Smart Money / Dumb Money Confidence Spread reaches another important milestone

Key Points

- The Spread between Smart Money Confidence and Weak Money Confidence has continued to widen as the market has floundered in early 2022

- Several typically useful thresholds have been crossed in recent weeks (see here, here, and here)

- Yet another milestone was reached on 3/14/2022 when the Spread crossed above 0.60

- If history proves an accurate guide, a viable opportunity may be at hand - if not now, then very soon

A cross above 0.60

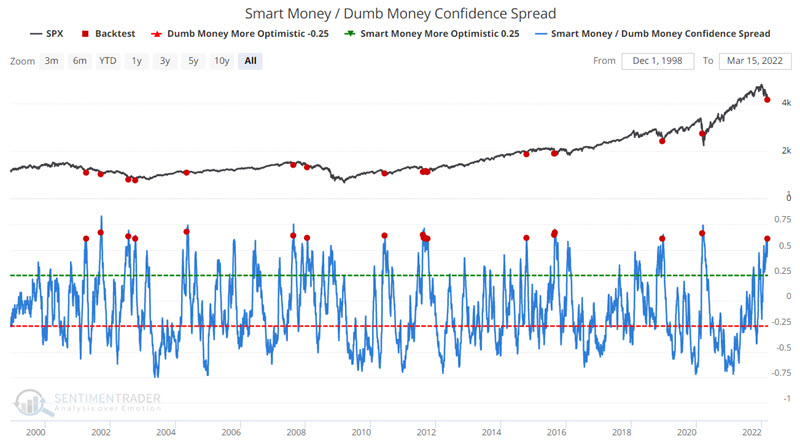

The chart below displays each time the Smart Money / Dumb Money Confidence Spread has crossed above 0.60. You can run this test in the Backtest Engine.

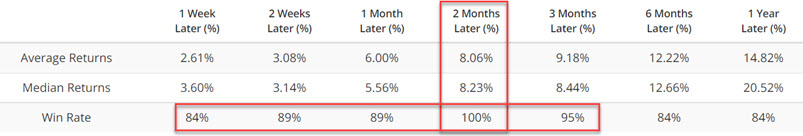

The table below displays a summary of the S&P 500 Index performance results following previous signals.

Note the consistently high Win Rates across all time frames. Of particular note is the performance during the two months after a signal (100% Win Rate, Average gain of 8.23%).

A trading strategy

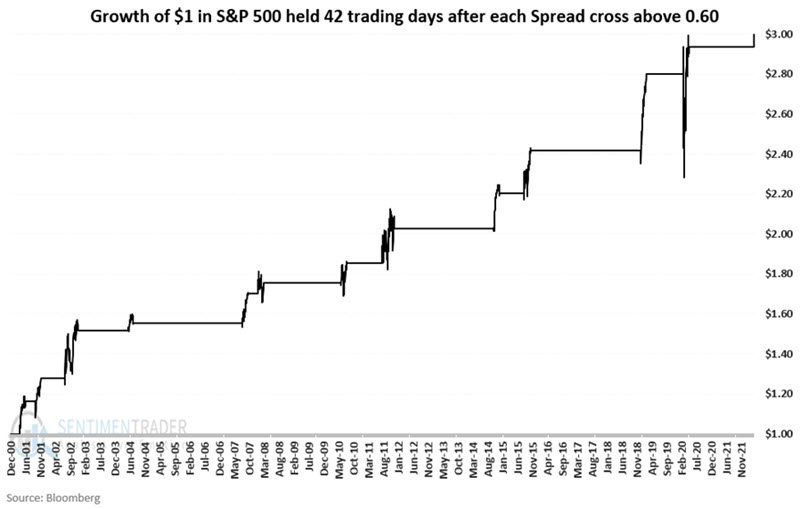

To further illustrate the potential significance of this latest milestone, consider the following hypothetical strategy:

- Buy and hold the S&P 500 Index for 42 trading days each time the Smart Money/ Dumb Money Confidence Spread crosses from below 0.60 to above 0.60

- If a new signal occurs within 42 trading days of a previous signal, the holding period is extended another 42 trading days.

The hypothetical growth of $1 invested following these simple rules appears below.

The latest signal occurred at the close on 3/14/2022. If there are no more new signals in the meantime, the 42-trading day holding period will extend through 5/12/2022. If the Spread drops back below 0.60 and then pops back above it again between now and then, the hypothetical holding period would be extended another 42 trading days from that day.

What the research tells us…

The above results do not guarantee that the stock market will move higher in the next several months. Each new signal is its own "roll of the dice." Nevertheless, the "lower-left-to-upper-right" nature of results is unmistakable and may well buoy the confidence of traders looking once again to play the long side of the U.S. stock markets.