So many recoveries in trend, it's historic

We've spent a lot of time looking at the 50- and 200-day moving averages over the past week, and this will likely be one of the last posts about it for a long while. This form of looking at the market has become wildly popular lately and while that doesn't mean it's no longer effective, it's certainly becoming less unique.

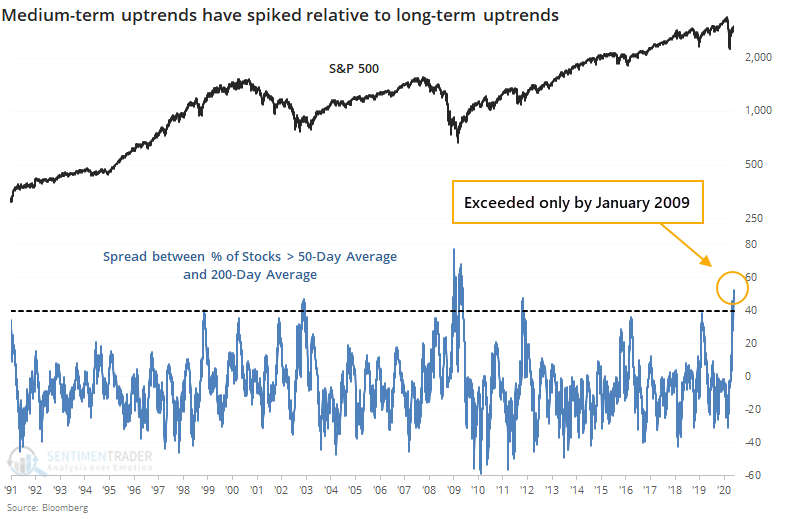

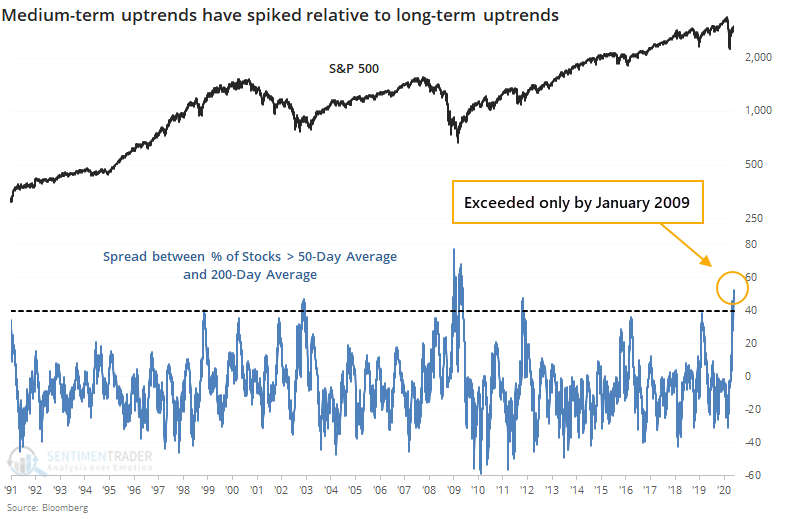

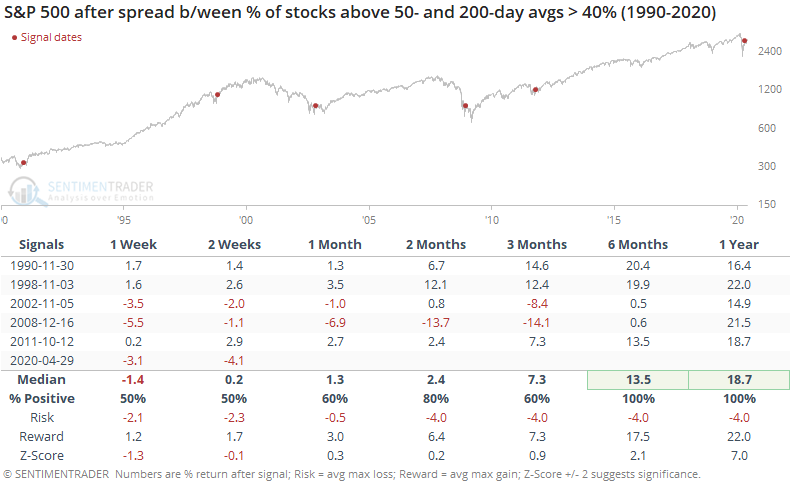

As we saw on Wednesday, there has been a surge in stocks within the S&P 500 rising above their 50-day moving averages but relatively few have climbed above their 200-day averages. As of Wednesday, 95% of S&P stocks were above their 50-day average but only 43% were above their 200-day, so the spread between them was more than 50%. That's the 2nd-highest in 30 years, next to January 2009.

