S&P Gapping Down In December

Here's an interesting tidbit. The S&P 500 is currently indicated to open more than 1% below where it closed on Monday.

Opening gaps are often suggested to be "dumb money" traders reacting to overnight news events. For the most part, historical studies support that characterization.

Big negative gaps are unusual in December, typically a positive time of the year, though as we've often discussed the middle part of the month tends to be mushy - it's the latter half that's the good stuff.

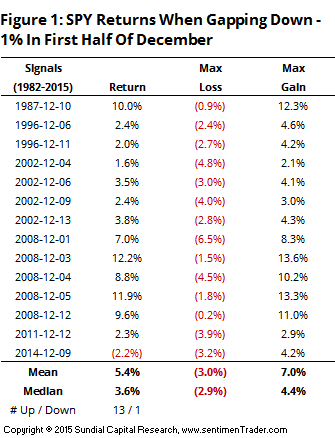

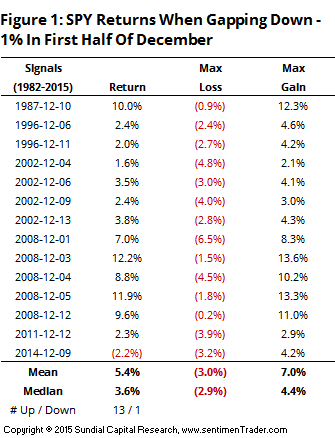

Let's go back to 1982 and look for every time the S&P 500 futures or ETF gapped more than -1% below the prior close in the first half of December (before December 15). We'll buy the open and sell it at the close on the third trading day in January.

This takes advantage of two tendencies, for gaps to be filled and for positive seasonality in the latter half of December to take effect. Out of 14 trades, 13 gave impressive positive returns. The only loss was the last one, which dents this a bit (we place more weight on recent occurrences).

Notice, however, that the drawdown could be severe. The Max Loss column was hair-raising at times, because we usually saw these kinds of gaps during bear markets.

We'd never suggest using this to trade mechanically, but rather as an indication that short-term emotional weakness this time of year tends to get reversed in the latter half of the month.