Smart Money Is Betting On The "Gundlach Ratio"

Smart money is betting on the Gundlach Ratio to predict a rise in interest rates, and micro-cap stocks are breaking out.

Smart money’s bet on ‘Gundlach Ratio'

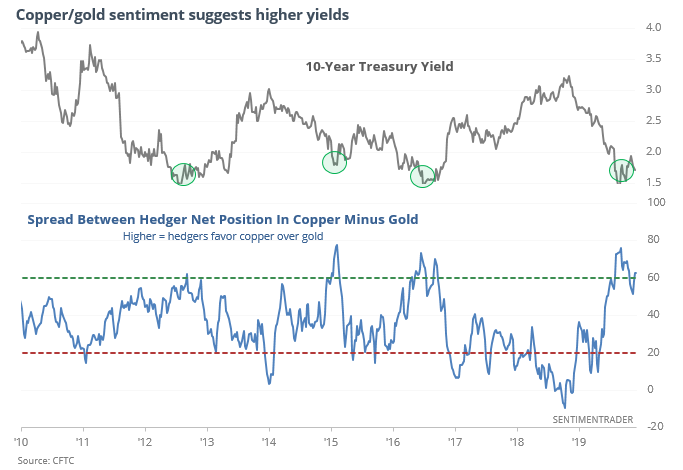

Respected bond fund manager Jeffrey Gundlach highlighted his use of a ratio of copper to gold to forecast the future path of interest rates.

Currently, smart money hedgers are net long copper while being heavily short gold, something which has led to gains in the copper/gold ratio...and interest rates going back nearly 20 years.

For other assets, it has preceded mostly positive returns for stocks, lower prices for the U.S. dollar, and a higher level in the ratio of copper to gold.

Small- Micro-caps

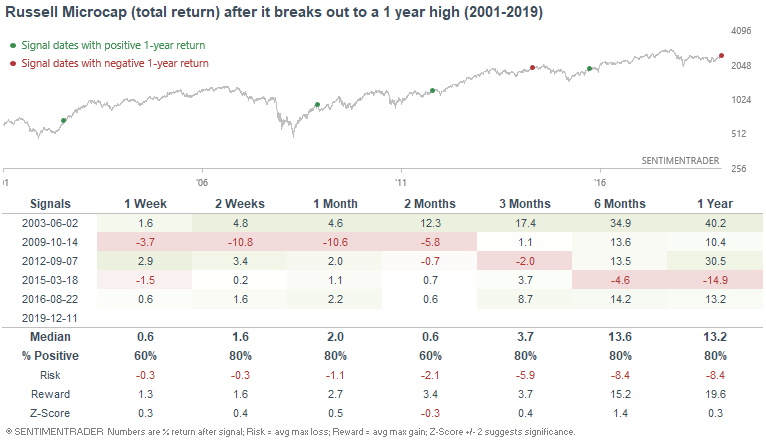

As Dan Russo noted, the Russell Microcap Index (total return) has broken out to the highest level since November 2018. This index tends to move inline with the Russell 2000, with the difference that it focuses on the smallest of small cap stocks.

As is the case with most breakouts in the U.S. stock market, these micro-cap breakouts typically led to more gains in the coming months and year. The one exception was March 2015, when micro-caps broke out just as the U.S. stock market entered into a period of high volatility over the next 9 months.

For the broader market, the S&P 500 was lower a month later 3 times, but higher six months later 3 times.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A breakout in financial stocks reaching 52-week highs

- Smart Money Confidence is curling higher from a low level

- What happens when the U.S. dollar falls to a 100-day low

- Eurozone economic growth expectations are picking up

- Applying sentiment indicators to Nasdaq trading models