By the time the spread hit 40%, it indicated moments of medium-term upside momentum during markets that were showing longer-term struggles. As a result, forward returns were shaky in the shorter-term, but positive over the next 6-12 months every time. When the spread got this high in 2009, it indicated only the beginning of the long-term bottoming process.

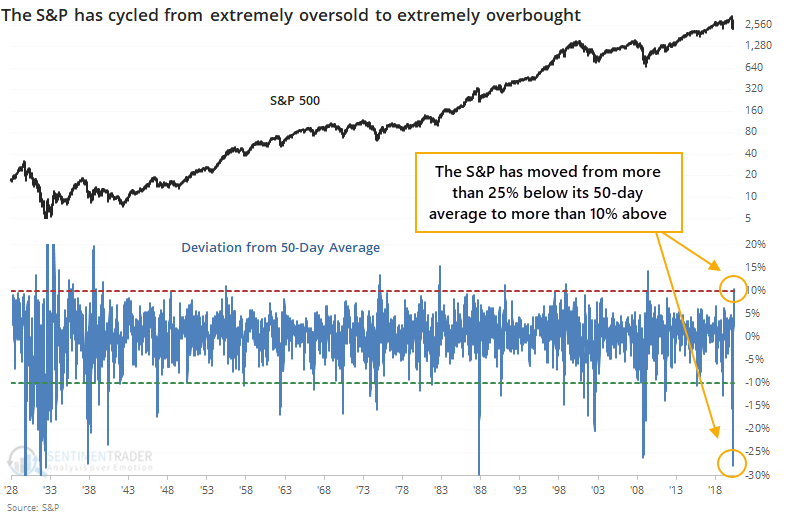

For the S&P 500 index itself, it has cycled from more than 25% below its 50-day moving average, one of the most oversold readings in history, to more than 10% above, one of the most overbought.

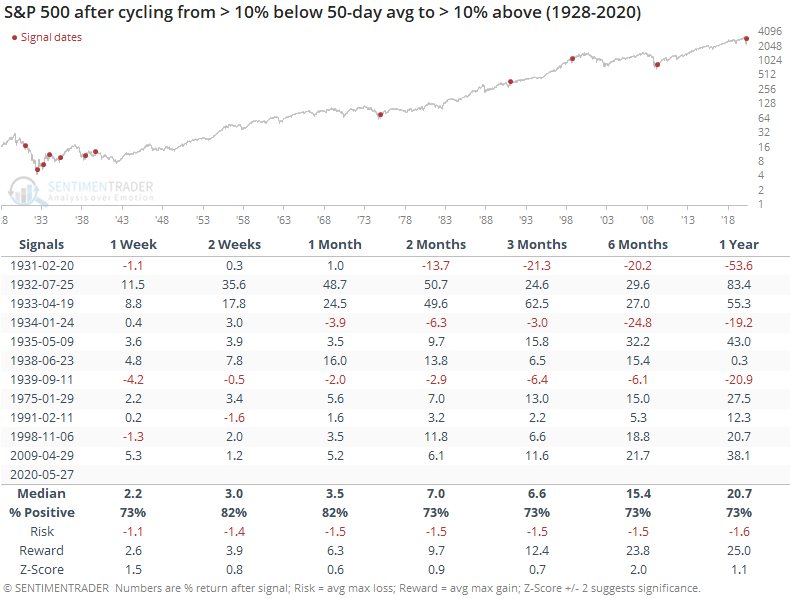

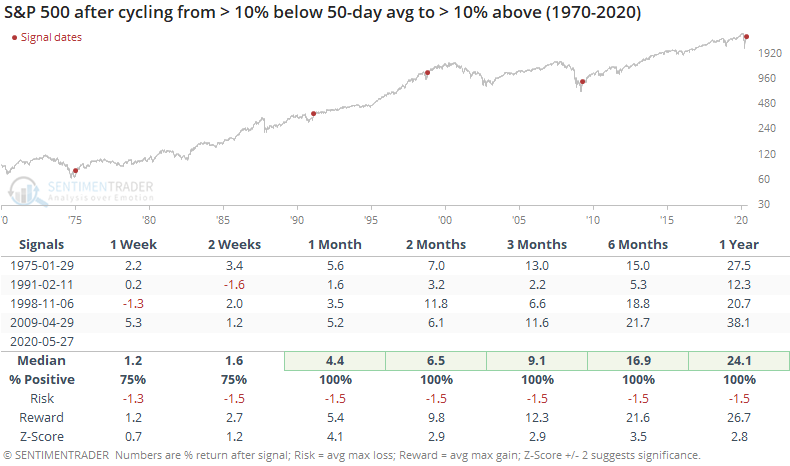

If we look at lesser extremes, times when it moved from 10% below to 10% above, then we get the following.

