Some thoughts on speculative stocks

With the air coming out of some of the more speculative pockets of the market, I thought it would be an excellent time to remember the following thought. With great reward comes significant risk. The intent of my note today is not to make any dire predictions about what the future holds. My goal is to provide you with some historical perspectives on risk.

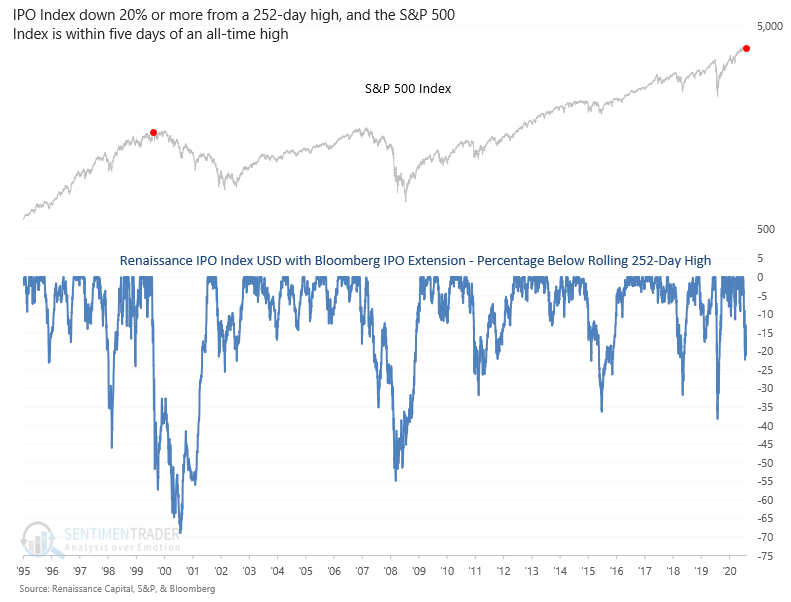

With IPO, SPAC, Solar, and other speculative stocks down on a peak to trough basis of greater than 20%, let's see how that compares to the technology bubble in the mid to late 1990s.

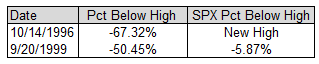

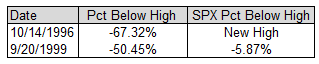

Internet Services and Infrastructure

The internet services and infrastructure group underwent two brutal bear markets between 1996 and 1999. In both cases, the damage to the S&P 500 was minimal. In one instance, the S&P 500 closed at a new high on the max down day for the internet group.

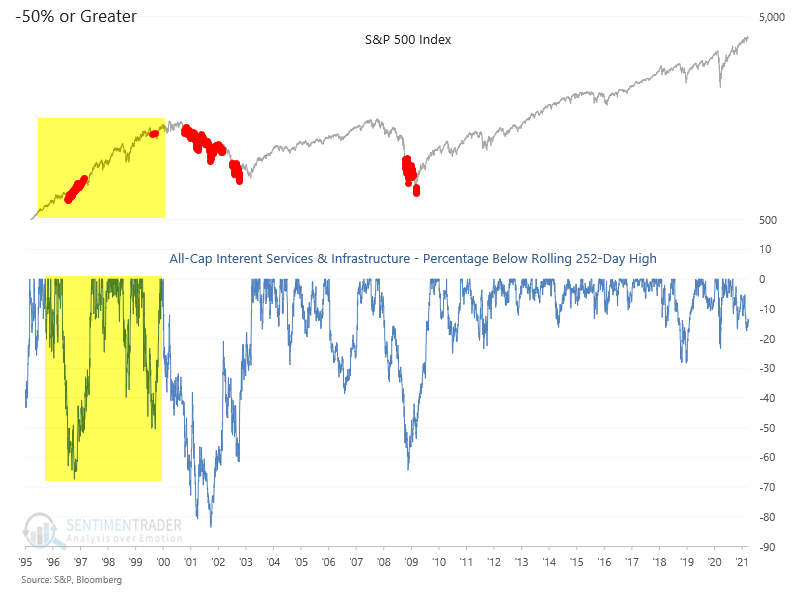

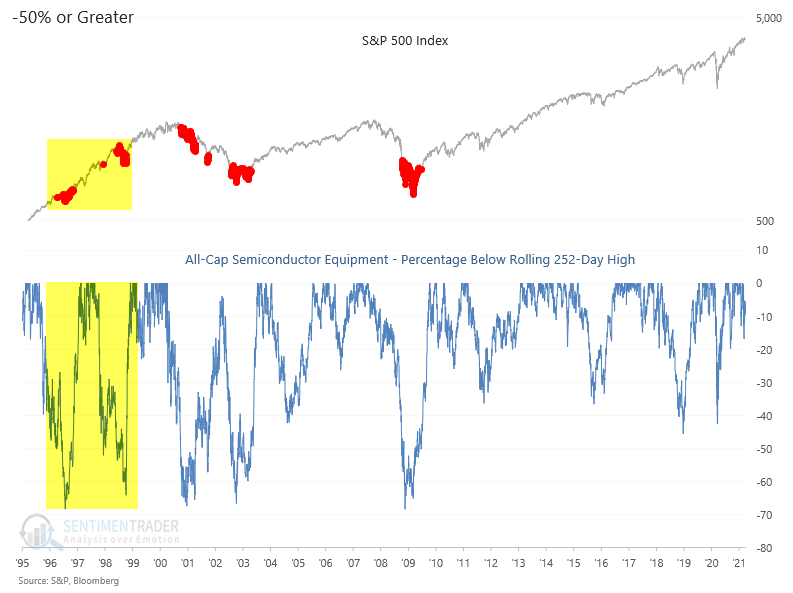

Semiconductor Equipment

The semiconductor equipment group underwent two brutal bear markets between 1996 and 1997. In both cases, the damage to the S&P 500 was minimal. I would also note that the semiconductor group corrected alongside the equipment group, but the damage was not as severe.

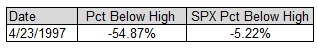

Home Entertainment Software

The home entertainment software group underwent one brutal bear market in 1997. The damage to the S&P 500 was minimal.

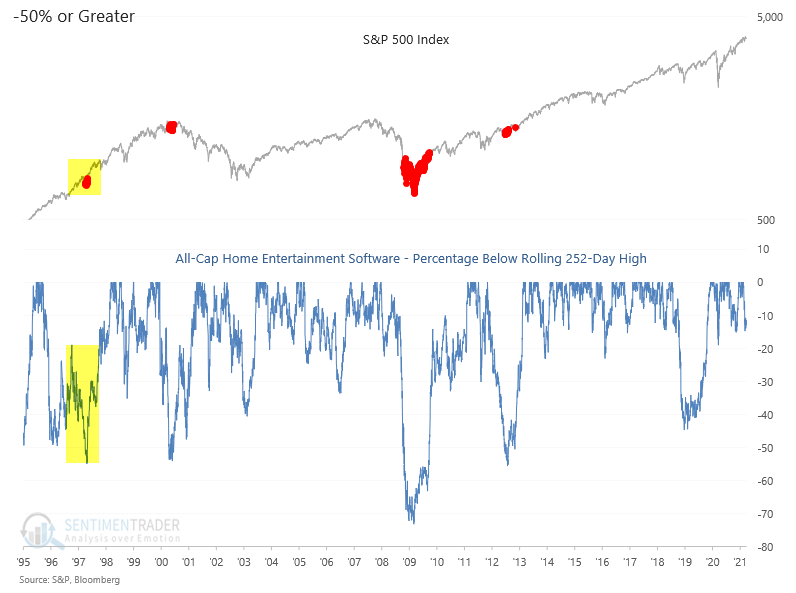

IPO Index

As many of you know, the IPO Index is a component in my relative ratio range composite model that measures risk appetite. As I was reviewing the data this week, I noticed the following setup. The IPO index closed down more than 20% from its most recent high as the S&P 500 was less than five days from a new all-time high. As the chart below shows, this is the second instance in history. I want to reiterate that I'm not making any dire predictions; this is merely an observation.

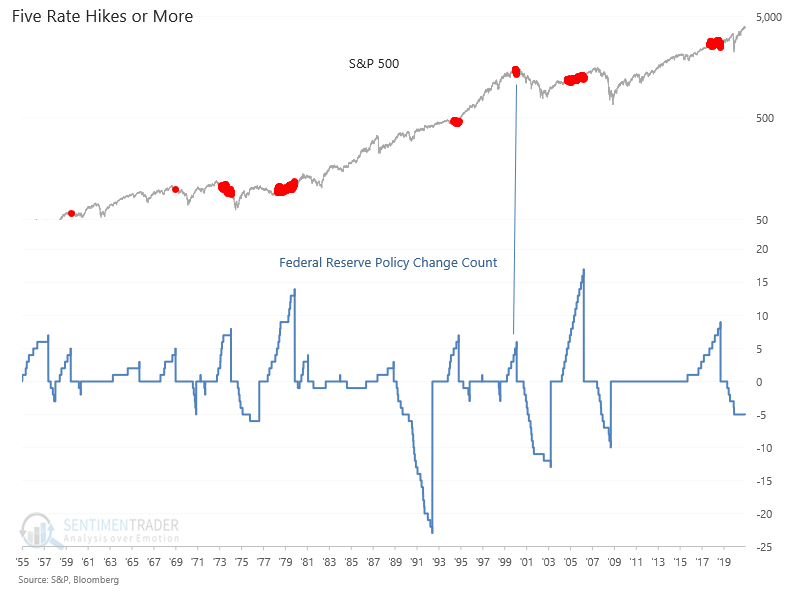

Fed Policy

As always, Federal Reserve policy plays a vital role when it comes to influencing investors' risk appetite. I suspect this time will be no different.

Conclusion: Speculative stocks have been under pressure of late. While the setback has been painful, I would point out that the drop is less severe than several instances during the technology bubble period. Does it get worse from here? I have no idea. Today's note is a friendly reminder that markets are risky and that brutal bear markets can develop in an individual group at any time.