S&P Nearing A New High On Nonfarm Payroll Day

There is a constantly changing dynamic in markets regarding whether good news should be taken as good news (growing economy) or bad news (Fed is more likely to hike). Just when traders think they have it figured out, sentiment changes.

Today the good news of better-than-expected payrolls is being taken as good news. Curiously, both stocks and bonds are being bought. Dating back to 1996, the only other time that the Nonfarm Payroll (NFP) report beat estimates and SPY and TLT both gained at least 0.5% on the day was March 4, 2005. For what it's worth, stocks peaked the next day and fell about 7% over the next two months.

There were 6 times that SPY gained at least 0.5% and TLT by any amount on a NFP beat and it led to short-term weakness 4 of the 6 times.

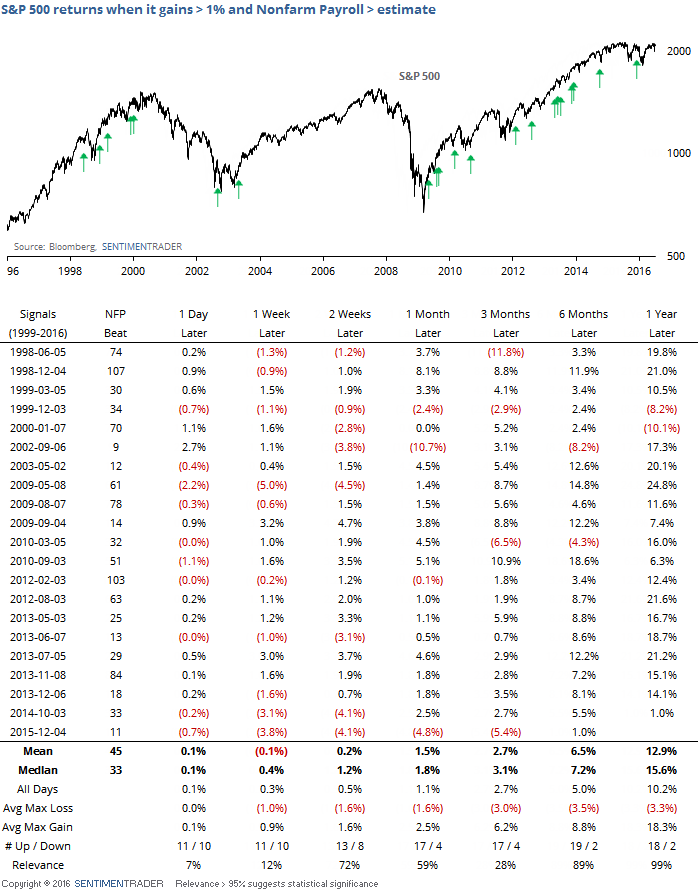

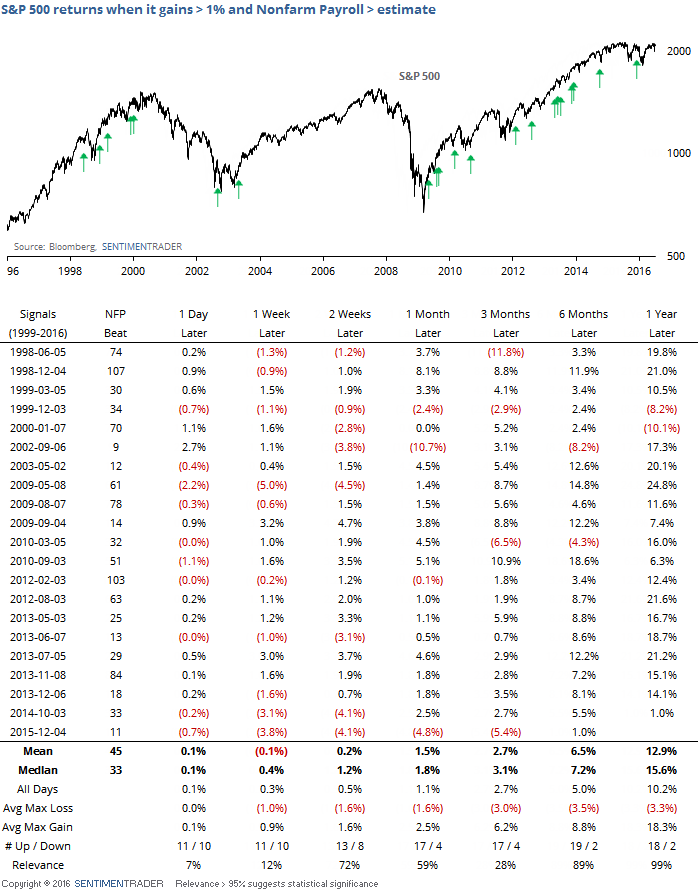

If we just focus on stocks, then there have been 21 times that SPY gained 1% or more on a NFP beat. As we've discussed often with large moves on a NFP day, there was often some give-back in the day(s) ahead. After these particular occurrences, there was a strong tendency to rise in the medium-term. We don't put a lot of weight on medium-term results stemming from one-day patterns, though.

If the S&P happens to close at a new high today, then it would mark the 16th time that it closed at a new 52-week high on a NFP beat. It continued to gain over the next three days after only 4 of the 15 prior occurrences.

If the S&P broke out to a multi-year high on any NFP day (whether it beat estimates or not), then it gained ground the next day 10 out of 31 times and up to a week later only 13 times.

Forgetting about economic reports, there have been 64 times since 1957 that the S&P 500 rose at least 1% on a Friday, to within 1% of a 52-week high. It continued to rally through Tuesday 42% of the time. Since 2000, that drops to 31% of the time, including 3 out of 9 times since the 2009 bottom.

Overall, behavior like today's (so far, anyway) would argue for some weakness early next week as the buying enthusiasm takes a breather. This will be especially interesting given the S&P's proximity to a new high. Half of traders will argue that it means we'll see a breakout and runaway rally, the other half will argue that it's resistance and we're about to top out. Judging from typical behavior, the most likely scenario would be a push to a new high that sucks in late buyers, then 1-3 days of backtracking that flushes some of those out.

In the medium-term, we're still focused on the positives that were indicated by the breadth thrust last week and nothing since then has caused much of a worry that that's wrong-headed.