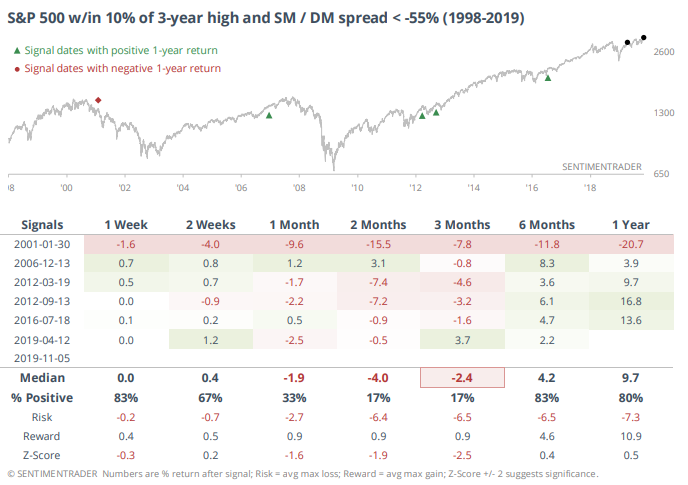

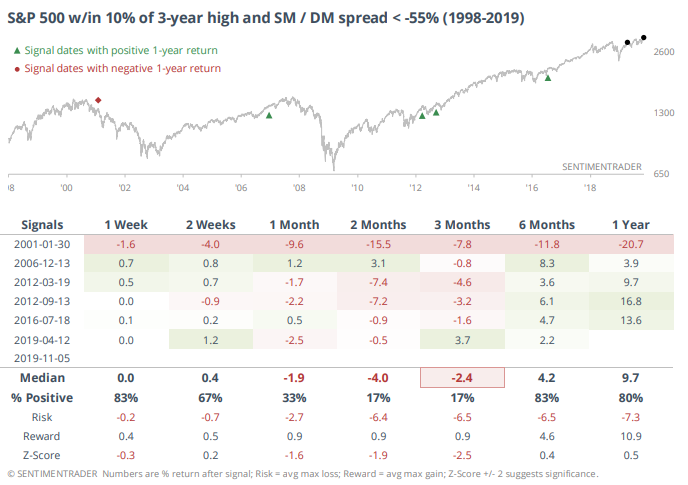

Smart / Dumb Money spread widens

Near the end of October, a lot of our core indicators had reached extreme levels. Given the strong trend in stocks, though, it wasn’t enough to be a consistent sell signal. That’s quickly changing. Maybe not enough for an actual sell signal, but enough to be wary in the short-term. The spread between Smart Money and Dumb Money Confidence has widened to a negative 55%, one of the worst spreads in five years.

See this post for more detail.