Some factors to consider as we start the new week

Here are some things I'm looking at as we start the new week.

Crude oil

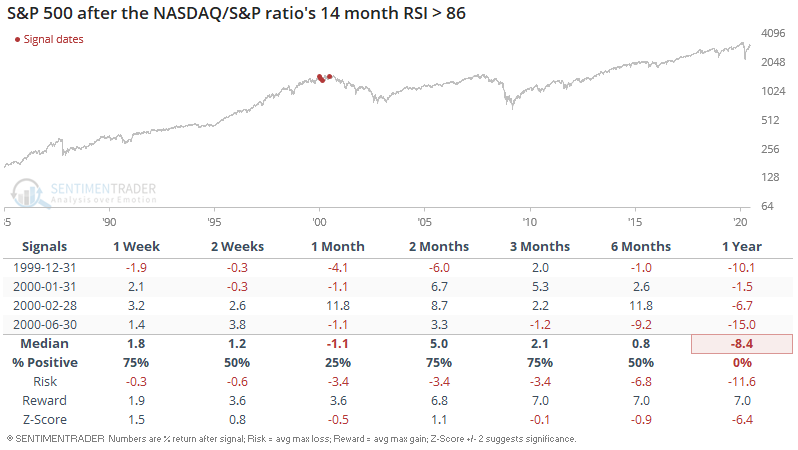

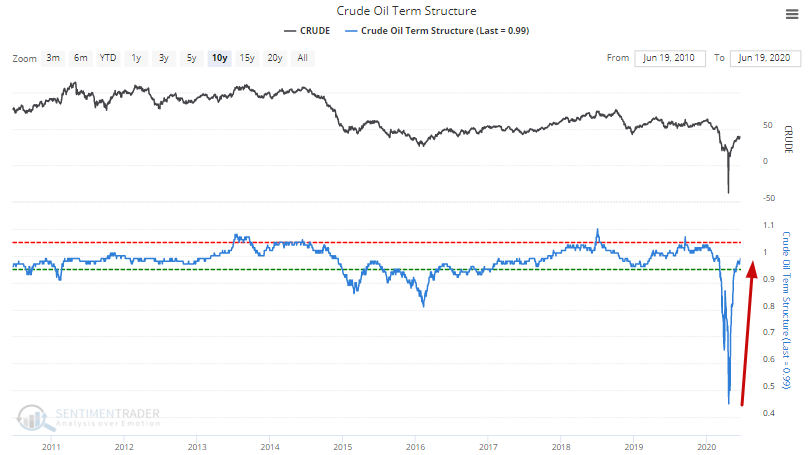

The coronavirus-driven recession pushed oil down to previously unthinkable lows. Crude oil's term structure was at record lows, implying that traders were betting on a rebound in oil. And rebound it has. While still not back up to pre-COVID levels, oil is much higher than it was during the global lockdowns.

When crude oil's term structure almost climbed back up to 1 after falling below 0.85, oil climbed further over the next year, even if it made a short term pullback:

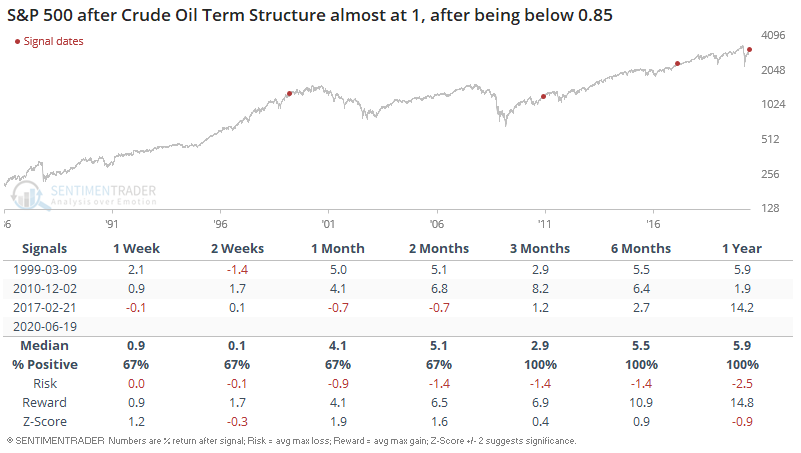

Since rapid declines in oil prices are often accompanied by a deterioration in the global economy, rising oil prices (accompanied by an improving global economy) also usually led to more gains for stocks over the next 6-12 months:

