S&P 500 Streaks Are Dropping Like Flies

At various points this year, the majority of stocks have trailed the major indexes. Sometimes, there was a wide divergence between what the average stock was doing versus, say, the S&P 500. Historically, that has preceded declines in the indexes, but 2021 has thrown a whole host of historical markers out the window.

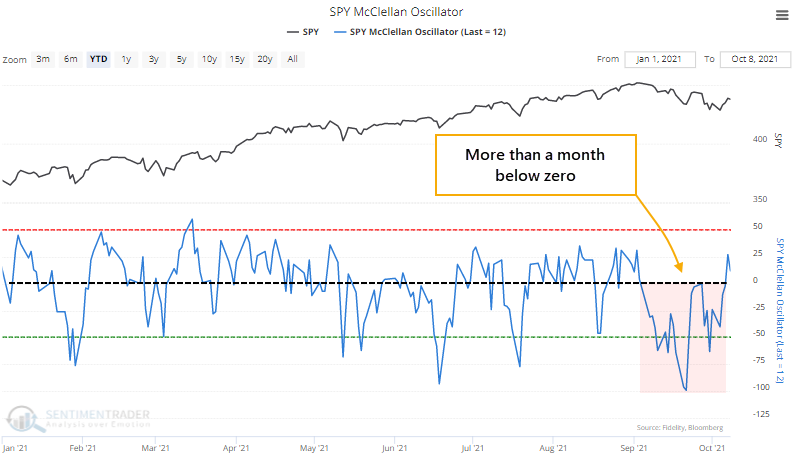

Even so, the internal weakness was enough so that when the S&P actually did start to struggle over a month ago, some of its breadth metrics really struggled. The rally at the tail end of last week started to change that; the McClellan Oscillator for the S&P 500 has turned positive for the first time in a month.

The extended run below zero in the Oscillator caused the longer-term Summation Index to plunge, and it recently dived below its zero line for the first time in well over a year. The worst possible scenario for an index or sector is when its Summation Index is negative and declining - that's when the ugliest selloffs tend to occur.

The drop below zero ended the 4th-longest streak in positive territory for the Summation Index since 1926, and it missed making it into 2nd place by only a few sessions.

What else we're looking at

- Annualized returns in the S&P 500 since 1926 based on McClellan Summation Index regimes

- What happens after a long positive run in the Summation Index comes to an end

- An update on absolute and relative trends in industry, sector, and country ETFs

- Using the Backtest Engine to find opportunities in Smart Money and Dumb Money Confidence

| Stat box The 10-day realized volatility in the S&P 500 recent rose to its highest level in 90 days, the first time since 2017 that rose so high when the index as so near a multi-year high. |

Etcetera

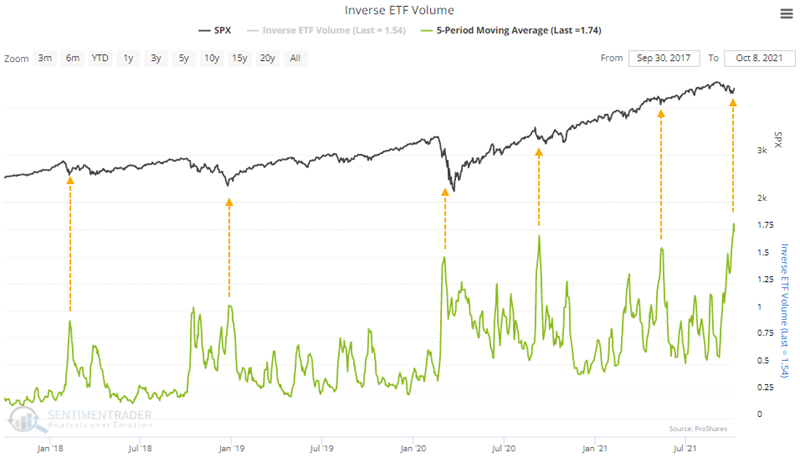

Big bearish bets. Over the past week, volume in inverse ETFs accounted for more than 1.75% of total NYSE volume. That's a record high.

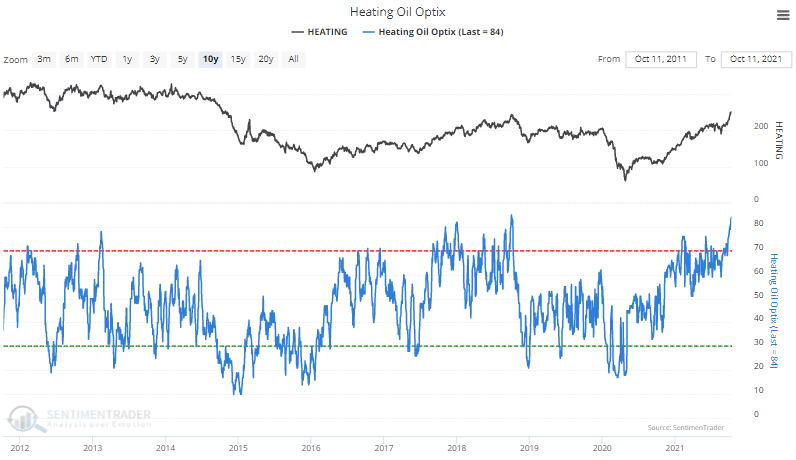

A hot market. Optimism in heating oil is close to eclipsing the highest it has been in over a decade.

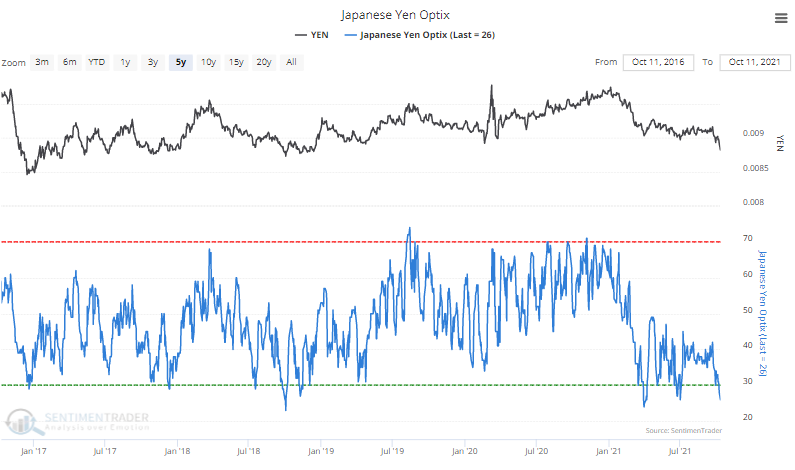

No yen for yen. At the opposite end of the sentiment spectrum, the Optimism Index for the Japanese yen is approaching the lowest in the decade. It gets lower, and stays there longer, during sturctural bear markets.