S&P approaching all time highs

NOTE: I (Jason) am dealing with some family health issues, so I'm re-publishing Troy's note with some quick notes from myself, noted with [Jason]

The past few weeks and months have seen U.S. tech stocks rally relentlessly while other countries' stock indices bounced sideways. The tech rally managed to drag the S&P 500 towards all-time highs, which is quite amazing given all the doomsday predictions we saw in late-March.

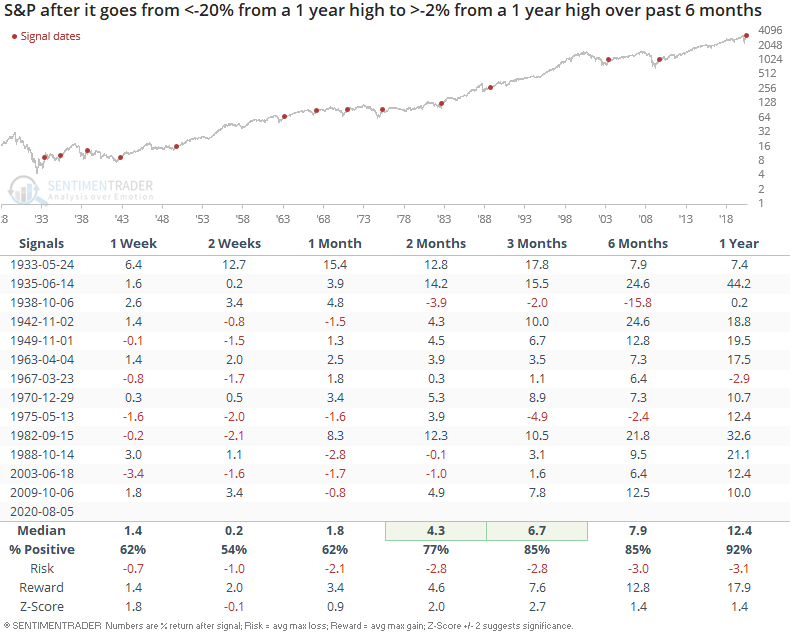

The S&P is now less than -2% from its all-time high. When the S&P cycled from bear market territory to within -2% of a 1 year high, the S&P usually trended higher over the next 2+ months:

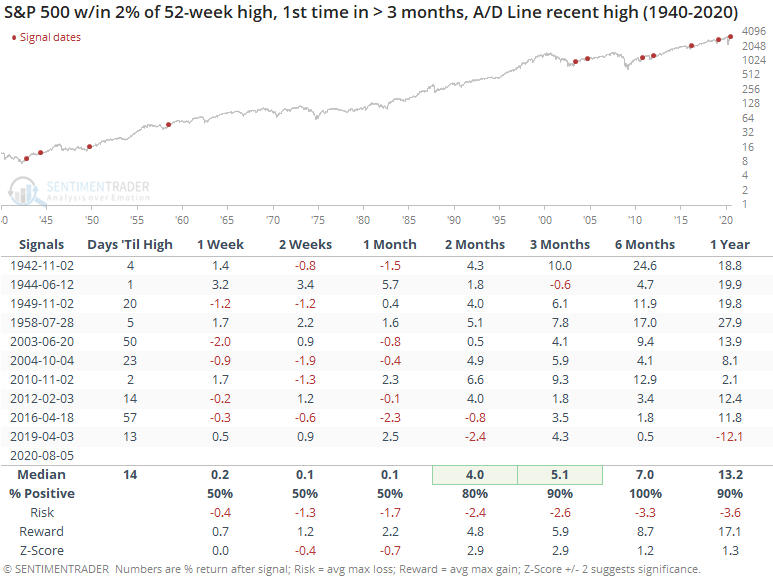

[Jason]: We also know that the Advance/Decline Line is hitting new highs, suggesting a broad rally. That isn't really the case, and we're still seeing a somewhat poor environment coupled with high optimism, but the recent run has been persistent enough that even though (relatively) few securities are advancing, they've been advancing long enough that the line is hitting new highs. When we see that in combination with the S&P approaching its prior highs, the S&P has always been able to eclipse its prior high within 60 days, usually much quicker. How do we square that with the negatives that have cropped up over the past 1-2 months? I don't think we can, we just need to weigh which is more important. So far, momentum has clearly been winning out, even if the rally has tapered off some. Given the environment/sentiment combination in recent weeks, it still seems likely that reward should be limited, with a high probability that the gains will be given back at some point in the coming months.

