Smart money turns negative on the dollar

The smart money has gone net short stocks for the first time in months. They've also started to short the U.S. dollar.

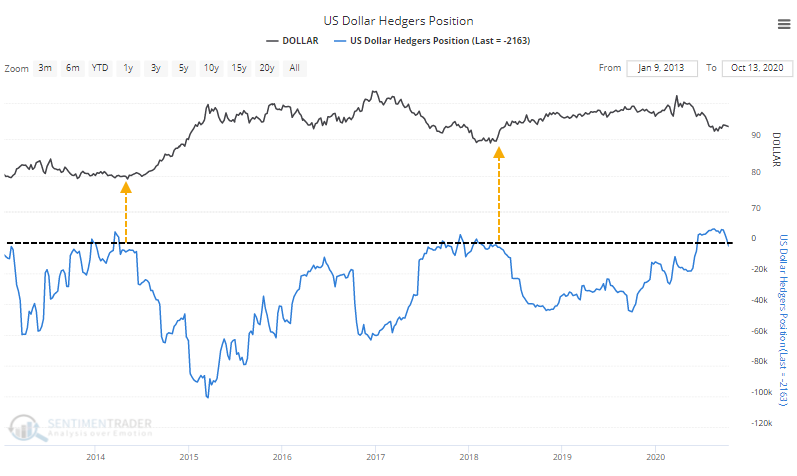

The last two times they flirted with longs in the dollar and then flipped to short, the buck proceeded to rally strongly. Commercial hedgers have underlying exposure to the contracts they're trading, so while it always seems like they're fighting the primary trend, they're not. They're just constantly adjusting their exposure and should never truly be net short any market.

Those last two instances are a bit different from what we've seen in recent months because hedgers only flirted with being net long, and not for any more than a few weeks at a time. This time, they were net long for several months.

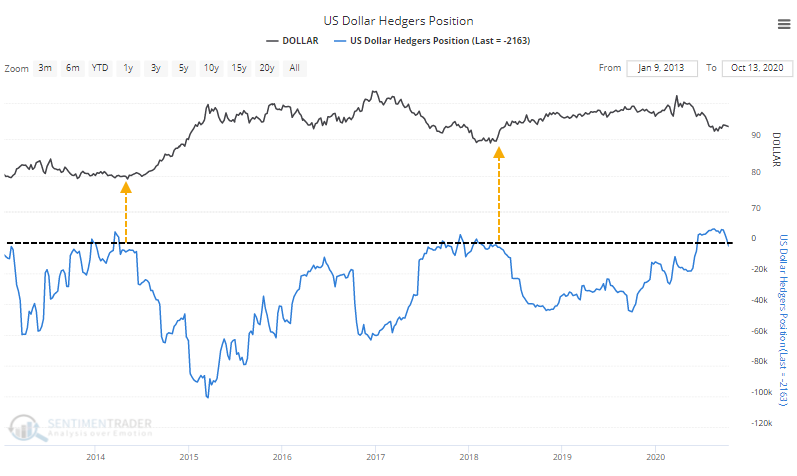

When hedgers have flipped to net short after at least 12 weeks of being net long, the dollar suffered going forward, thanks to all of the signals triggering during a terrible decade.

Since all of the signals occurred from 2001- 2011, the dollar had a tough time showing a positive return on almost any time frame. Between 2-3 months, it sported a negative return every time.

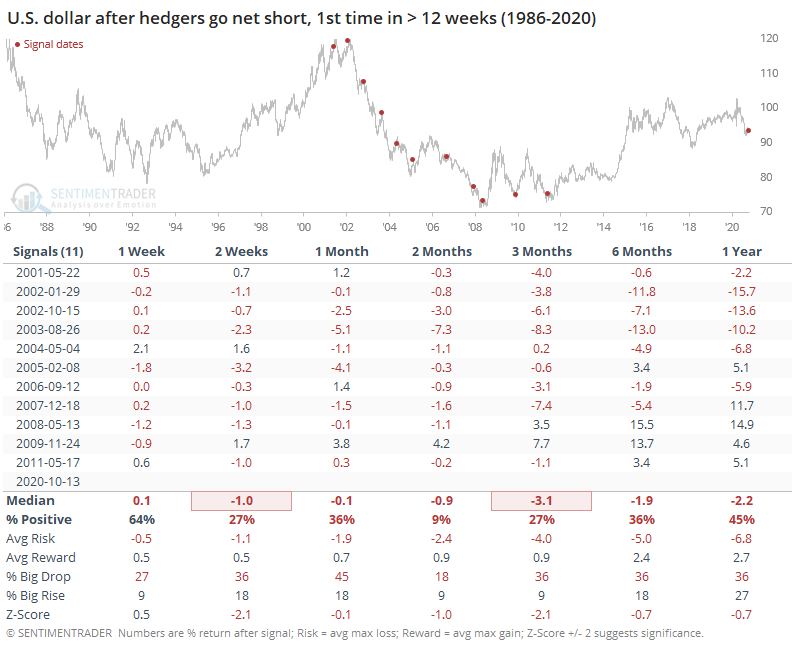

While they're not perfectly inverse, the dollar does tend to influence markets like precious metals. So the weakness in the buck also meant consistent gains for gold.

