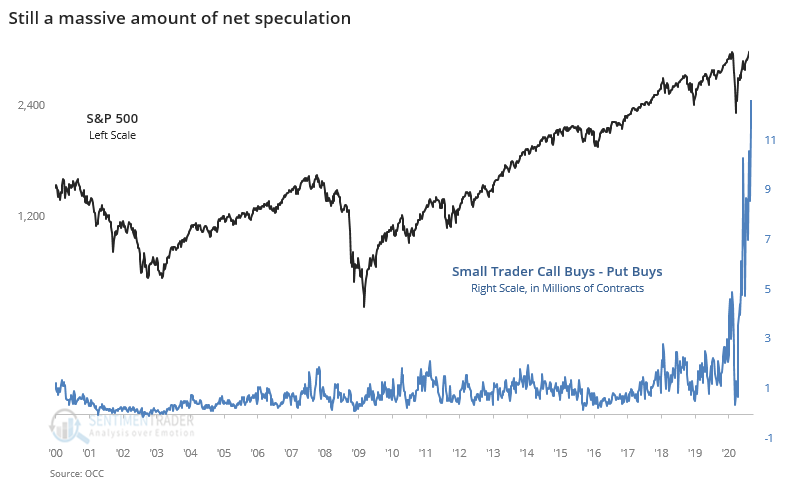

At least, it's not the whole story. It wasn't just Softbank, and it most certainly wasn't a single trade as the WSJ speculates. There has been an unprecedented move into speculative options among all trader types. It started in earnest in June and went parabolic a week ago.

The scariest thing is that the plunge on Thursday and wobble on Friday wasn't enough to deter this activity - it fueled even more of it.

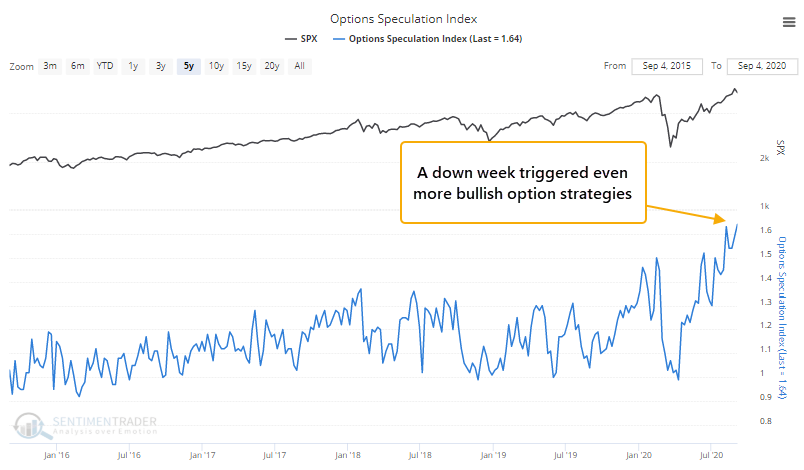

The hope would be that these traders would have gotten their first real whiff of two-way volatility on Thursday, and pulled back on their call buying. Maybe they did a bit, but for the week they bought nearly 20 million call options to open on equities and ETFs (84% of which was equities). This is 11% above the prior record from early June.

Zooming out, we can see just how ridiculously extreme this is.

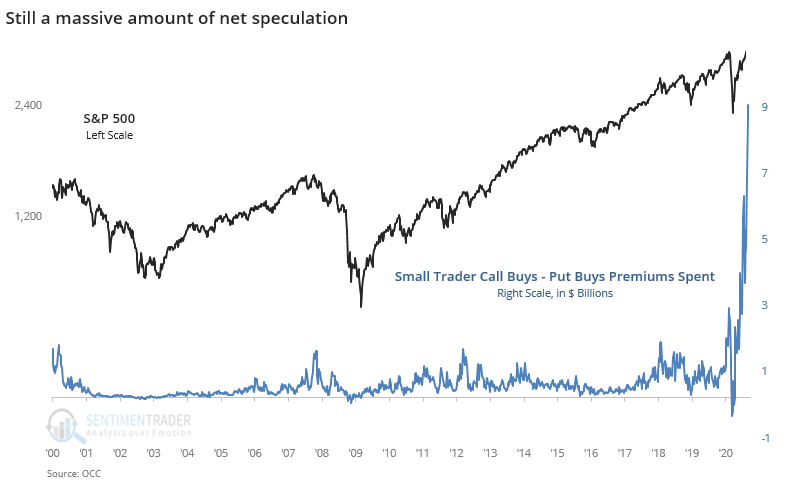

What's even more remarkable is how much they're paying for the right to likely lose their money. We noted earlier last week how implied volatility was rising along with stocks, a highly unusual situation in the stock market. Options premiums have a strong tendency to rise in downtrends as investors scramble to buy protection. It's exceptionally rare for them to pay increasing premiums for protection against an upside move. Until this week.

How unusual is this? For the week ending June 12, small traders bought to open 17.9 million call contracts, spending $6.6 billion for the privilege. Last week, they bought 19.9 million contracts (11% more), spending a stunning $12.4 billion to buy them. That's 88% more than that week in June.

In the past 4 weeks alone, retail traders have spent a mind-numbing $39.3 billion on opening call option premiums.

Here's the real kicker. According to that WSJ article:

"Investors pay a small premium to buy options, giving them exposure to a much larger notional amount of shares. In SoftBank’s case, the roughly $4 billion in options generated an exposure of around $50 billion, according to the people familiar with the matter."

If we apply the same multiple to the retail trades, then it suggests that the premiums they spent in the past month on calls generated an exposure of $512 billion to the stock market.

That's about 2% of the S&P 500 entire market capitalization. But it was focused on only a handful of stocks, in only a few weeks. In highly leveraged, expiring lottery tickets. Somebody, somewhere, had to take the opposite side to those trades and buy the underlying stocks for hedging protection.

When the calls expire, which most of them will do within the next 3 weeks, those hedgers no longer need to hold the stock and will sell it to reduce their own exposure.

It's never a good idea to only focus on one side of the ledger. So perhaps all these calls were being offset by an equal or greater number of protection put options. Not so. Last week alone, small traders bought 13 million more calls than puts.

Once again, zooming out we can see how this has gone parabolic.

The premiums spent on each is even more remarkable.

Just last week, small traders spent $8.9 billion more on opening calls than opening puts. That's on top of $8.5 billion the week before that.

The bottom line is that the large number of oddities we've discussed in recent weeks now make some sense. Well, it makes sense in terms of what is happening, but not why. There is probably going to be an incredible story that comes out of all this once the dust settles.

Unless Softbank's traders are disguising their footprint by buying tiny lots of options instead of big blocks, the tail-wagging-the-dog move in markets over the past few weeks is not confined to that single whale. There has been a gigantic, concerted effort across the gambling-addicted public to buy lottery tickets. That has helped propel underlying buying pressure. Once these options expire this month, there is a high likelihood that much of this buy-to-hedge activity has to be unwound.