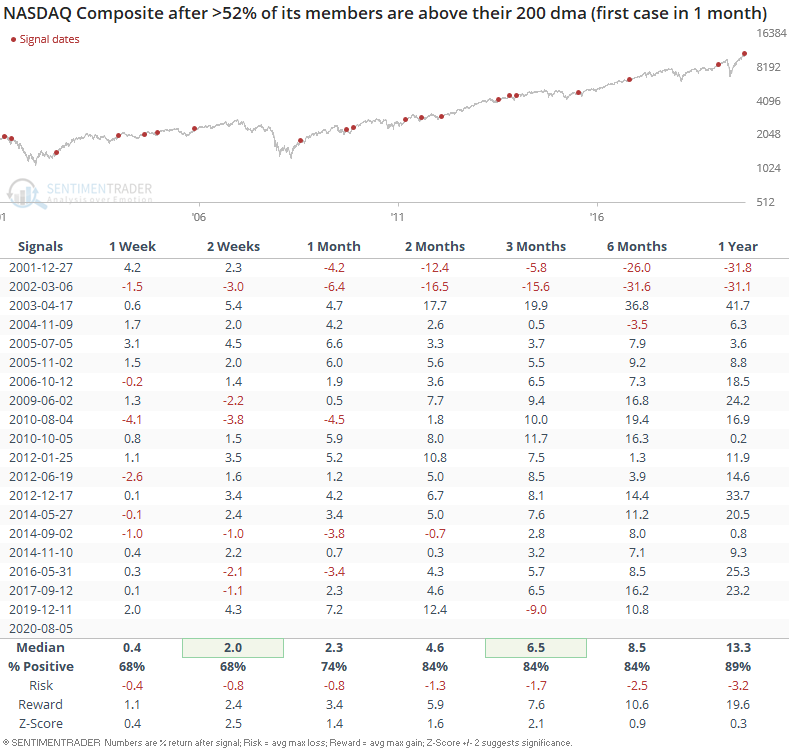

One of the big complaints during the entire course of this rally is "weak breadth". Breath is still weak, but at least for the NASDAQ Composite is ever so slightly improving. 52% of the NASDAQ Composite's members are now above their 200 dma:

When this happened in the past, the NASDAQ Composite usually rallied over the next 3 months:

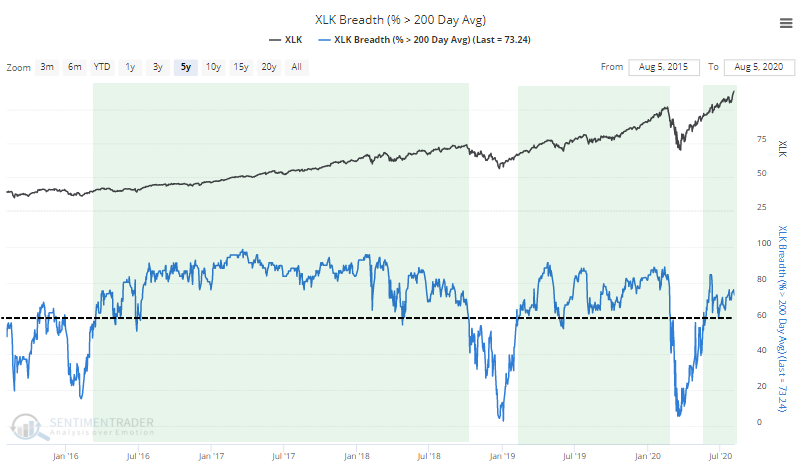

[Jason]: Unlike what we're seeing within the S&P 500 (and industries, sectors, and countries), more than 60% of stocks in the S&P tech sector have consistently been holding above their 200-day moving averages. This is a hallmark of healthy markets, so for this sector, anyway, it's bucking the broader environment.