Because these signals triggered during one of the best decades for gold, its risk/reward going forward was exceptional. On average, it suffered no more than a -0.8% loss over the next several months, while enjoying double-digit maximum gains.

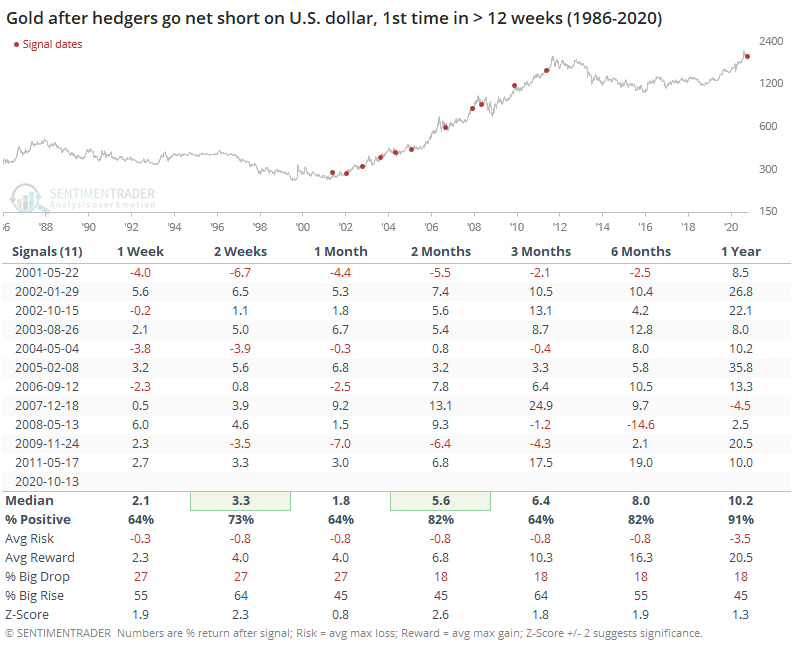

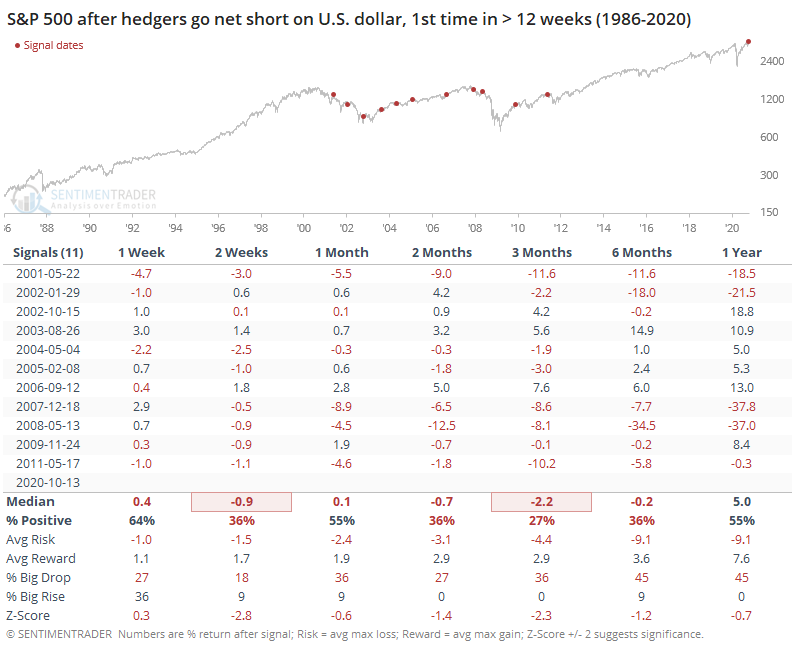

The dollar's correlation with stocks is inconsistent, but these signals proved tough for stocks.

Over the next three months, the S&P showed a positive return only 27% of the time, with a poor risk/reward and much larger probability of a big drop than a big rise.

We'd have more confidence in these outcomes if they were scattered over more cycles instead of clustered during a single decade. It still appears to be a modest negative for the dollar, at least.