S&P Rallies Hard, May Cross 200-Day Avg

Stocks are on a tear yet again, with most broad indexes up close to 2%. As noted ad nauseam in the Reports over the past three weeks, when a market does not react to short-term extremes, it's telling us something about the medium-term and we're seeing that again on a real-time basis. Even as the risk/reward has evened out lately from what had been a positive skew, this kind of momentum does not die easily.

That doesn't mean we won't see short-term gyrations, and today's push looks set to trigger some extremes that tend to lead to very short-term weakness.

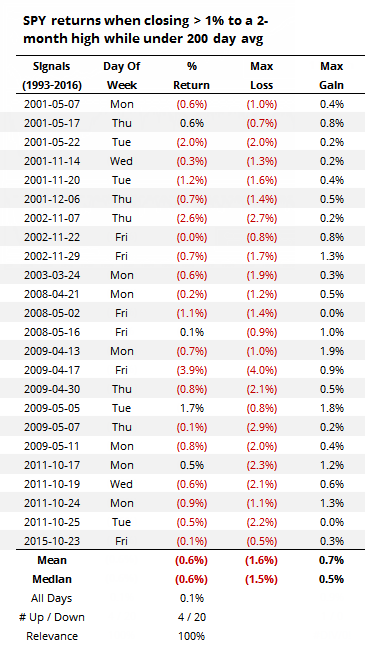

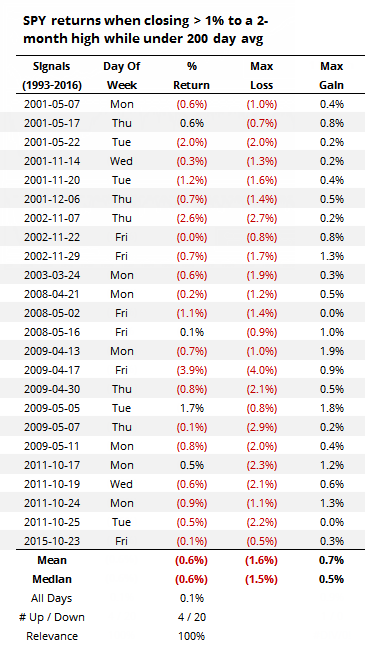

An example is that the S&P is gaining more than 1% to a multi-month high while below its 200-day average (though it may rally enough to close barely above it). When that happens, if we buy the next day's open and hold for two days, the returns were terrible.

There were only 4 winners out of 24 trades, and the risk/reward was skewed 3-to-1 to the downside. When it happened on a Friday, there was 1 winner out of 6 occurrences, averaging -0.4%.

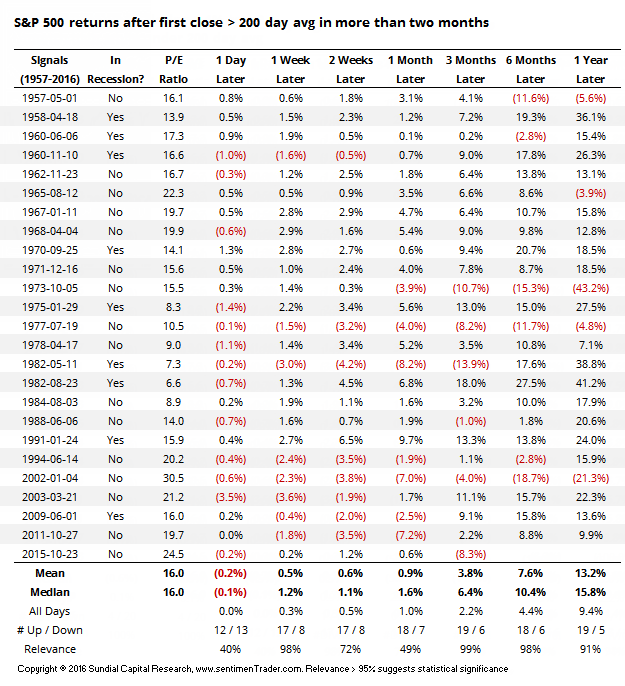

Even if we do cross the 200-day average, that hasn't been a great buy signal in the very short-term. Since 1957, stocks have struggled immediately after crossing above. In the past 40 years, the S&P dropped back the next day 10 out of 14 times.

This is all very short-term and says nothing about the medium- to long-term. Most of what we've looked in the past week or so has started to see more negative returns in those time frames but not enough to be overly defensive just yet.