Momentum & volatility

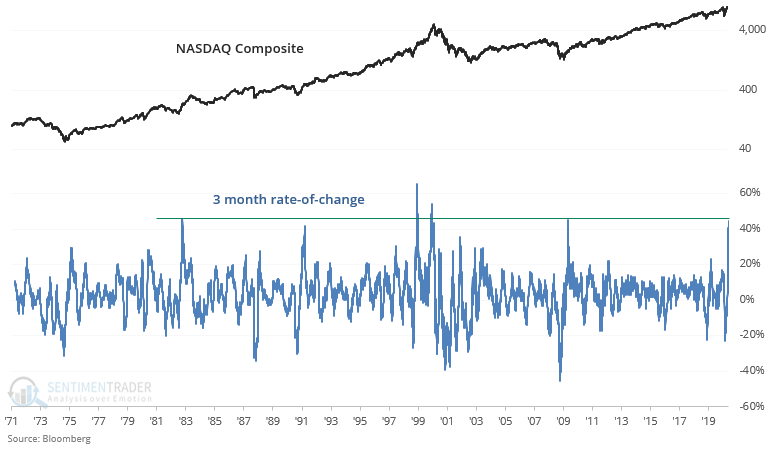

It's been almost 3 months since stocks bottomed in late-March, and tech stocks have surged. The NASDAQ Composite's 3 month rate-of-change is at its highest level in over a decade. And just when it seemed like tech stocks were poised to pullback last week, the NASDAQ rallied 6 months in a row.

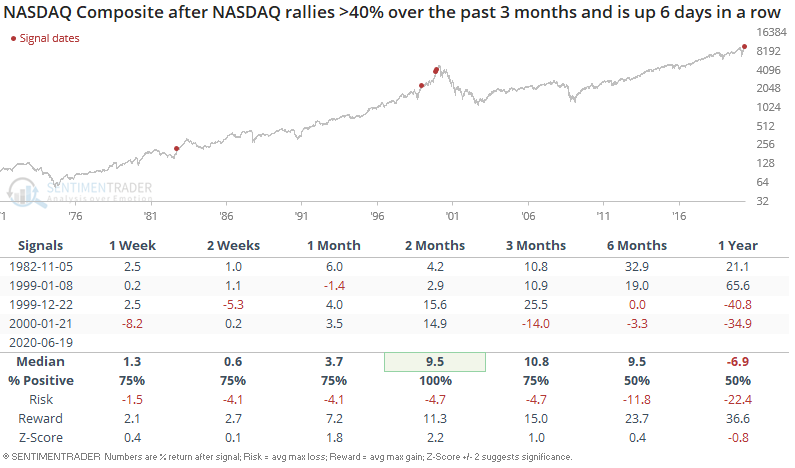

It's extremely rare for the NASDAQ Composite to rally >40% over the past 3 months and go up 6 days in a row. When this happened in the past, it wasn't a consistently short term bearish factor for the NASDAQ. Animal spirits can easily swamp any short term extremes:

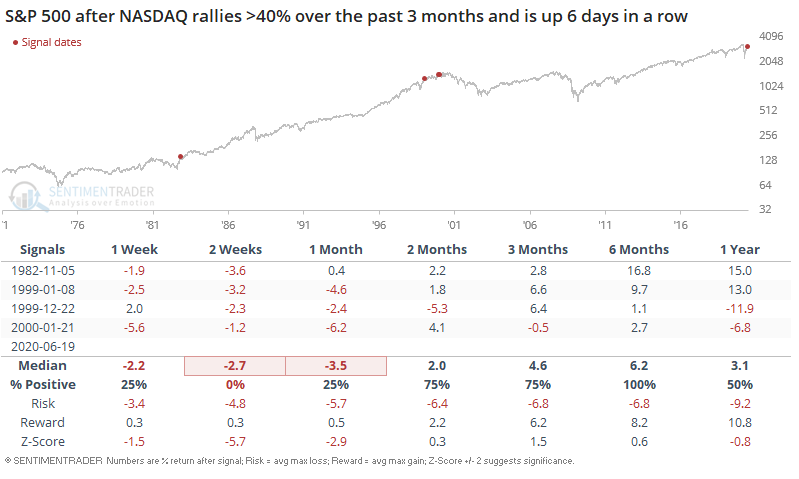

But as for the S&P 500, this consistently led to pullbacks over the next 2 weeks:

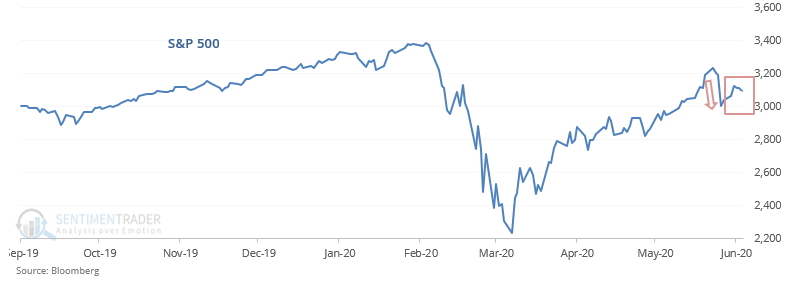

Trading has been somewhat muted this week after last week's 1 day crash.

