Smart Money / Dumb Money Confidence Spread reaches another threshold

Key Points

- When our Smart Money / Dumb Money Confidence reaches a positive extreme, it typically portends good things for stocks

- There is no "one best way" to designate the spread as "extreme," but there are several thresholds that have proven useful (see here and here)

- Another one of the more useful measures of an extreme in sentiment using this indicator just triggered a new signal

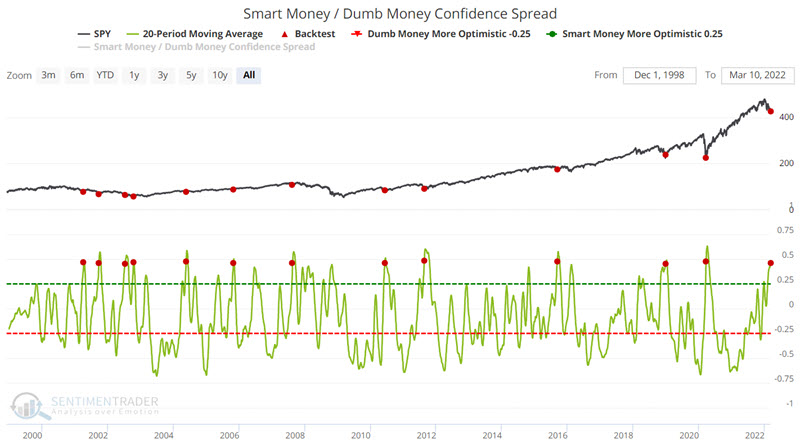

The 21-day moving average

The chart below displays each time the 20-day average for the Smart Money / Dumb Money Confidence Spread crossed above 0.45 for the first time in 21 days. You can run this test in the Backtest Engine.

The latest signal was triggered on 3/10/2022.

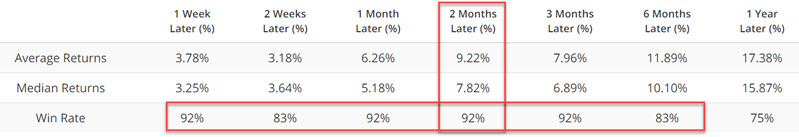

The table below displays a summary of SPY (iShares S&P 500 Trust ETF) performance results following previous signals.

Note the consistently high Win Rates across all time frames. Of particular note is the performance during the two months after a signal (92% Win Rate, Average gain over 9.2%, and worst loss of -1.26%).

The results for all previous signals appear in the table below.

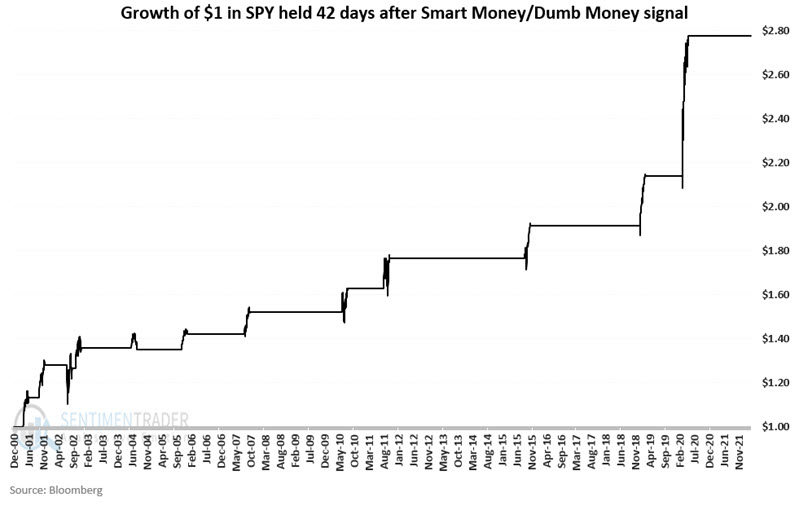

The chart below displays the growth of $1 invested in SPY for 42 trading days after each previous signal. The key things to note are the steady nature of the gains and the lack of significant drawdowns.

What the research tells us…

Do the very favorable results shown above guarantee that stocks are headed higher in the weeks and months ahead? Not at all. Just because price action following previous signals has witnessed relatively low drawdowns and consistent profitability does not mean that the latest signal won't be the exception to the rule. But history certainly suggests the potential for better days ahead.