S&P Jumps Multiple Days As Volatility Halves

This is an abridged version of our Daily Report.

What a difference a week makes

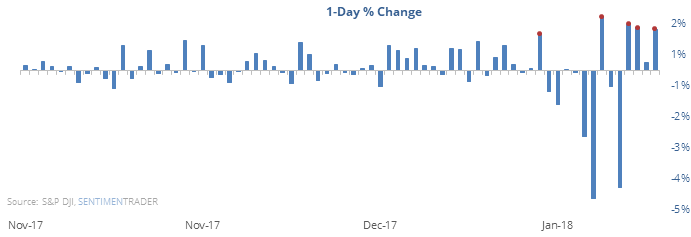

The S&P 500 has jumped more than 1% on 3 out of the past 4 sessions. That buying thrust comes on the heels of a multi-month low during a bullish long-term trend.

Future shorter-term returns were skewed positive, a stark contrast to similar thrusts during bearish trends.

Volatility x 1/2

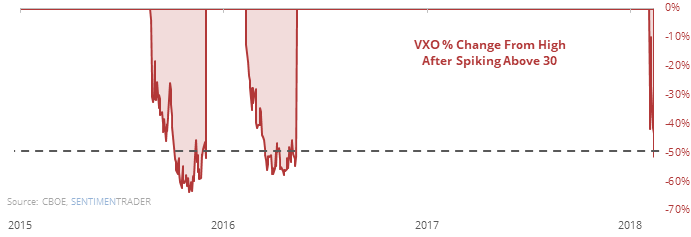

The original VIX index has plunged by half in recent days, after spiking well above 30. That is usually taken as a sign that the worst is over and the storm has passed.

Similar spikes-and-plunges, however, led to weak returns in stocks and an increase in volatility.

No breaks for bonds

The popular investment-grade corporate bond fund, LQD, has been able to stitch together only 4 positive sessions over the past month.

Good news for miners

The HUI Gold Bugs index was at a 52-week low three days ago, and has since jumped more than 3% on two of the sessions since. That has happened 7 other times in the 23-year history of the index.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.