S&P Breaks Out As Tech, Energy Highs Surge And

This is an abridged version of our Daily Report.

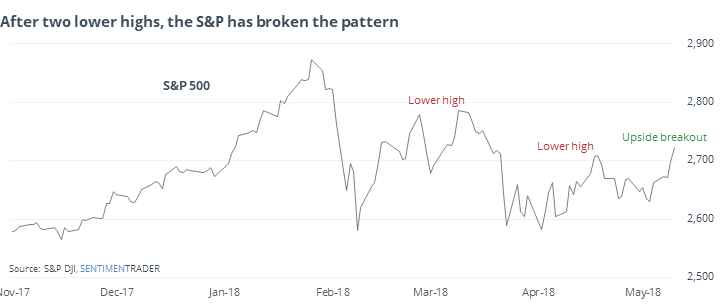

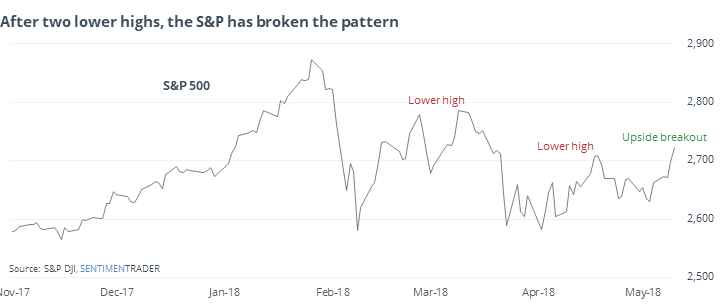

A broken pattern emboldens bulls

The S&P 500 put in consecutive lower highs since the January peak, but broke that to the upside on Thursday.

The initial breakout from a coiled pattern has a high failure rate in the medium-term. Similar breakouts from lower highs led to a positive return six months later less than half the time.

Tech, Energy stocks are recovering

Both the Tech and Energy sectors have seen more than 20% of their members reach a 52-week high in recent days. For Tech, that was a mixed blessing shorter-term, but a good sign long-term, thanks to the mid-90s bull market. Energy stocks had a much harder time maintaining the momentum.

Dow is on track

The Dow has rallied for 6 straight days, while being down more than 7% from its recent peak. Since 1928, that has led to some weakness in the very short-term, with its most consistent strength being 10-20 days later.

Most hated fund

The lowest optimism among the most popular ETFs we track is on VXX, where the Optimism Index has dropped below 10. The fund is terribly constructed for anyone holding more than a day.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |