S&P 1500 Index constituents flash an oversold signal

Key points

- At the risk of sounding like a broken record, individual objective indicators continue to flash "oversold in an uptrend" signals

- The S&P 1500 RSI 14-day > 70 indicator just flashed on an oversold signal

- This signal has generally benefitted both short-term traders and long-term investors in the past

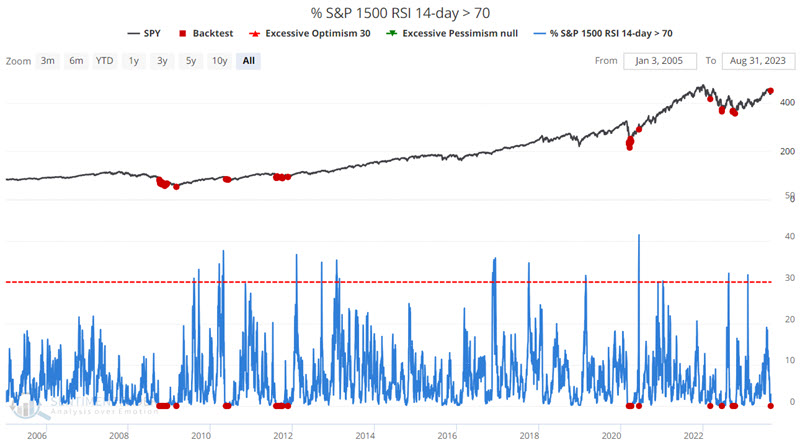

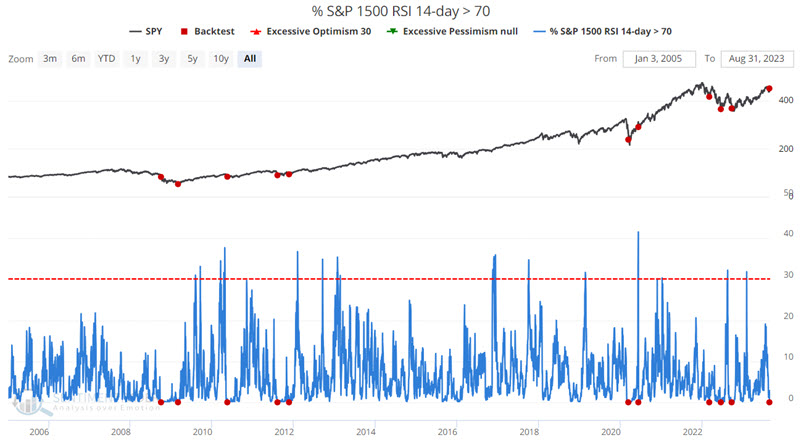

% S&P 1500 RSI 14-day > 70 drops to 0

As the name implies, the % S&P 1500 RSI 14-day > 70 indicator measures the percentage of stocks that comprise the S&P 1500 Index that presently sport a 14-day RSI reading above 70. The chart below displays all days when this indicator stood at 0% - i.e., not a single stock among the S&P 1500 constituents showed a 14-day RSI reading above 70.

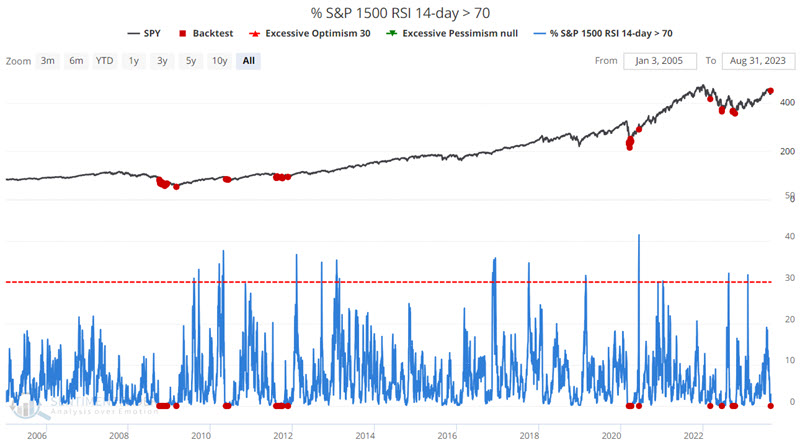

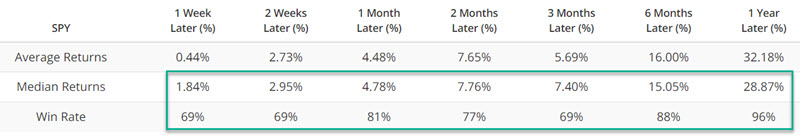

The table below summarizes SPX performance following these days.

Overall results are favorable; however, these signals can be early if the market is in the middle of a more drawn-out decline.

Alternative interpretations

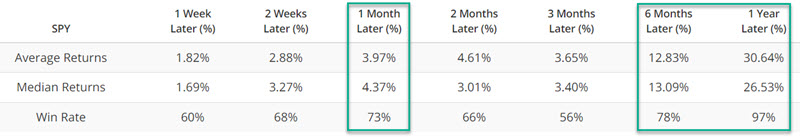

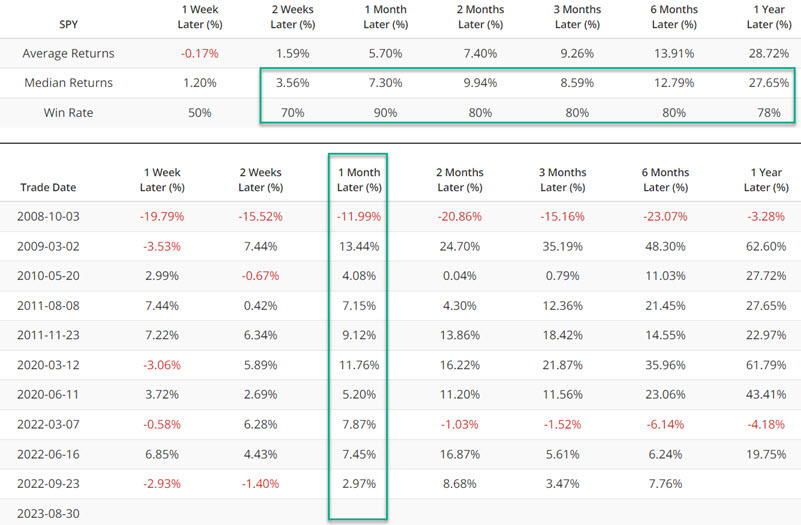

One alternative is waiting for this indicator value to rise above 0. The chart below displays all days when this indicator rose above 0% after first touching 0%, and the table summarizes SPX performance.

Overall, the results are better virtually across the board, but not by a lot, and a continuation of a given decline can occur, as seen in 2008, 2011, and 2020. Still, either of the signals above generally serve as:

- An alert to short-term traders to look for a buying opportunity

- A signal for long-term investors to consider putting cash on the sidelines to work in the market

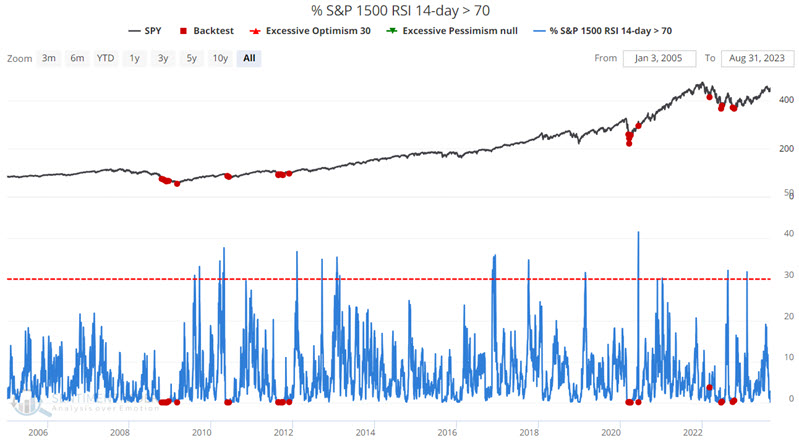

To illustrate this opinion, consider results if we exclude signals that occur within three months of a previous signal. The chart below displays those times when the indicator fell to 0% for the first time in three months.

The tables below display SPX performance. Note the relatively high Win Rates from 1 month to 1 year. On the other hand, note also that the October 2008 signal is a reminder that no signal is ever perfect, and traders are never relieved of their responsibility to manage risk.

1-month results have historically been well above average. However, given that September has a history of being the weakest month of the year, it will be interesting to see how the market reacts to the 2023-08-30 signal in the month ahead.

What the research tells us…

As always, no single indicator should be considered as the "be all, end all" for trading purposes. And to repeat, no matter the historical track record of any indicator, individual investors and traders are never relieved of their responsibility to allocate capital wisely and manage risk ruthlessly. That said, the signals from the % S&P 1500 RSI 14-day > 70 indicator highlighted above remind us that pullbacks are a natural occurrence in the market and that alert investors and traders can often take advantage of these pullbacks as opportunities to put money to work.