Returns were mixed-to-positive, but the negatives were due to the 1930s. If we make the assumption that lessons have been learned and we're not going to repeat some of those same mistakes, then we can focus on the post-1930s era. Those forward returns were pristine.

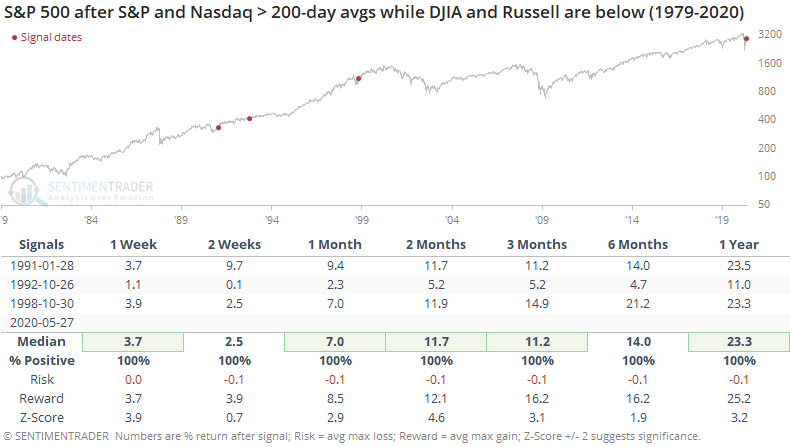

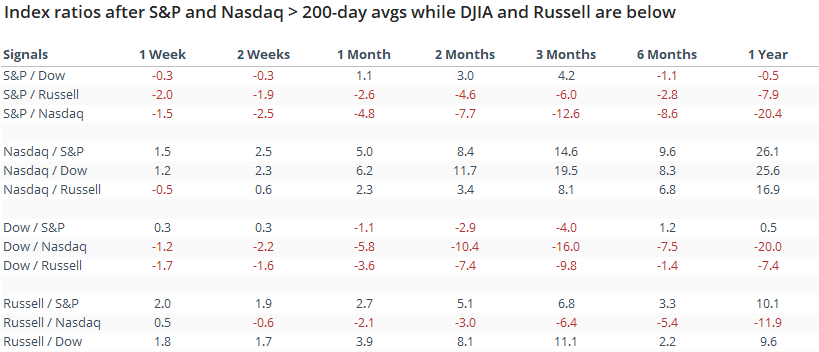

The S&P 500 and Nasdaq Composite are the first of the "big four" equity indexes to trade above their 200-day averages. The Dow Industrials and Russell 2000 remain below. When the S&P and Nasdaq led the other two out of declines, it was a good sign the few other times it happened.

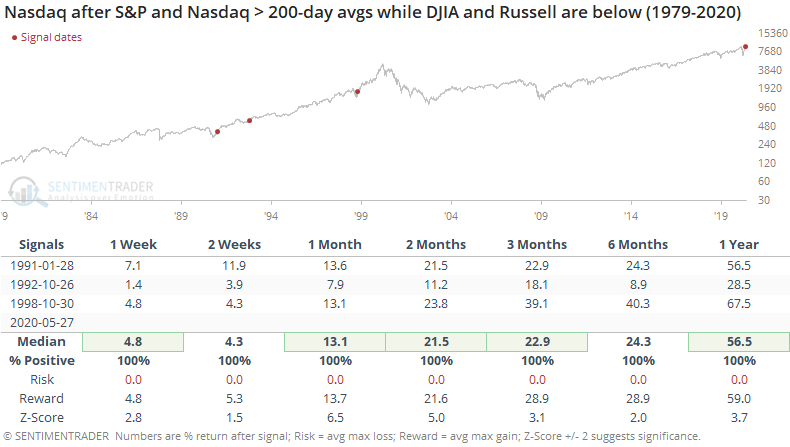

For the Nasdaq, it was an even better signal. Those one-year returns and risk/reward skews are impressive, with the caveat that the sample size is minuscule.

Comparing all four indexes to each other, the Nasdaq consistently outperformed the others. The Russell also tended to do well. The S&P and Dow consistently under-performed.

The overall takeaway from the indexes and stocks recovering above their medium- and long-term averages is that this kind of behavior, to this degree, have typically only come during long-term recoveries, with excellent medium- to long-term returns. The short- to medium-term was more of a question.