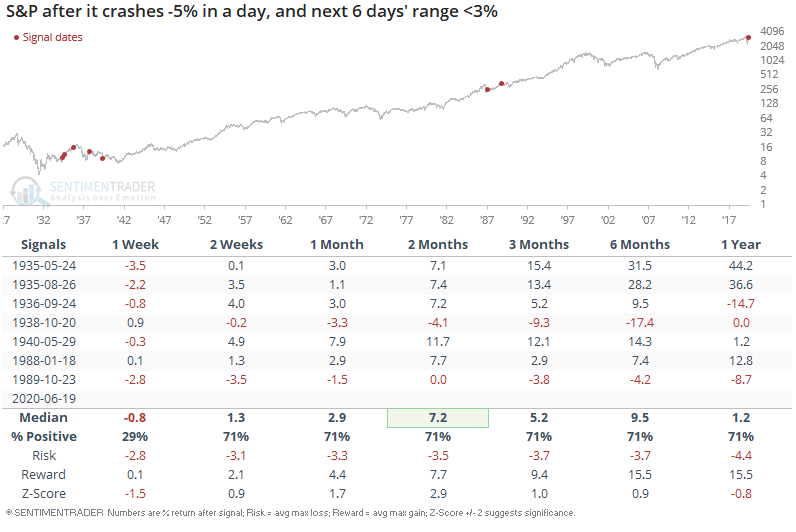

The S&P crashed more than 5% in one day last week, and then the next 6 days saw the highest close price exceed the lowest close price by no more than 3%. When a big one day crash was followed by a small trading range, the S&P usually fell over the next week:

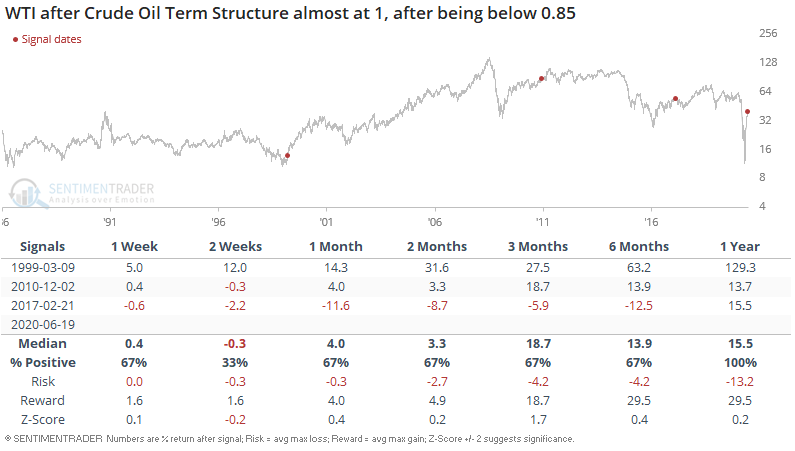

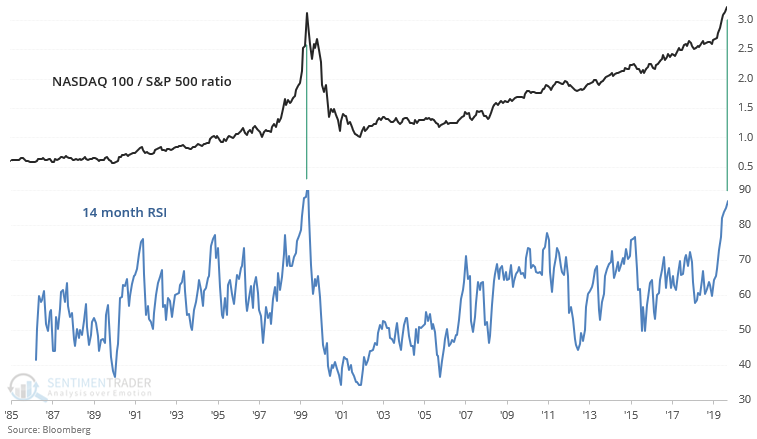

The NASDAQ 100 / S&P 500 ratio is registering 2 extremes at the same time:

- The ratio itself is higher than where it was at the top of the dot-com bubble.

- The ratio's 14 month RSI can only be matched by 3 other months from December 1999-February 2000:

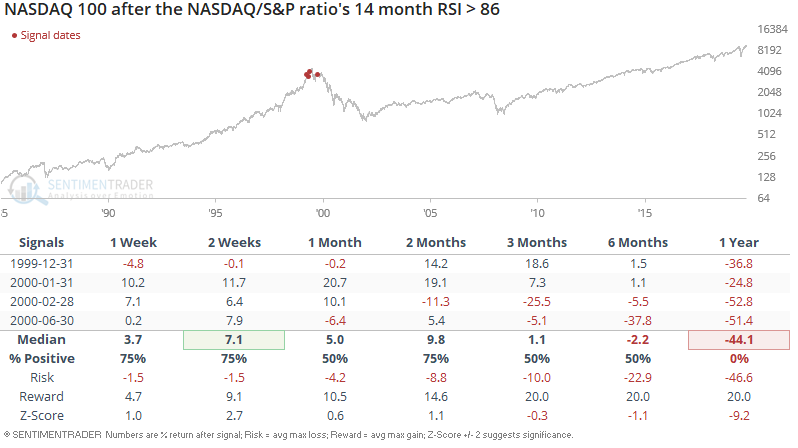

Needless to say, those dates were not good for long term investors who bought tech stocks:

Or for long term investors who bought U.S. stocks in general: